The U.S. stock market’s slow 2016 start has mostly been reversed with the S&P 500 and the DJIA now down by only about 1%, compared with lows in mid-February of around 10%. Since reaching a peak of around 2,135 in May 2015 the S&P 500 had dropped 13.5% by mid-February.

When equity markets reached that May 2015 peak, sales of U.S. homes valued at $1 million or more had risen to 2.2% of all home sales, almost double its historical level of around 1.2%. At the February trough in equity prices, sales of homes priced at $1 million or more had dropped by 30 basis points, or 15%.

The data come from CoreLogic, which points out that where the market for million-dollar homes goes now is a function both of stock market performance and rising inventory levels.

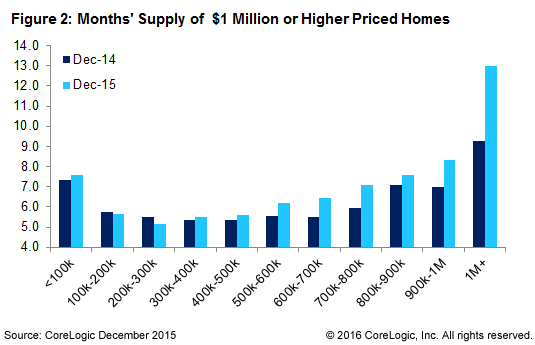

The supply of home prices below $500,000 remains very tight, according to CoreLogic, but inventory above that level is increasing. And it’s increasing especially fast in the supply of million-dollar homes, rising to supply of 13 months at the end of December 2015. That’s the highest supply number since January 2012, just as home prices began to bounce back and high inventories began to fall as buyers came back into the market.

CoreLogic created the following chart comparing the months of supply at the end of 2014 and the end of 2015. High demand for houses priced between $200,000 and $300,000 has reduced the supply by about 10% year over year, while soft demand for million-dollar homes has boosted supply from about 9.4 months to 13.0 months.

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.