Caterpillar Inc. (NYSE: CAT) has had a wild ride in 2014. Its fundamentals have never really improved to where they had been in the prior years, and it looked at the start of 2014 to have the worst fundamentals of all Dow stocks in our bull and bear analysis at the start of the year. Yet here we are in August and the 20% or so gain year to date makes Caterpillar the third best-performing Dow stock of 2014.

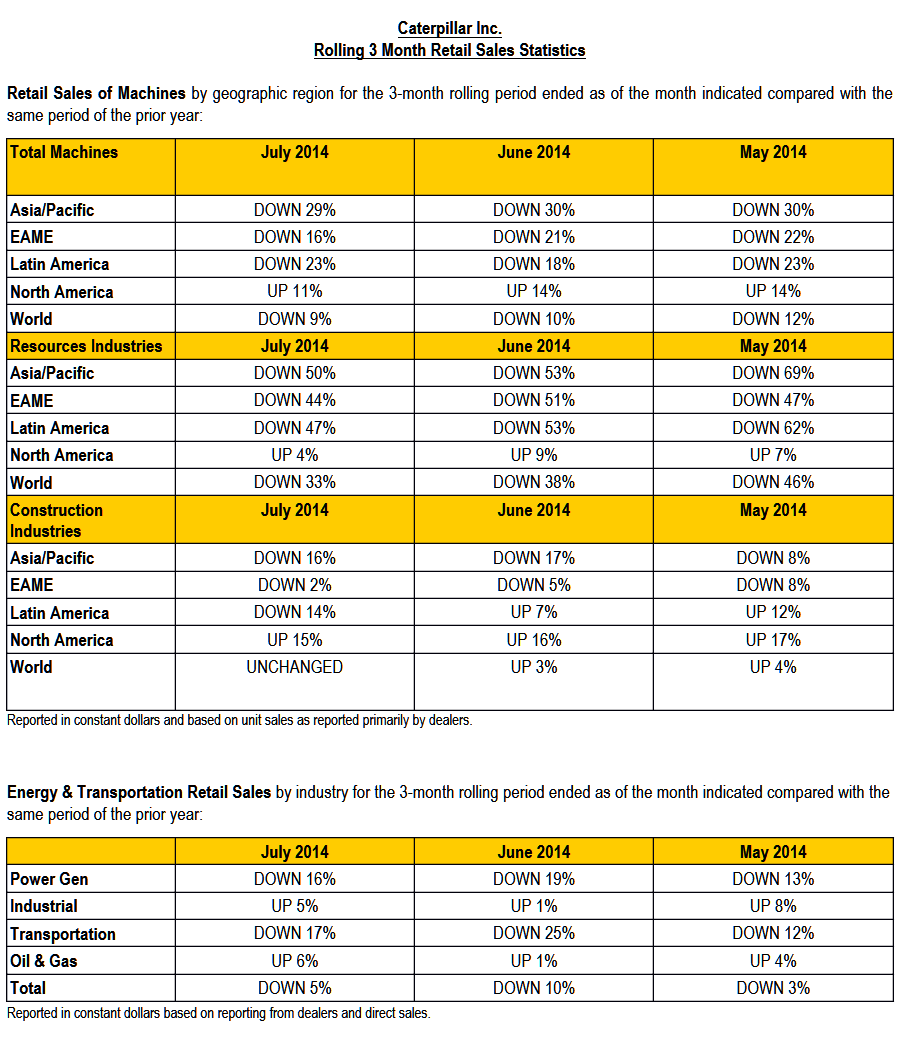

On Wednesday the company released its monthly dealer sales data for July. It seems odd to think that a 9% drop in total global demand is good, but that number had been a drop of 10% in the full second quarter.

Mining equipment was down by 33%, but that was 38% previously. Energy and transportation is very broad, but that drop fell to -5% rather than roughly -10% seen previously.

As you can see in the table below for the total machines reporting, Latin America was the only region for Caterpillar that worsened in the monthly drop — down to -23% from -18%. North America’s gain of 11% compared to a gain of 14% the prior month. Then, if you look at the Energy & Transportation Retail Sales, it looks as though the rolling three-month period showed improvements (even if some were just less-bad) over the prior report.

READ ALSO: What Apple at $100 Again Really Means

Caterpillar shares were up 0.5% at $107.80 in Wednesday morning trading. Its 52-week range is $81.46 to $111.46, and the consensus price target from analysts is up at $113.24.

A full table from Caterpillar’s SEC filing has been provided below.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.