Federal Housing Finance Agency (FHFA) director Mark Calabria announced last week that government-sponsored enterprises Fannie Mae (FNMA) and Freddie Mac (FMCC) have been approved to purchase some single-family home loans in forbearance, if those loans meet specific requirements. This may be something of a mixed blessing for homeowners, but it will help maintain liquidity in the nation’s mortgage market.

Earlier this week, Calabria had to clear up what he called “misinformation” that had been circulating regarding repayment of the Fannie- and Freddie-backed loans. The short version is that once homeowners reach the end of their forbearance plans, no lump-sum payment is required of borrowers whose loans are backed by Fannie or Freddie. That is a blessing for homeowners who have struggled with mortgage payments during a period when many are required to remain at home to help stop the coronavirus outbreak and have no source of income.

However, keeping the mortgage industry liquid will be neither cheap nor easy.

The Emerging Forbearance Picture

As of April 19, 6.99% of mortgage servicers’ loan portfolios are in forbearance, according to the Mortgage Bankers Association (MBA). That percentage increased by more than a full point week over week and represents a total of nearly 3.5 million mortgages. The MBA survey data represents almost 77% of the first-mortgage servicing market (38.3 million loans).

Ginnie Mae (the Government National Mortgage Service), which guarantees mortgage-backed securities payments to institutional investors, is included in the MBA’s weekly statistical report. The agency has the largest overall share of loans in forbearance at 9.73% and the largest week-over-week increase at 1.47%.

Fannie and Freddie loans represent 5.46% of all loans in forbearance and rose by 0.82 percentage points week over week. The number of loans in forbearance, categorized by the MBA as “other loans,” including private label securities, portfolio loans and jumbo mortgages of more than $766,000, saw an increase from 6.43% to 7.52%.

The number of requests for forbearance as a percentage of the number of servicers’ portfolio volume declined slightly week over week from 1.79% to 1.14%. Mike Fratantoni, the MBA’s chief economist, warned:

Forbearance requests fell relative to the prior week but remain roughly 100 times greater than the early March baseline. While the pace of job losses have slowed from the astronomical heights of just a few weeks ago, millions of people continue to file for unemployment. We expect forbearance requests will pick up again as we approach May payment due dates.

What Fannie and Freddie Will Buy

Due to the sudden loss of jobs related to the coronavirus pandemic, some borrowers sought forbearance too soon after their single-family property loan closed. That prevented the lender from selling the loan to either Fannie or Freddie. The FHFA’s announcement last week lifts that restriction on buying mortgage loans that are either delinquent or in forbearance, up to a limit of four months.

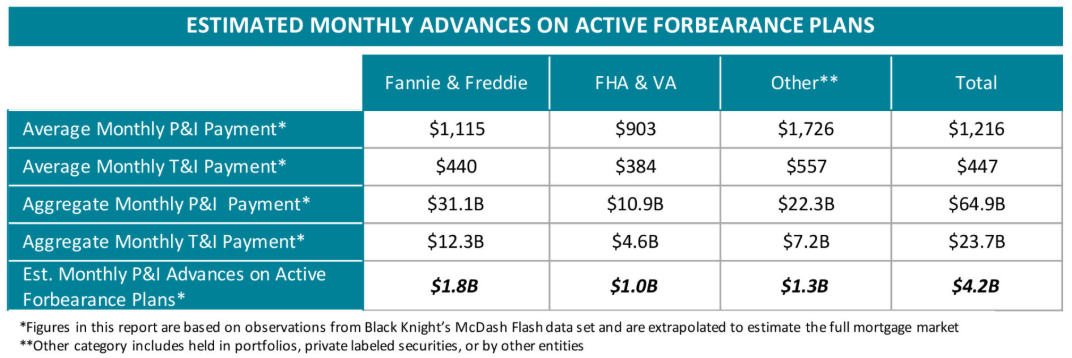

Data analytics provider Black Knight reported last week that, as of April 23, the number of loans in forbearance due to the COVID-19 outbreak represents $754 billion in unpaid principal. At that level, mortgage servicers must advance $2.8 billion in principal and interest payments to holders of government-sponsored mortgage-backed securities every month. Including other loans, the monthly total climbs to $4.2 billion, as the following chart from Black Knight shows.

Black Knight CEO Anthony Jabbour calls the four-month limitation “extremely helpful” for servicers. However, he noted, “Still, even knowing that time limit, with today’s number of forbearance plans, servicers are still looking at more than $7 billion dollars in advances over those four months. And the forbearance numbers are climbing steadily, day by day. Clearly, this remains a challenging situation all around.”

The Costs to Fannie and Freddie

Estimates of the percentage of mortgage loans that will wind up in forbearance range from 15% to 25%. Because the agencies are exposed only to new borrowers seeking forbearance before they are able to purchase the loans in the normal course of business, the hit to liquidity should not be too severe.

Add to that the new mortgage applications are down 30% year over year. According to the MBA, buyer traffic is down, inventory for sale is lower and sales of existing homes were at a 12-month low in March.

Still, Fannie and Freddie stock prices are down about 45% and 47%, respectively, for the year to date. As we’ve noted before, a public offering of new stock may not be forthcoming by the end of next year due to the COVID-19 outbreak. On one hand, that’s not good news. On the other, the possible reason for the delay (rescuing homeowners from foreclosure) is good news.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.