Investing

Special Report: Chart Deaths of BRIC & Emerging Markets (EEM, VWO, EWZ, BRF, ECH, CH, RSX, TRF, CEE, EPI, PIN, IFN, IIF, FXI, GXC, TAO, HAO, CHN, TDF)

Published:

Last Updated:

The old saying goes, “When the U.S. sneezes, the rest of the world catches a cold.” But what about when Europe gets the flu and when China and India drink the tap water from Latin America? There have been many books about the Post-American economies and about the rest of the world catching up to America’s fiscal dominance. It turns out that our leverage isn’t so bad when you consider some of the other great nations. The recession in America is still only an unofficial and debated recession, but the recession in Europe and the equivalent of a recession is heading back to the developing nations.

The old saying goes, “When the U.S. sneezes, the rest of the world catches a cold.” But what about when Europe gets the flu and when China and India drink the tap water from Latin America? There have been many books about the Post-American economies and about the rest of the world catching up to America’s fiscal dominance. It turns out that our leverage isn’t so bad when you consider some of the other great nations. The recession in America is still only an unofficial and debated recession, but the recession in Europe and the equivalent of a recession is heading back to the developing nations.

All you have to do is look at the exchange-traded funds and closed-end which track the emerging markets and the BRIC nations (and those surrounding the BRICs). Ugly is not quite the right description and we will explain more after showing just how bad the carnage is. Greece is no emerging market, but it is on the path to default faster than emerging markets used to default.

The ETFs for the broad emerging markets is not a good signal for their equity markets. The revolutions of early 2011 did not help, nor did the food inflation, but the economic slowing is taking a hit here left and right. iShares MSCI Emerging Markets Index (NYSE: EEM) closed down 2.1% at $34.36 and the 52-week trading range is $34.29 to $50.43 (52-week low was Monday). Vanguard Emerging Markets Stock ETF (NYSE: VWO) closed down 1.75% at $35.20 and the 52-week trading range is $35.13 to $50.92 (52-week low was Monday).

We have included the most active ETF chart on each from Stockcharts.com at the end of this report. The data on the BRICs is almost shocking…

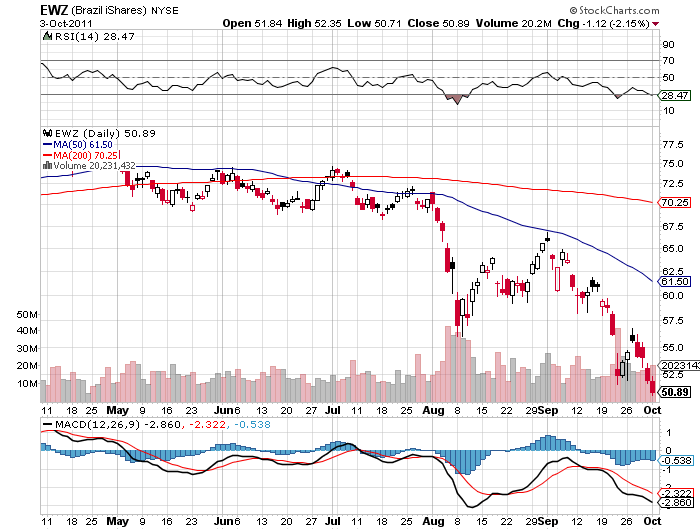

BRAZIL

BRAZIL

Brazil may have energy independence and the Olympics headed its way, but the implosion there has been massive. The BOVESPA lost 2.9% of its value on Monday and let’s just say that its high-flyers are now grounded due to more than just weather. It seems that minerals and forestry are not going to generate cash, just like it missed out on royalties from the term “Brazilian” in personal grooming.

iShares MSCI Brazil Index (NYSE: EWZ) closed down 2.1% at $50.89 and the 52-week trading range is $50.71 to $81.77 (52-week low was Monday). Market Vectors Brazil Small-Cap ETF (NYSE: BRF) closed down 3.15% at $37.96 and the 52-week trading range is $37.73 to $63.78 (52-week low was Monday). iShares MSCI Chile Investable Market Index (NYSE: ECH) closed down 3.8% at $51.16 and the 52-week trading range is $50.92 to $80.38 (52-week low was Monday). Aberdeen Chile Fund, Inc. (NYSE: CH) closed down 4.9% at $13.45 and the 52-week trading range is $13.37 to $26.56 (52-week low was Monday).

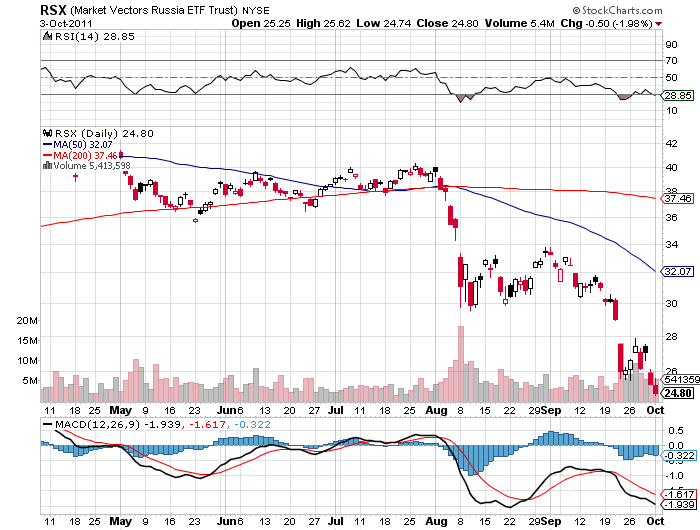

RUSSIA

RUSSIA

The Vladimir Putin effect has already worn off, and the rest of the world is not as strong at backing that regime as much as the Russians themselves are. Russia may now be energy independent and may be the new capitalists (or oligarchs), but the nation is far from being immune to the recessionary climate. The proximity to Europe is now help.

Market Vectors Russia ETF (NYSE: RSX) closed down 2% at $24.80 and the 52-week trading range is $24.74 to $43.16 (52-week low was Monday). Templeton Russia and East European Fund Inc. (NYSE: TRF) closed down 3.9% at $14.06 and the 52-week trading range is $14.06 to $25.97 (52-week low was Monday, and it closed on the low). Central Europe & Russia Fund Inc. (NYSE: CEE) closed down 3.4% at $29.40 and the 52-week trading range is $29.20 to $47.93 (52-week low was Monday).

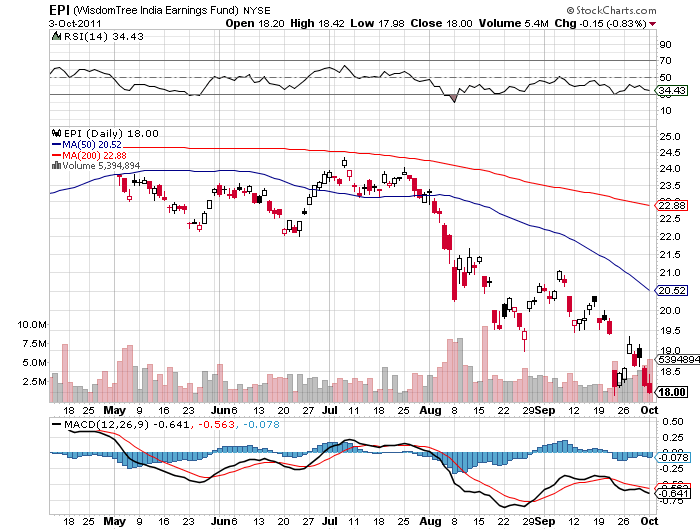

INDIA

INDIA

India may be leading itself down at its own fault. The nation has raised interest rates over and over in an effort to stave off inflationary pressures. The problem is that the inflationary pressure has passed, and now you really have to ask yourself if the goal was to just slow down the economy. Maybe the high gold prices that the citizens want for jewelry is being confused with inflation for the things that make up what you eat, drink, and wear.

WisdomTree India Earnings (NYSE: EPI) closed down 0.8% at 18.00 and the 52-week trading range is $17.98 to $28.72 (52-week low was Monday). PowerShares India (NYSE: PIN) closed down 0.5% at $18.12 and the 52-week trading range is $17.93 to $26.72, but this was not quite a 52-week low. India Fund, Inc. (NYSE: IFN) closed down 2.2% at $22.44 and the 52-week trading range is $22.44 to $40.94 (52-week low was Monday, and the close was on that low). Morgan Stanley India Investment Fund, Inc. (NYSE: IIF) closed down 2.6% at $16.35 and the 52-week trading range is $16.35 to $30.45 (52-week low was Monday, and it closed on the low).

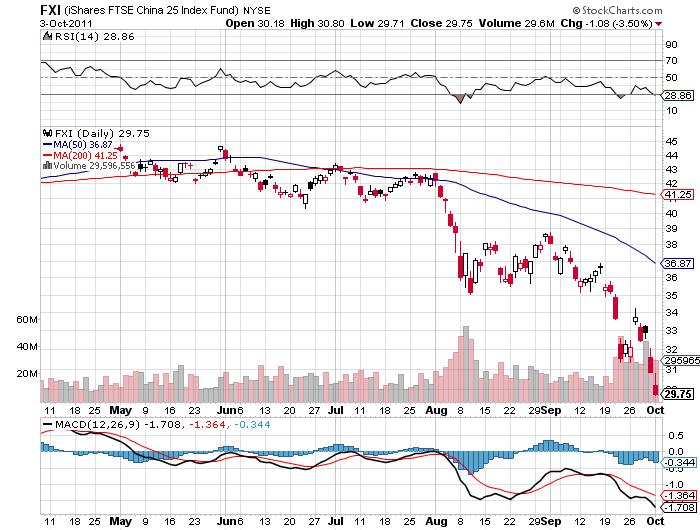

CHINA

CHINA

China is entering a recession, but maybe not a classic recession. The nation’s growth of 8% or higher is now looking like 4% or maybe even less. For China that is a recession. The real problem is China’s property and financial system outside of government guarantees. Hedge fund manager Jim Chanos is winning big now on his short selling bets against China. The arguments for China to float its currency have to be put on hold for the time being, because otherwise there is going to be an instant rise in the price of goods and it will instantly throw China into a real manufacturing recession. The other issue at hand for China is its shoddy accounting, and we have even boasted that the most free speech in the world comes out of China from its corporate CFOs.

iShares FTSE China 25 Index Fund (NYSE: FXI) closed down 3.5% at $29.75 and the 52-week trading range is $29.71 to $47.99 (52-week low was Monday). SPDR S&P China (NYSE: GXC) closed down 3.5% at $53.83 and the 52-week trading range is $53,79 to $84.88 (52-week low was Monday). Guggenheim China Real Estate (NYSE: TAO) closed down 4.1% at $12.69 and the 52-week trading range is $12.69 to $22.00 (52-week low was Monday, and low close). Guggenheim China Small Cap (NYSE: HAO) closed down 5.1%% at $17.18 and the 52-week trading range is $17.18 to $33.57 (52-week low was Monday, at a low close). The China Fund, Inc. (NYSE: CHN) closed down 2% at $22.53 and the 52-week trading range is $22.50 to $35.33 (52-week low was Monday). Templeton Dragon Fund Inc. (NYSE: TDF) closed down 1% at $23.96 and the 52-week trading range is $22.87 to $32.75 (did not hit low on Monday).

REST OF THE WORLD

REST OF THE WORLD

It is easy to point out that Europe is burning and that Asia is slowing and putting on the brakes harder than a cab driver in Chicago. The ISM data in the United States showed we are not yet in a manufacturing recession. Last week’s jobless claims came in unexpectedly less bad than expected. GDP is still expected to remain marginally up for Q3, but “marginally” should read “by the hair of the chinny-chin chin.”

The downside calls from equity strategists are getting worse and worse, now with one guy calling for as low as 700 on the S&P 500 Index. That would be brutal and it is painful to imagine what that would put the economy in… Maybe as a pure guess: -3% GDP, 11.5% unemployment, even wider budget deficits.

The VIX is so high and back above 45.0 that we cannot wonder if a severely oversold technical bounce is close in the equity markets. The trick is trying to predict a catalyst as the markets are hostage to Europe and Asia and the situation is worsening and is also lacking any obvious catalysts.

Bonds are back at the lowest yields again, with the 30-year Treasury at 2.76% and the 10-year Treasury at 1.78%. The 2012 U.S. election is now just a year or so away and it seems more and more likely that a regime change is headed our way each month that passes if you look at the economic situation. We certainly expect Ben Bernanke and Fed governors to continue lowering their growth targets for the rest of 2011 and likely into 2012.

There is some good news and some bad news. With the VIX so high and with every single market participant calling for a weaker market, this is an environment that is a contrarian’s most pleasurable dream scenario that there can be. The problem is that it is hard to find any bullish catalysts. Europe is in total denial. Much of Southeast Asia may have reached close to its capacity for a while. Africa and the Middle East are now not even concerns at all for the West. We are still waiting for some sort of flush-out event.

We would like to leave one last closing statement here. As you can see, there is almost no good news included here that is worth much for the bulls. The banks and techs are getting sold wholesale and the regulatory and political environment gets less and less business friendly by the day. The only cover is in the truly defensive stocks and those stocks that offer predictable earnings. If the world does not get dragged back into a system wide recession, then this market carnage may in many cases be a gift. Some will say that the opportunities are almost as great as they were in February and March of 2009. Stay tuned.

Here were Monday’s closing levels:

JON C. OGG

Stocks below from Stockcharts.com in iShares MSCI Brazil Index (NYSE: EWZ), Market Vectors Russia ETF (NYSE: RSX), WisdomTree India Earnings (NYSE: EPI), and in iShares FTSE China 25 Index Fund (NYSE: FXI):

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.