Industrials

General Electric Earnings Nothing to Write Home About

Published:

Last Updated:

General Electric Co. (NYSE: GE) reported first-quarter 2013 results before markets opened this morning. The conglomerate posted adjusted diluted quarterly earnings per share (EPS) of $0.39 on revenues of $35.01 billion. In the same period a year ago, GE reported EPS of $0.34 on revenues of $35.08 billion. First-quarter results also compare to the consensus estimates for EPS of $0.35 on revenues of $34.63 billion.

GAAP earnings totaled $0.35 per share, which does not include a $0.04 per share benefit from the sale of NBCUniversal to Comcast Corp. (NASDAQ: CMCSA).

The company did not provide guidance in its press release, but the consensus estimate for the second quarter calls for EPS of $0.40 on revenues of $36.83 billion. For the full year, EPS is pegged at $1.67 and revenues at $149.26 billion.

The company’s CEO said:

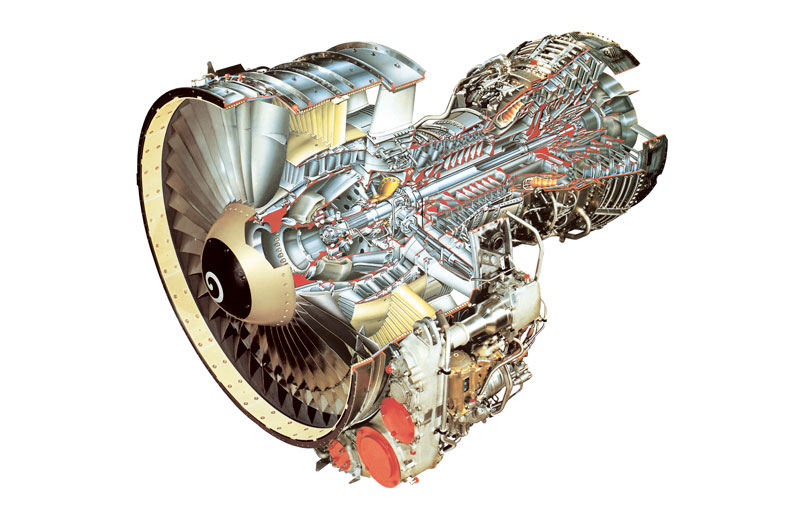

GE’s markets were mixed. The U.S. and growth markets were in line with expectations. We planned for a continued challenging environment in Europe, but conditions weakened further with Industrial segment revenues in the region down 17%. Overall, Power & Water markets were worse than we expected. While we anticipated significantly fewer wind and gas turbine shipments, we saw additional pressure in European Power & Water services. This weakness also had a negative impact on margins. We always anticipated that the first half of 2013 would be our toughest comparison; we expect Power & Water to improve during the year and be positive in the second half.

The drop in GE’s power and water segment was stunning: revenues down 26% and profits down 39%. For the entire industrial segment of the company, first-quarter profits fell 4% year-over-year. Had it not been for a reduction of 55% in the company’s corporate expenses, profits could well have been flat or worse for the quarter.

The headline numbers look good for GE, but they lie on top of a pretty weak foundation. Investors are likely to be unhappy with these results today.

Shares are down 3.1% in premarket trading this morning, at $21.97 in a 52-week range of $18.02 to $23.90. Thomson Reuters had a consensus analyst price target of around $25.70 before today’s results were announced.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.