Housing

Are Nonbanks Taking Back Control of the Mortgage Market?

Published:

Last Updated:

When it comes to getting a mortgage, there have always been many options. Traditional banks have still dominated this scale, but it turns out that the so-called nonbanks are gaining traction in the fight for your mortgage. Some of this may have to do with less regulation after the financial crisis, some may also have to do with fees.

A fresh report from S&P Global Market Intelligence showed that, in 2015, nonbanks accounted for 48% of all new mortgages in the United States. This is up from 45% in 2014. S&P sourced the newly released data from the Home Mortgage Disclosure Act, or HMDA.

Again, there have always been many options outside of the banking sector. Still, should this raise any red flags? S&P showed that the last year nonbanks accounted for that much mortgage activity was in 2006. That was just a year before the subprime mortgage crisis began, and nonbanks accounted for 55% of mortgages that year.

As a reminder, the waves of bankruptcies, delinquencies and foreclosures wiped out many of the nonbank subprime lenders. Then there was also the big bank bailout that came into play as well.

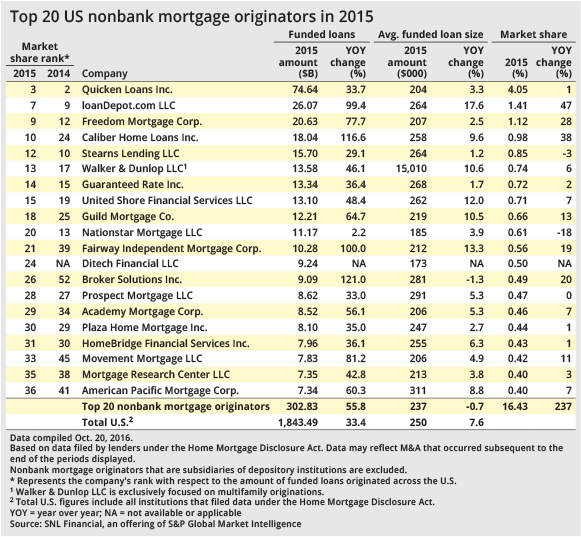

One issue driving the nonbank dominance here is that the nation’s large banks are focusing their efforts on the jumbo or non-conforming loans. Details are shown in a table below, but here are some of the data by company shown in an SNL report that was sourced:

- LoanDepot.com moved up to the No. 7 mortgage originator from No. 9 in 2014, with roughly 32% of its mortgage originations come from FHA-insured loans or Veterans Administration-guaranteed loans.

- JPMorgan Chase regained its second place spot with barely any government loans, as FHA-insured and VA-guaranteed loans accounted for roughly 1% of its origination volume.

- Wells Fargo maintained its number-one position as roughly 10% of its loans come from the two programs.

- Despite heavy advertising, Quicken Loans was shown to be in third place in 2015 versus second place in 2014.

The table from SNL below shows the market share rank, including the nonbank lenders. Again, Wells Fargo was number one and JPMorgan Chase was number two.

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.