Caterpillar Inc. (NYSE: CAT) has had a much better performance for its investors in 2014 than the pundits might have guessed. In fact, shares were up about 17.5% to $105.39 prior to Tuesday. Now the company has made a filing with the Securities and Exchange Commission showing just how poorly its retail sales turned out in the most recent month and quarter.

When we showed the bull and bear case for Caterpillar in 2014, this stock was much lower and the analysts were expecting far less than the performance we have already seen. It may simply be that the investors were looking for value of the beaten up Dow Jones Industrial Average stocks since the market was getting toppy and “value” was being sought.

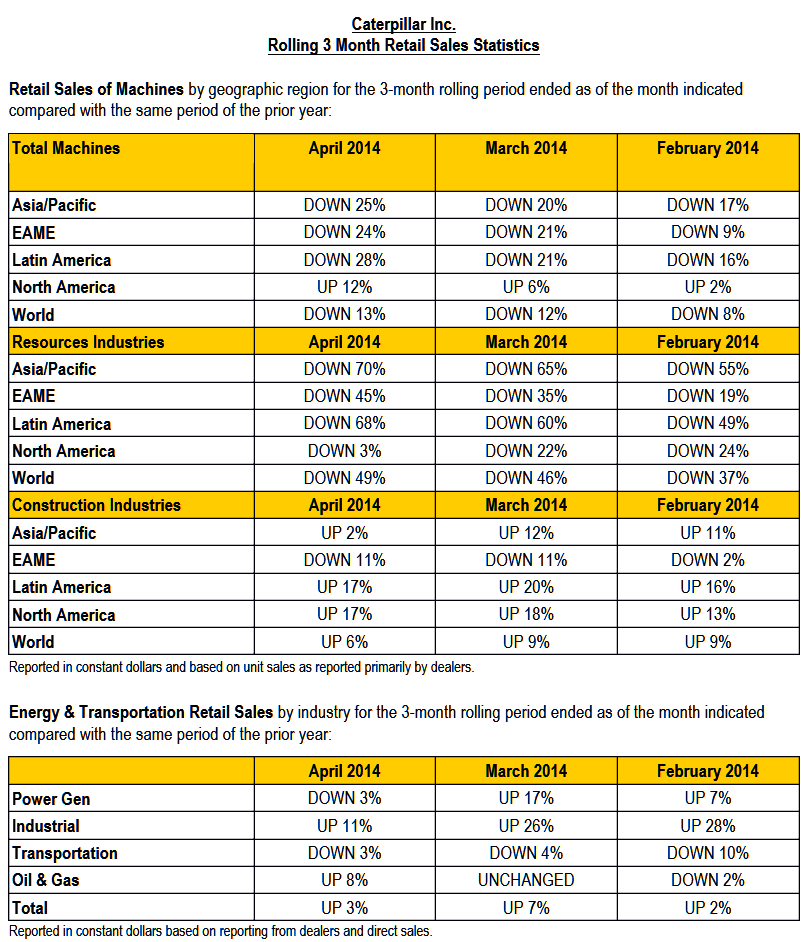

The latest sales figures cover April, and total machine sales were down everywhere outside of North America. The reported sales in North America were up 12%, but they were down more than 20% in the key Asia/Pacific, EMEA (Europe, the Middle East and Africa) and Latin American markets.

The sales were up globally in construction industries in all but EMEA sales in April, but the resources industries where its massive machines and heavy equipment sales occur were down 70% in Asia/Pacific, down 45% in EMEA, down 68% in Latin America and even down by 3% in North America.

ALSO READ: Global Gold Demand Trends Better Than Gold Prices Indicate

Caterpillar shares closed out 2013 at $90.81, and at the time of our annual outlook its consensus analyst price target was all the down at $90.59. Shares were above $105 prior to Tuesday. Caterpillar shares were lower by 1.5% at $103.70 shortly after the open and the consensus price target was up at $111.96 ahead of this monthly report.

We have included an image showing the table to see just how negative these trends are in the rest of the world. Imagine how much higher this stock would be if it was posting gains in its retail sales channels rather than contraction.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.