Investors who were hoping for an uptick in Caterpillar Inc. (NYSE: CAT) sales in the world’s growth markets are going to have to wait. The heavy machinery making giant released a rolling three-month report for August, and the weakness seen in the financial markets and in the economic reports was just too much escape from.

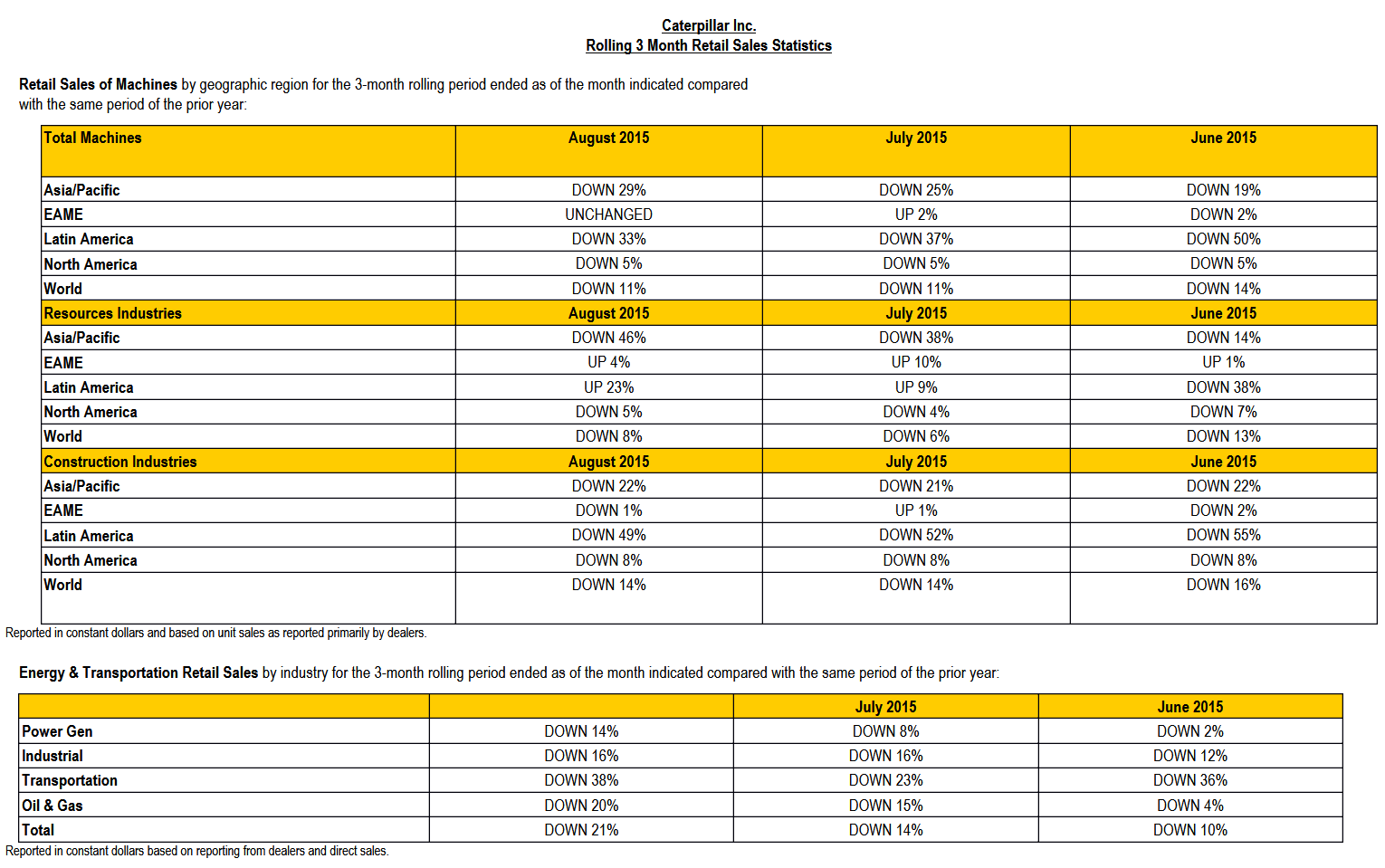

All in all, there was an 11% drop globally in the period ending in August. This effectively matches the report for the three-month rolling period ending in July. Europe, Africa and the Middle East saw cumulatively flat sales. North America was down 5%, and Asia and Latin America were both weak, with Asia/Pacific sales down 29% and Latin America down 33%.

When you break out the trends in the Energy & Transportation retail sales by segment, the trends were even worse than in the three-month period ending in July — a trend that was getting worse from June already. All in all, this was down 21%. Industrial sales held steady at -16% lower. The segments getting worse were as follows: Power Generation at -14%, Transportation at -38% and Oil & Gas at -20%.

Caterpillar shares were still up 0.9% at $72.55 shortly after the opening bell, but they backed off their intra-morning highs of $72.83 after this filing was released.

ALSO READ: 9 Analyst Stock Picks Under $10 With Huge Upside Calls

24/7 Wall St. has included a copy of the two tables provided by Caterpillar in its 8-K filing with the Securities & Exchange Commission.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.