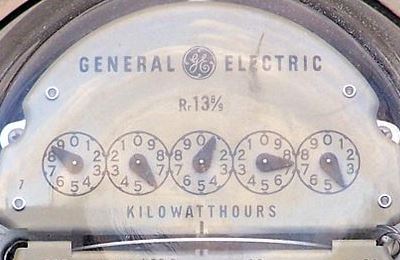

Industrials

Why General Electric's Stock Price Has Been So Terrible

Published:

Last Updated:

General Electric Co. (NYSE: GE) shareholders doubtlessly will be unimpressed by the returns the stock has offered over the past decade. Over this time frame, GE stock is down around 20%, while the S&P 500 has soared more than 78%.

Under CEO Jeff Immelt’s leadership, the company has undergone a series of major reorganizations. In the early days of his tenure, he supervised the division of GE Capital into four distinct segments, as well as the merger of its appliance and lighting divisions. The company also spent huge amounts of money on acquisitions in the industrial space.

In 2008, another reorganization was announced, aimed at simplifying the massive conglomerate’s operations. Its six business segments were cut down to four, energy infrastructure was spun off into a separate unit, and the consumer and commercial finance segments were combined.

ALSO READ: Has the Endless Growth of Dividends and Buybacks Peaked?

Earlier this year, the company announced it would finally be spinning off GE Capital altogether in what is its biggest reorganization to date, as increased regulation has made banking a less attractive proposition and prompted GE to return to its industrial roots. Together with this announcement, the company approved another $50 billion share buyback program, aimed at, most likely EPS problems, and lack of investor interest in the faltering conglomerate.

All of this is ahead of the formal and already expected spin-out of Synchrony Financial (NYSE: SYF), a move that may create a similar ex-date stock move similar to dividend payments. More formal details are still outstanding on the post-GE Synchrony trading.

These endless reorganizations have not paid off in terms of growth, however. Over the past five years, the company’s performance has gone nowhere. In fact, annual revenue steadily decreased between 2010 and 2013, and while fiscal 2014 showed some recovery, revenue is still nowhere near its pre-crisis peak. Net income shows a similar trend, wobbling between roughly $11.0 billion and $15.2 billion between 2009 and 2014, after peaking at over $22.2 billion in 2007.

The question now is whether GE’s shares are cheap enough to entice new buyers after such a lag in performance. 24/7 Wall St. named GE as one of ten stocks to own for the decade because its shares became inexpensive enough at that time that they had perhaps discounted all likely restructurings and recovery ahead. GE now has a rival in 3M Co. (NYSE: MMM) on that list.

Despite his company’s lackluster performance, CEO Immelt has continued to receive generous compensation. Last year, he made some $18.9 million and, including his pension, his pay nearly doubled over the previous year. In the same time span, GE stock fell nearly 10%, compared to an 11% increase for the S&P. When Immelt took over the helm in 2001, the company was worth more than $40 per share. It now trades at under $27.50.

ALSO READ: 10 Stocks to Own for the Next Decade

All in all, Immelt’s tenure has been a somewhere between a disappointment and a disaster for GE shareholders. Aside from its poor financials, one reason for GE’s underperformance relative to the market may be that investors are simply fed up with the company’s apparent identity crisis. Both a bank and an industrial, and now back to a pure industrial, countless restructurings have failed to achieve the kind of results shareholders have sought. Although its most recent reorganization may facilitate greater focus and efficiency, it remains to be seen whether this will pay off in terms of growth.

By Daniel James

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.