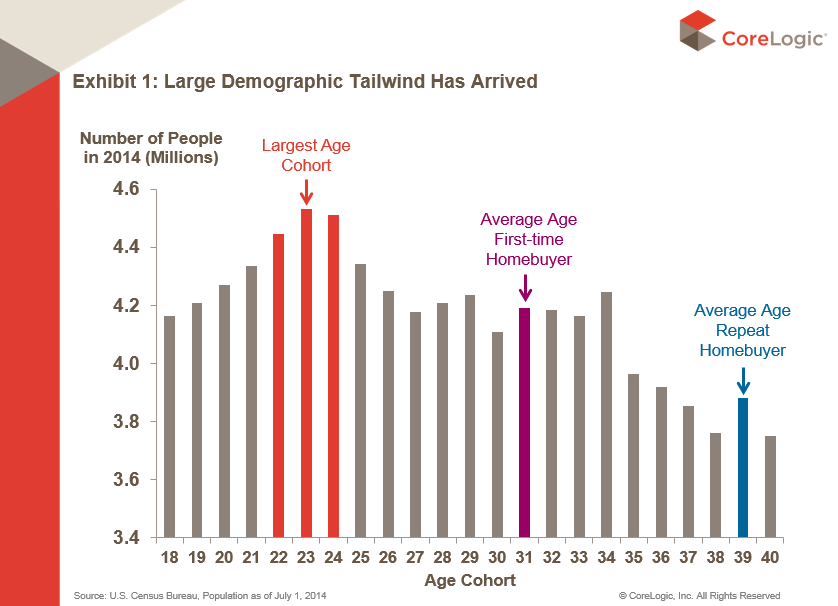

In 2014, the single largest cohort of millennials was 23 years old, with 24-year-olds and 22-year-olds clustered around them at about 4.5 million people of each age. When those 23-year-olds reach the average age (31) of a first-time homebuyer in 2022, they will be the driving force in the home-buying market.

They won’t be the only force, however, according to recent data from CoreLogic. The average age of a “move-up” home buyer is 39, and in eight years there are expected to be about 4.2 million Americans in that cohort. CoreLogic also notes that the largest waves of baby boomers will be reaching retirement age at the same time, and if the buying patterns remain as they have been, these Americans will be moving to retirement homes, second homes or smaller condos.

CoreLogic also notes that household formation increased in 2015 as younger Americans entered the U.S. workforce and left their families’ homes. Most of the new household formation involved rental properties, but over the next several years these young folks will begin to look for homes to own. CoreLogic noted:

Millennials’ high student debt ratios and antipathy to buying homes is the stuff of legend. But that is likely to change as they advance in their working careers and plan families. Surveys of millennials indicate that they have a similar desire for homeownership as their parents’ cohort, but recognize that they plan to transition into ownership at a later age. Six to eight years from now, it’s a good bet they will look more like the home-buying cohorts of the past.

ALSO READ: America’s 50 Best Cities to Live In

The millennials are more ethnically and racially diverse than older cohorts, with 45% minorities compared with 28% of the baby boom generation. Households headed by minorities are projected to comprise about 75% of net new households formed over the next decade. CoreLogic observed:

Whether the homeownership gap by race/ethnicity narrows or not over time depends on many factors outside of the housing industry, such as quality of workforce skills, labor-force opportunities, and access to credit. Nonetheless, the demographic bulge represented by the millennials will boost home sales in the future and is likely to boost rental demand as well.

The following chart from CoreLogic illustrates the millennial tailwind:

ALSO READ: The Drunkest City in Each State

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.