Riverbed Technology, Inc. (NASDAQ: RVBD) lost its way for a while. After a huge disappointment in July, Riverbed shares tanked from $40 to $30. Then it from $30 to $25 and then ultimately under $20. Now the stock is finally showing some signs of life and investors have to be wondering whether or not the stock is ready for a comeback.

Riverbed Technology, Inc. (NASDAQ: RVBD) lost its way for a while. After a huge disappointment in July, Riverbed shares tanked from $40 to $30. Then it from $30 to $25 and then ultimately under $20. Now the stock is finally showing some signs of life and investors have to be wondering whether or not the stock is ready for a comeback.

The data and traffic acceleration equipment maker for wide area networks reported earnings on Wednesday evening of $0.24 EPS versus $0.17 EPS a year earlier and it showed that sales rose 28% to $190 million. The consensus data from Thomson Reuters was only at $0.21 EPS and $185 million in sales.

This was a record quarter with growth year over year and sequentially. Riverbed also confirmed that it generated $90 million in cash flow from operations and it exited the quarter with $559 million in cash and investments after it repurchased $20 million in its own stock and after paying out $120 million for acquisitions. Riverbed even noted strong business in Europe and in government spending.

FBR has noted the company positively so far and we would expect more positive endorsements even if this is not quite the same growth rate or upside surprise that some investors used to expect. We have seen reports that Citi maintained a “Neutral” rating and $25 target, and that Needham & Co. maintained a “Buy” rating but lowered the target to $41 per share. The consensus price target remains just above $30.00.

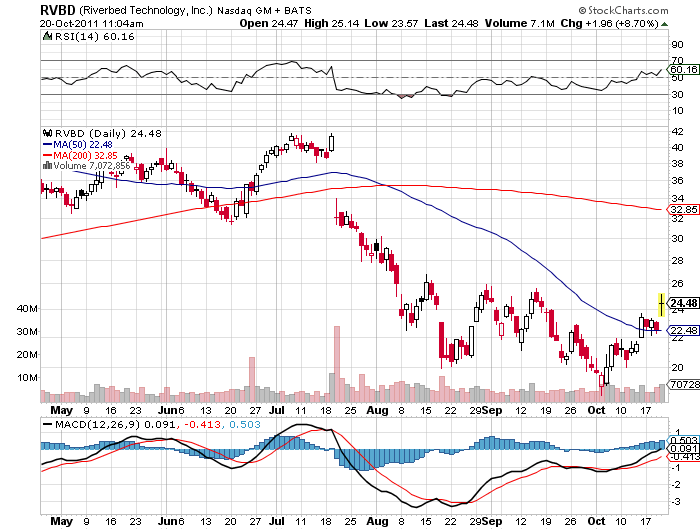

The stock chart (seen below from stockcharts.com) shows that Riverbed had already crossed back above its 50-day moving average (listed as $22.48 today) and the 200-day moving average is all the way up to $32.85. Realistically, the true pivot point on a long-term basis is not really until the share price of $32.00 but there will be some additional real resistance at just under $26.00 as that is the price that everyone who bought Riverbed will be profitable or breakeven going back to mid-August.

Options activity is active, but the expiration date is this Friday. Call option activity is elevated for November expirations, but it is light for December expiration.

If the company just meets expectations ahead, Riverbed trades at almost 29-times 2011 earnings and about 22-times 2012 earnings. Since this stock was a high-speed flame-out that crashed and burned, it seems that many investors are not willing to chase the stock after a near-10% gap-up. The good news is that investors are not calling Riverbed by the names of “Dry Creek” or “River Bad” today.

Shares are currently up almost 9% at $24.50 and the 52-week trading range is $18.33 to $44.70. In less than 2 hours of trading we have seen more than 7 million shares trade hands and that represents about 125% of normal trading volume for a whole day.

JON C. OGG

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.