Housing

This Retirement Town Is the Fastest Growing City in America

Published:

Last Updated:

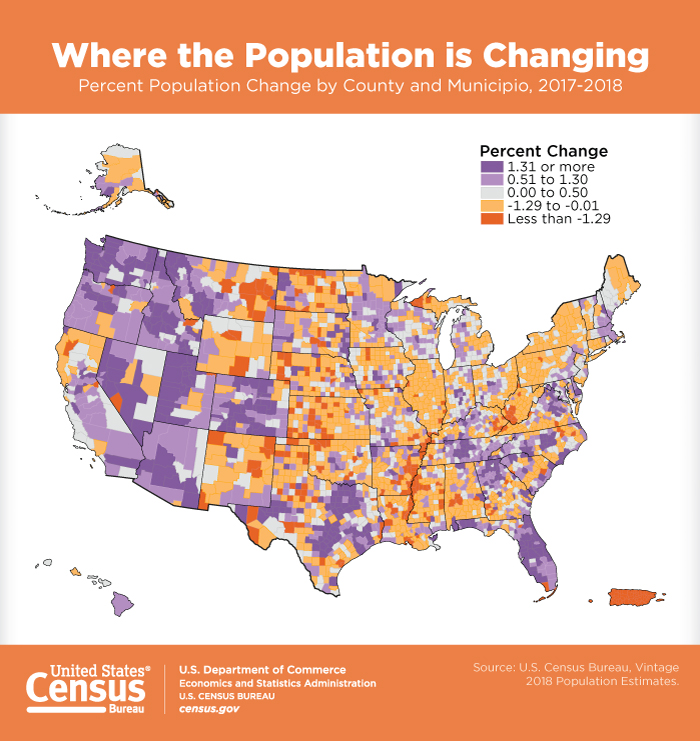

The U.S. Census Bureau has just released its data on the growth in the population of America’s cities and counties. Only one city has grown over 30% over the period measured. It is a city known primarily for its retirement communities built for aging Americans.

The new U.S. Census Bureau population estimates cover two periods. One is from the 2010 Census until July 1, 2018. The other is from July 1, 2017, through July 1, 2018. The fastest growing metro area over the longer period was The Villages, Florida, where the number of residents rose 37.8% to 128,754.

The Villages describes itself as “Florida’s Friendliest Active Adult 55+ Retirement …”, a “Fun and affordable active adult community where everything you could possibly want, need, or dream of doing in your retirement years is just a golf car ride away…” The American FactFinder Census analysis puts the median age of residents at 70.9 years. The median age of the U.S. population is approximately 38 years. The Villages has an extremely low poverty rate at 5.3%, and over 98% of the residents are white.

The Villages is not the only Florida city on “Top 10 Metropolitan Areas in Percentage Growth: 2010 to 2018.” Cape Coral-Fort Myers ranks seventh on the list. Its population over the period grew 22% to 754,610. Orlando-Kissimmee-Sanford ranked ninth. Its population rose 20.5% to 2,572,962. Florida itself ranks 25th based on what it costs to retire in every state.

The balance of the 10 fastest growing cities 2010 to 2018 included Myrtle Beach-Conway-North Myrtle Beach in North and South Carolina, which grew 27.7% to 480,891. In third place, Austin-Round Rock, Texas, grew by 26.3% to 2,168,316. In fourth place, Midland, Texas, grew 25.9% to 178,331. In fifth place, St. George, Utah, grew 24.3% to 171,700. Next Greeley, Colorado, grew 24.3% to 314,305. Bend-Redmond, Oregon, ranked eighth with a rise of 21.7% to 191,996. In tenth place, Raleigh, North Carolina, grew 20.5% to 1,362,540.

Commenting on the data, Sandra Johnson, a demographer in the Census Bureau’s Population Division, said the smaller cities like The Villages were where the most rapid population growth is occurring. “One interesting trend we are seeing this year is that metro areas not among the most populous are ranked in the top 10 for population growth.”

Most of the fastest growing counties, the report showed, are also relatively small. Over the eight-year period, leading the list is Williams County, North Dakota, which grew 57.8% to 35,350. To be on the top 10 list in terms of growth, a county had to grow over 34% and to have a population over 20,000. Four of the top 10 counties with the most rapid growth were in Texas. Hays County ranked second on the list, up 41.7% to 222,631. Comal County was sixth, up 36.8% to 148,373. Kendall County ranked seventh, up 36.0% to 45,641. Fort Bend County came in 10th, up 34.7% to 787,858. Two counties among the top 10 were in Florida. Sumter County ranked fourth on the overall list, up 37.8% to 128,754, while Osceola County ranked fifth and was up about 37% to 367,990. The balance of the top 10: Wasatch County, Utah, ranked third, up 41.3% to 33,240; Dallas County, Iowa, eighth, up 36.4% to 90,180; and Forsyth County, Georgia, ranked ninth and grew by 34.8% to 236,612.

Finally, an aged population does not guarantee safety. The Villages is among the cities where crime is soaring across the 50 states.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.