Investing

Recession or No Recession, Stocks May Be Close To Fully Valued

Published:

Last Updated:

This is an interesting time in the market and the economy. The market is full of so much mixed and conflicting data. It was late last week that we ran an article showing ten different economic indicators which were offering a signal that the U.S. has avoided a double-dip recession. Some may think that this means “Buy, buy, buy” article, but that is the problem with readers merely looking at headlines.

This is an interesting time in the market and the economy. The market is full of so much mixed and conflicting data. It was late last week that we ran an article showing ten different economic indicators which were offering a signal that the U.S. has avoided a double-dip recession. Some may think that this means “Buy, buy, buy” article, but that is the problem with readers merely looking at headlines.

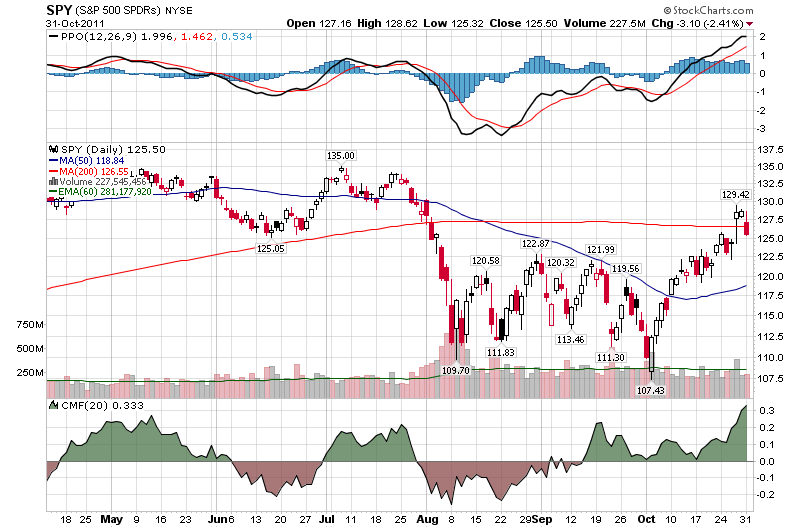

Equities may have gone from cheap and very oversold to fairly valued and overbought over this massive move we have recently seen. After two days of selling, it looks like stocks are trying to find a fair value at a price lower than the October rally would have put it. The news and the reaction coming out of Europe is negating the progress made just a week earlier.

The charts are looking against stocks right now. Steve Bigalow, one of our technical analysis affiliates at Candlestickforum.com, noted to us on Monday evening, “The S&P has dropped 31 points in the last two days after a massive run during the month of October. This represents a Japanese candlestick chart called the Evening Star Signal, one of the twelve Candlestick reversal signals. Generally, this implies the start of a strong downtrend.”

One of the top “inflows and outflows” trackers is Birinyi Associates, and within hours of the top last week in the stock market they noted how stocks had now become extremely overbought. They even cited nine out of ten sectors showing a very overbought reading. Birinyi also shows that the blogger sentiment poll is now 66.67% Bullish and bearish is even under “Neutral” at 14.81% versus 18.52%. The bulls were only 35.71% and the bears were far more grizzly at 39.29% just the week before.

After publishing the “no recession” article, the caveats that were brought up need to be addressed. We conducted a poll on Friday over the European bailout and the 1-day poll only and it being Friday afternoon may have muted how many readers actually participated in the poll. Still, the votes were massively skewed against Europe being a game-over victory. The votes were as follows:

It is easy to argue about an incredibly poor employment situation, a very poor housing market, and very weak growth. The problem in arguing over a formal recession or not is that the more recent data, including 2.5% or so GDP growth in the third quarter, is signaling that a new recession is not imminent.

There are a couple of things that still need to be considered. They are critical. Stocks may actually now be fully valued or at least close to it. Even if they are not at full value, they certainly did move higher in such a fast manner that many investors who are not forced to chase performance can still sit and wait for lower prices. A 5% or a bit more of market correction from last week’s highest close would not be out of the realm of possibilities after the move higher that we saw during October.

The most under-reported current story remains the Super-Committee in Washington D.C. With so much infighting in Washington D.C. and with so many predicting that this committee was designed to fail, we are calling it the Super-Stinker. Sadly, if no resolution is made by Thanksgiving then the politicians will have gambled with our sovereign credit ratings all over again. While not official, there seems to be a new opinion by politicians forming that “The debt rating cut didn’t kill us before, so it won’t kill us if it happens again.” This is extremely dangerous, but after all we are talking about Washington D.C. here.

Our take is that the U.S. has likely averted a second recession, or the double dip recession, but equity assets may be fairly valued and they may even have to settle a bit lower again before they are deemed cheap.

JON C. OGG

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.