Infrastructure

Are Utilities Losing Their Defensive Appeal Ahead of Summer?

Published:

Last Updated:

It is no secret that the economy and the market have run across some newfound challenges. On top of slower global growth, as well as an escalating trade war with China, now President Trump has imposed a fresh set of tariffs against Mexico. With all the uncertainty, the “sell in May and go away” theme prevailed. The major market indexes have all pulled back handily from their highs, with the S&P 500 down 7%, the Dow Jones industrials down 8% and the Nasdaq down about 9%. It’s hard to feel too sorry for the markets though, with the year-to-date gains still being about 6.5% for the Dow, 10% for the S&P 500 and over 12% for the tech-heavy Nasdaq.

When times become uncertain, investors who have to maintain exposure to the stock market tend to look for defensive sectors. One of the most defensive of them all, with safety and predictability of income, is the utilities sector. Yet, over the past week, the utilities did not have a good turnout at all, even after considering some of the key players made recoveries on Friday. To confuse matters more, the sector should have been strong because long-term interest rates came down. Utilities also should be beneficiaries if the Federal Reserve decides that it’s time to start lowering short-term rates again.

Two issues may be at work against utilities: valuation and performance. In the prior week, utilities screamed higher, with many of them hitting all-time highs. It is quite possible that blow-off highs were simply seeing profit taking as investors may be inclined to lock in some profits. There is also the notion that the utility sector is generally leveraged up with lots of debt, but that is one reason the sector rallies when interest rates come down (and that their dividend yields are generally deemed safe among the top players).

Investors should keep in mind that the yield on the 10-year Treasury yield, this most direct reference we use for utilities and other long steady dividend payers, was down 8.5 basis points on Friday to 2.14%. That’s a low not seen since August of 2017. The 30-year yield fell seven basis points to 2.58%, a low not seen since October of 2016. And going back to the start of October 2018, right before the stock market slide and bond market peaked, the 10-year Treasury yield has come down 108 basis points and the 30-year Treasury yield has come down 82 basis points.

24/7 Wall St. has used a Finviz screener for performance metrics (total return) and Refinitiv (Thomson Reuters) for consensus analyst target prices and for earnings estimates when calculating forward price-to-earnings ratios. Other trading data and color also has been added.

FirstEnergy Corp. (NYSE: FE) was the worst weekly performer of the S&P 500’s domestic utility and electric generation companies with a 4.4% drop. Even with a 28-cent gain to $41.24 on Friday and with a $22 billion market cap, it is valued at a reasonable 16 times earnings expectations and it has a 3.7% dividend yield. The 52-week high is $43.24, and the consensus target price is $44.87.

Public Service Enterprise Group Inc. (NYSE: PEG) managed to post a nine-cent gain to $58.76 on Friday, but it was still the second worst performer of the S&P 500 domestic utilities with a drop of more than 4.2%. The company most of its customers know as PSE&G is valued at 18 times expected earnings, with nearly a $30 billion market cap and with a 3.2% dividend yield. It has a high of $61.63, and its consensus target price is $62.25.

NRG Energy Inc. (NYSE: NRG), which has been in the takeover rumor mill in the past, managed to gain almost 1% on Friday, but Finviz still showed it with a 4.2% drop in the past week. Trading at $34.04, it is down massively from the high of over $43 that was seen in March. Its $9.1 billion market cap comes with a mere 0.3% dividend yield, and it is valued at less than 10 times expected earnings. Wall Street analysts still have a consensus target price of $47.27 for the company most of its customers know as NRG or Reliant. Still, it shares have been dropping day in and day out for some time now.

NextEra Energy Inc. (NYSE: NEE) is the largest utility of them all by value, with a market cap of nearly $95 billion. The company formerly known as FPL has a dividend of just over 2.5%, and the $198.21 share price (after a 52-cent gain on Friday) is down from an all-time high of $204.73 and compares with a consensus target price of $198.37. NextEra held up better than most of its peers last week, with a 2.6% drop, and the stock is actually still up by 14% year to date. With its value of 23.5 times expected 2019 earnings, some investors will be wondering how much higher it can run without creating even more earnings power. NextEra is the utility that is most likely to join the $100 billion market cap club.

Duke Energy Corp. (NYSE: DUK) is in the top utilities with a $62 billion market cap, and it valued at 17.4 times expected 2019 earnings. Its dividend yield is almost 4.3%, and the last trade of $85.61 (still up eight cents on Friday) was down almost 7% from its 52-week high of $91.67. The consensus target price is $92.25, but Duke’s shares were down 3.7% in the past week, and the stock is down about 1% year to date.

American Water Works Co. Inc. (NYSE: AWK) is the largest water utility in America, and while it recovered almost 1% to $113.02 on Friday, it was still down 0.26% on the week. It has a $20.4 billion market cap, and the $113.02 share price is against a high of $114.50 and above the consensus target price of $109.83. Because it is the top defensive player of all, it has a lower dividend yield of 1.6%, and it is somehow valued at about 31 times expected 2019 earnings. American Water is also up about 24% year to date.

One issue to watch in the days and weeks ahead, particularly as the electricity markets enter the volatile summer pricing months, is whether the performance of the past week is quickly reversed. Another issue to watch is if the performance continues to falter at a time when the performance has historical support to remain firm or move higher.

The Utilities Select Sector SPDR Fund (NYSEARCA: XLU) is the king of the utilities when it comes to exchange-traded funds (ETFs). This should have done rather well when interest rates were falling and with more market uncertainty. Still, the performance of −2.8% in the past week was slightly worse than the drop in the key ETFs tracking the Dow, S&P 500 and Nasdaq-100.

Merrill Lynch had an alternative way of looking at future valuations for more upside to come in a report earlier this year.

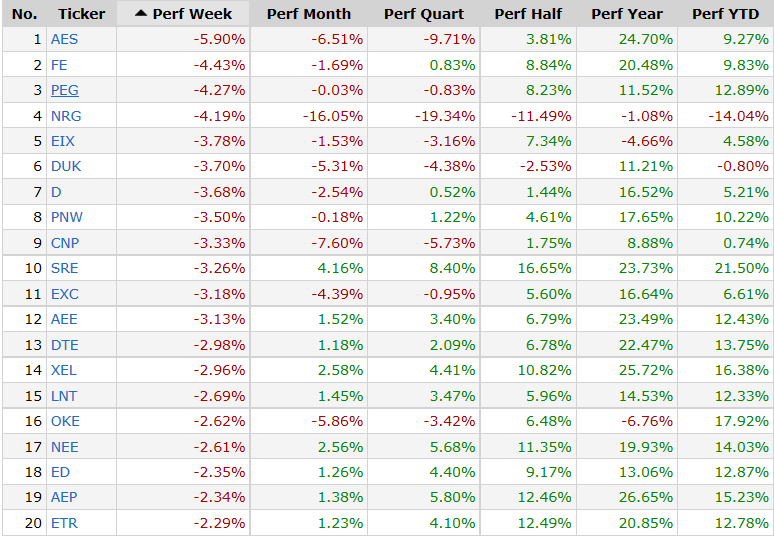

Below is a snapshot from Finviz of the top 20 negative utilities performers over the past week, which also shows performance metrics for 2019 and longer.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.