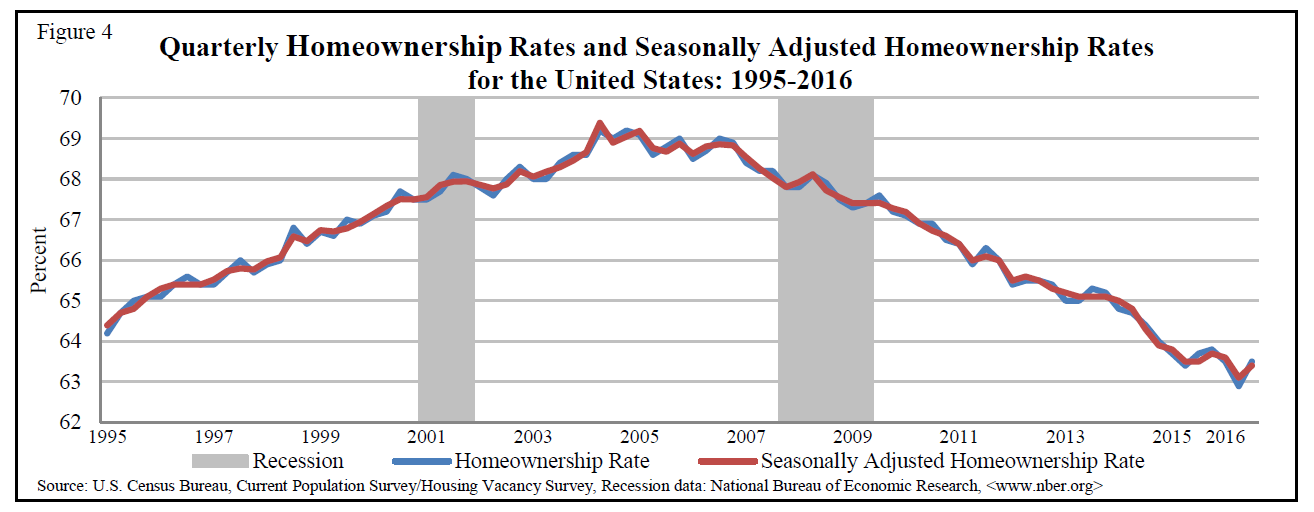

It can be said that some people can make any statistic look good or bad depending on what their angle is and what subset of data gets used. One statistic that has been undeniably bad in recent years is that homeownership rates have been incredibly low. Sadly, they might not reach anywhere close to the former peak any time soon. It is also evident that the official homeownership rate remains far lower than before the recession.

A new report from the Census Bureau is now showing that the official homeownership rate was 63.5% in the third quarter of 2016. This may not be statistically different from the rate in the third quarter 2015 at 63.7%, but it is shown to be 0.6 percentage points higher than the rate in the second quarter 2016.

For a reference, the formal high was a reading of 69.2% measured in two quarters back in 2004. A Census chart (see below) will also show just how much the homeownership rate has been in decline since before the recession. Sadly, we are currently at homeownership rates that are still at the lowest rates in over 20 years.

Before getting too excited about a rise in homeownership rates, we need to consider that this Census report is +/- 0.4 percentage points. That means that the improvement could be only two-tenths higher than in the second quarter on the low end. Still, it could also be a full point higher.

National vacancy rates in the third quarter 2016 were 6.8% for rental housing and 1.8% for homeowner housing. The rental vacancy rate of 6.8% was 0.5 percentage points lower than the rate in the third quarter 2015, but it was not statistically different from the rate in the second quarter 2016. The homeowner vacancy rate of 1.8% was not statistically different from the third quarter 2015 or second quarter 2016 rates.

Additional data from the Census showed that approximately 87.4%of the housing units in the United States in the third quarter 2016 were occupied and 12.6% were vacant. Owner-occupied housing units made up 55.5% of total housing units. Renter-occupied units made up 31.9% of the inventory in the third quarter 2016.

In the third quarter 2016, the median asking rent for vacant for rent units was $842. For the same period, the median asking sales price for vacant for sale units was $157,500. Rents were up from around $660 before the recession while the asking price for vacant homes was down from about $180,000 before the recession and down from right at $200,000 two quarters before the recession.

Total housing units were 134,857 in the third quarter of 2015, and this was up to 135,679 total housing units by the third quarter of 2016.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.