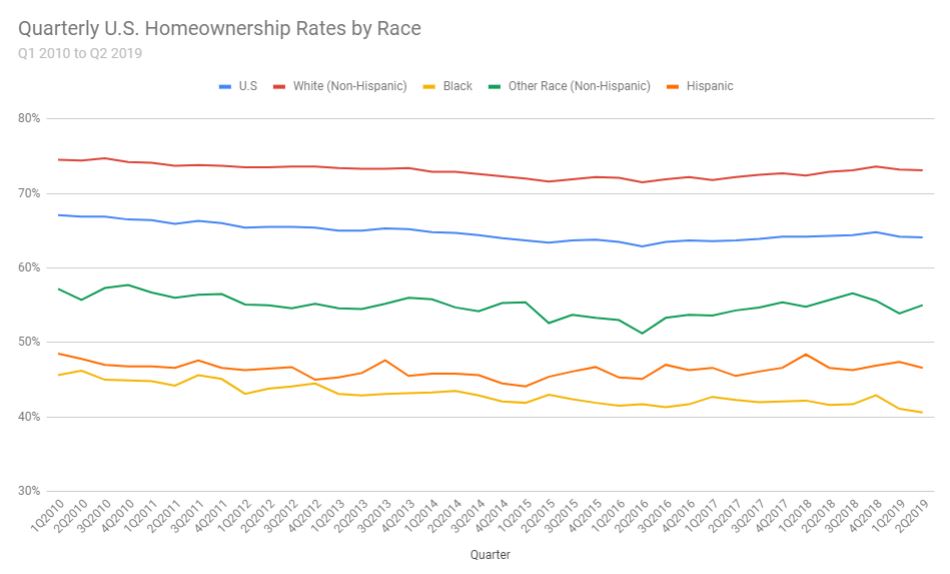

Since the home price recovery began in 2010, U.S. home prices have risen by 73%, even though homeownership rates among all Americans has declined by 3% to 64.1%. The rate of homeownership among white Americans was 73.1% at the end of the second quarter of 2019, while the rate for black Americans was a record low 40.6%. The Hispanic and Latino American homeownership rate was 46.6%. Homeownership is higher in certain metro areas. These are the cities where the most people own their homes.

The ownership gap between white and black Americans widened by 3.6 percentage points in the years since 2010, while the gap between white and Hispanic/Latino Americans grew by half a point. In the same period, homeownership rates dropped 5.0 percentage points for black Americans, 1.9 points for Hispanic/Latino Americans and 1.4 points for white Americans. Online real-estate brokerage Redfin reported the data on Wednesday.

Redfin’s chief economist, Daryl Fairweather, commented: “The growing racial homeownership gap has widened the wealth gap, as home equity remains one of the most significant wealth-building tools. And now, with higher home prices and tighter lending standards than before the housing crash of 2008, it’s more difficult than ever for minorities to break into the housing market. That’s likely to contribute to growing economic inequality in the U.S.”

While average home equity rose 213% in black communities between 2012 and 2018, the dollar change was 58% higher in white communities. Average home equity in 2012 in black communities was $38,547 and rose to $159,321 in 2018. In white communities, home equity averaged $105,776 in 2012, rising to $296,712 last year. Home equity in Hispanic/Latino communities rose from $77,817 in 2012 to $283,805 in 2018, a gain of 165%. Overall, home equity dollar gains for the period rang in at $194,000, an increase of 197%.

Using Federal Reserve data reported in 2017 and still the most recent available according to Redfin, median net worth for black Americans fell by 2.8% between 2010 and 2016, from $17,600 to $17,100. During the same period, median net worth for white Americans rose by 18.5% to $171,000, and the gap between the wealth of black and white Americans widened by 22.8%, from $125,300 to $153.900.

To the gaps in total homeownership, home equity and net worth, Redfin’s Fairweather adds a black unemployment rate that has dropped from 16.5% in January 2010 to 6.0% in June 2019. Over the same period, white unemployment fell from 5.5% to 3.3%. He comments: “Although the unemployment rate has gone down for black Americans, their wealth has also gone down. Homeownership has been the traditional way for the middle class to build wealth, so the fact that the black homeownership rate has gone down helps explain why decreased unemployment hasn’t translated to greater wealth.”

Homeownership is one of many metrics for which rates for black Americans are below average. Some areas of the country are worse off than others. These are the worst cities for black Americans.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.