Home prices have soared to record levels in the past year. Compared to 2021 in most months, the national average of the increases is nearly 20%. In some large cities, it is well above that.

One reason for the jump was mortgage rates that dropped below 3% for a 30-year fixed home loan. Those days are over, however, as rates have surged well above 5%.

Another reason is demand in some metro areas. People increasingly have left expensive coastal cities like New York and San Francisco for areas inland where home prices are less expensive.

Finally, the COVID-19 pandemic prompted many companies to close offices. Millions of Americans began to work from home, and many of them will not go back to their offices. These people are free to move wherever they would like.

Several organizations measure home data, from prices to foreclosures. The gold standard for this research is the S&P CoreLogic Case-Shiller Indices, which measure home prices nationwide and in America’s largest cities.

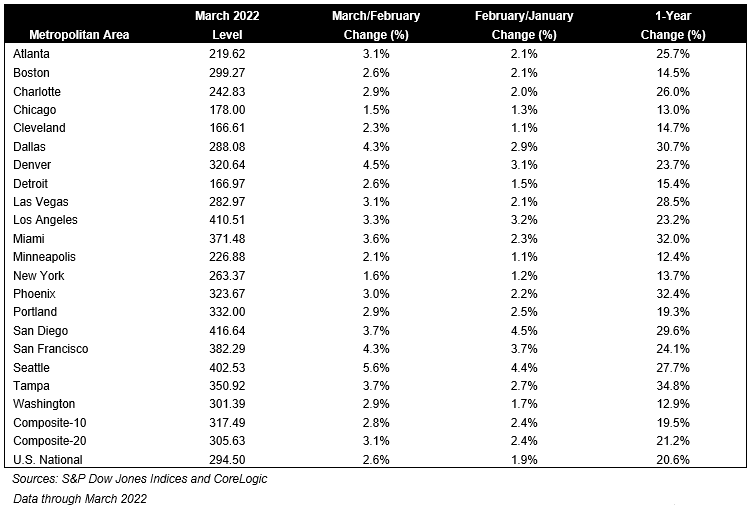

The most recent Case-Shiller data covers home prices in March, which rose a record 20.6%. The company keeps records that date back 27 years.

Craig J. Lazzara, managing director at S&P DJI, commented on the numbers: “Those of us who have been anticipating a deceleration in the growth rate of U.S. home prices will have to wait at least a month longer.” Perhaps at that point, rising mortgage rates will cool down price increases.

Three cities had particularly large home price increases compared to March a year ago. In Tampa, the increase was 34.8%, while in Phoenix and Miami the numbers were 32.4% and 32.0%, respectively.

These are the year-over-year price increases in all 20 markets measured in March:

Click here to see which is the most overpriced housing market in America.

Are You Ahead, or Behind on Retirement?

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: am I ahead, or behind on my goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With Zoe Financial’s free matching tool, you can connect with trusted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.