Industrials

RBC Says 5 Top Industrial Stocks Are Potential Takeover Candidates

Published:

Last Updated:

It happens every year, and 2018 won’t be any different. Larger companies looking to add to growth, in addition to that of the organic or internal variety, scan the field for purchases and acquisitions that are easy to bolt on and could add returns in a timely fashion. This year the process may even speed up some as last month’s market sell-off may have already put some companies in the sights of acquirers.

In what is a yearly and all-encompassing report, the analysts at RBC again go through every sector looking for possible takeover candidates. Last year, the company’s screens yielded 20 candidates that eventually were acquired over the following 12 months.

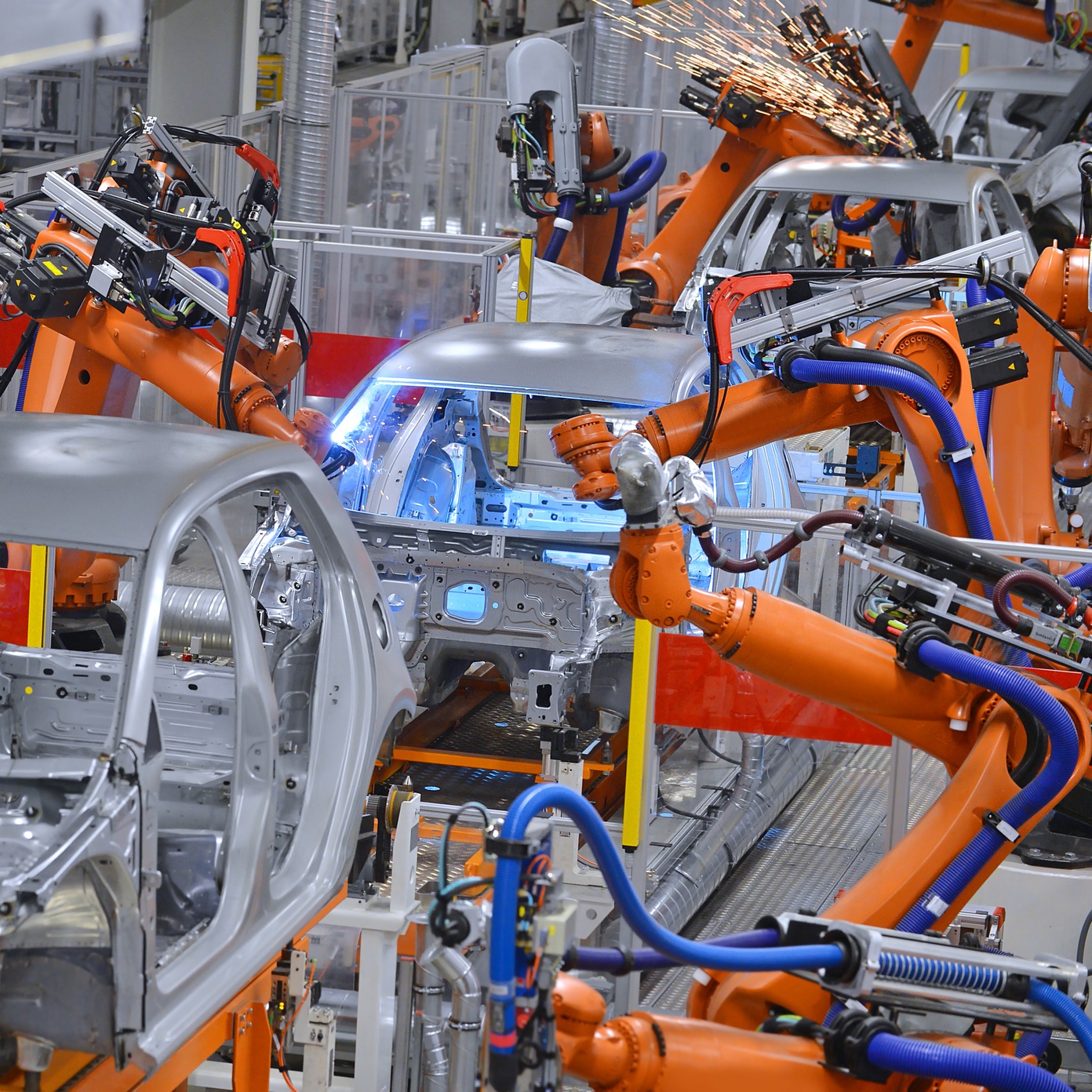

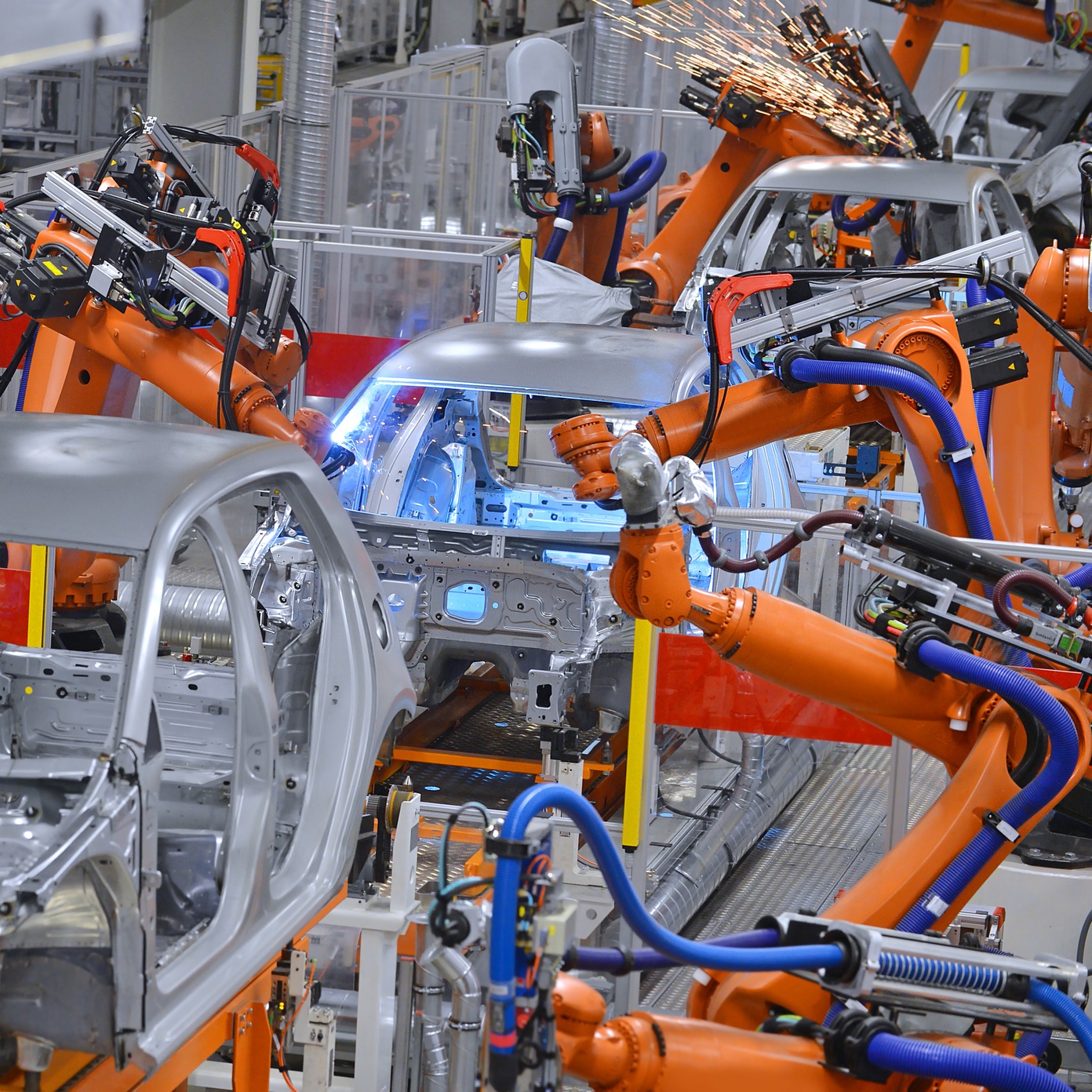

One screen that should be of interest to many investors is the potential takeout candidates in the industrial sector. With the potential for a large infrastructure build-out over the coming years, it makes sense that some of the top industrial companies would look to add additional capabilities that could add to their participation in big contracts, especially from the government.

We cross-referenced the RBC potential buyout candidates, looking for the highest profile names, and found four that like solid choices.

This smaller industrial is a favorite at many of the Wall Street firms we cover. American Axle & Manufacturing Holdings Inc. (NYSE: AXL) is a world leader in the manufacture, engineering, design and validation of driveline and drivetrain systems and related components and modules, chassis systems and metal-formed products for light trucks, sport utility vehicles, passenger cars, crossover vehicles and commercial vehicles.

In addition to locations in the United States (Indiana, Michigan and Ohio), AAM also has offices or facilities in Brazil, China, Germany, India, Japan, Luxembourg, Mexico, Poland, Scotland, South Korea, Sweden and Thailand.

The Wall Street consensus price target is $20.09. The shares traded early Tuesday at $15.40 apiece, in a 52-week trading range of $13.38 to $20.27.

This company used to be owned by General Motors and is one of the hot ideas for a takeover target. Delphi Automotive PLC (NYSE: DLPH) is a global supplier of vehicle electronics, transportation components, integrated systems and modules and other electronic technology.

The company’s operating segments include Electronics and Safety, Powertrain Systems, and Electrical/Electronic Architecture. The company is one of the most geographically diversified suppliers in the world, with a goal of generating an equal portion of sales from North America, Europe and Asia and the rest of the world.

Shareholders receive a 1.42% dividend. The posted consensus target price is $59.92. Shares traded at $47.75 Tuesday morning. The 52-week trading range is a huge $38.00 to $104.09.

This somewhat larger cap company has been a rumored takeover candidate for some time. Kennametal Inc. (NYSE: KMT) develops and applies tungsten carbides, ceramics, super-hard materials and solutions for use in metal-cutting and mission-critical wear applications to combat extreme conditions related with wear fatigue, corrosion and high temperatures worldwide. It operates through three segments: Industrial, Widia and Infrastructure.

The company’s product offering includes a selection of standard and customized technologies for metalworking applications, such as turning, milling, hole making, tooling systems and services for manufacturers of transportation vehicles and components, machine tools and light and heavy machinery; airframe and aerospace components; and energy-related components for the oil and gas industry, as well as power generation.

The $51.42 consensus price target compares with Tuesday’s open near $41.70, as well as a 52-week range of $32.22 to $52.53.

This is another supplier to the automotive industry that can be a very interesting acquisition. Tenneco Inc. (NYSE: TEN) is a producer of clean air and ride performance products and systems for light vehicle, commercial truck, off-highway and other vehicle applications. The company designs, manufactures and distributes highly engineered products for both original equipment vehicle manufacturers (OEMs) and the repair and replacement markets, or aftermarket, across the world.

Tenneco serves both original equipment vehicle designers and manufacturers and the repair and replacement markets, or aftermarket, globally through brands, including Monroe, Rancho, Clevite Elastomers, Axios, Kinetic and Fric-Rot ride performance products and Walker, XNOx, Fonos, DynoMax and Thrush clean air products.

The stock has a consensus price target of $65.67. Shares traded at $53.80, in a 52-week range of $50.73 to $65.59.

This mid-cap company looks like a solid stock to own during difficult times. W.R. Grace & Co. (NYSE: GRA) is engaged in the production and sale of specialty chemicals and specialty materials. The company operates in two segments.

The Grace Catalysts Technologies segment includes catalysts and related products and technologies used in refining, petrochemical and other chemical manufacturing applications.

The Grace Materials Technologies segment includes specialty materials, including silica-based and silica-alumina-based materials, used in coatings, consumer, industrial and pharmaceutical applications.

The company trades basically in line with peers, and its somewhat higher multiple is more than justified by the strong management team and the firm’s leadership position in catalysts.

Shareholders receive a 1.2% dividend. The shares traded at $61.26, in a 52-week range of $60.30 to $77.37. The posted consensus price target is $83.

While there is no guarantee that these industrial companies are acquired, they are outstanding stocks to own in aggressive growth portfolios on their own. The buyout factor is just another reason to consider them.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.