Industrials

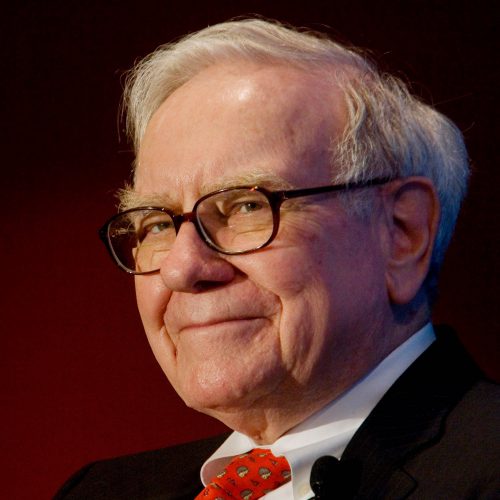

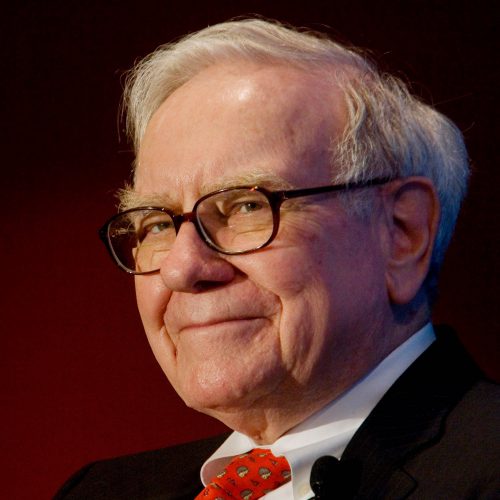

Tax Reform Winner: Warren Buffett and Berkshire Hathaway Get New Street-High Analyst Target Price

Published:

Last Updated:

It seems like the world just cannot get enough of Warren Buffett and Berkshire Hathaway Inc. (NYSE: BRK-A). With Buffett having previously been the wealthiest man in the world, and with him being considered the best long-term investor in modern times, perhaps he knows a thing or two.

What is unique about Berkshire Hathaway versus other corporate giants is that very few analysts on Wall Street actually have formal ratings and price targets on the conglomerate.

Yet, Berkshire Hathaway saw its price targets raised on both share classes at UBS. The price target on the B-shares was raised to $244 from $213, and the price target was raised on the A-shares to $366,000 from $319,000.

What stands out here is that UBS, along with its Buy rating, raised its price target on the A-shares to $319,000 from $291,000 just in October. This is now the highest analyst target on Wall Street for Berkshire Hathaway.

One driving force for the upgrade was benefits due to tax reform. Dropping the nominal rate to 21% from 35% is a huge win for Berkshire Hathaway. UBS now expects this to drive earnings 16% higher. Buffett himself explained this just a few weeks ago as a way that company now get to keep 79 cents of every dollar it earns rather than 65 cents, or that the government now gets only one-fifth of a company’s income instead of just over one-third previously.

UBS’s Brian Meredith expects Berkshire Hathaway shares to outperform the broader market, and he sees a chance that Berkshire Hathaway has an upside to earnings, with the company able to deploy a large portion of its $100 billion or more in cash. The lower tax rate will allow Berkshire Hathaway to grow its cash pile just that much faster.

The UBS note also shows that the non-insurance operations in Berkshire Hathaway remain on solid ground, and there are even improvements in its reinsurance and commercial insurance.

Both Berkshire Hathaway share classes have outperformed the broad market in the past year with gains in excess of 30%.

Berkshire Hathaway’s A-shares were last seen up $2,050 at $325,425, and the B-shares were last seen up $2.25 at $216.63 on Thursday. These are within 0.5% of all-time highs.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.