Here are Wednesday’s market winners and losers.

Biggest Winners

Shares of Riverbed Technology (NASDAQ: RVBD) are up 26.60% to $18.42 on trading volume of 7.3 million shares. Riverbed’s second-quarter revenue of $199.9 million was 17% higher than a year earlier and beat Wall St. estimates. The 52-week high is $30.73.

Shares of Lumber Liquidators (NYSE: LL) are up 21.20% to $39.49 on trading volume of 1.5 million shares. Second quarter earnings of 43 cents a share beat analyst estimates by 15 cents, according to Capital IQ estimates. Before Wednesday, the 52-week high was $34.71.

Shares of Symantec (NASDAQ: SYMC) are up 14.31% to $15.06 on trading volume of 9 million shares. The company posted second-quarter earnings of 43 cents a share, above analyst estimates of 38 cents a share. Shares were also assisted from the CEO Enrique Salem stepping down, where chairman Steve Bennett will take over the top executive post. The 52-week high is $19.81.

Biggest Losers

Shares of RadioShack (NYSE: RSH) are down 25.97% to $2.70 on trading volume of 3.7 million shares. The company reported a second-quarter loss of $21 million and announced it was suspending its dividend. Before Wednesday, the 52-week low was $3.47.

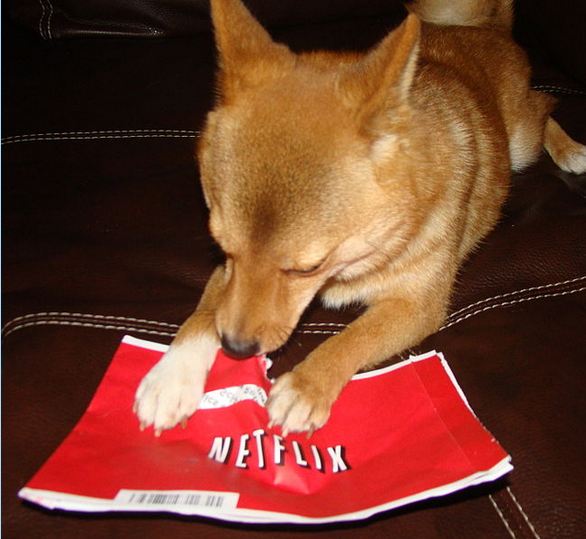

Shares of Netflix (NASDAQ: NFLX) are down 21.38% to $63.20 on trading volume of 8.9 million shares. While quarterly sales and earnings beat Wall Street estimates, Netflix CEO Reed Hastings said in a letter to investors that meeting its goal of 7 million new users in 2012 would be “challenging.” The 52-week low is $60.70.

Shares of TripAdvisor (NASDAQ: TRIP) are down 17.67% to $35.79 on trading volume of 3.7 million shares. The online travel-based company reported second-quarter revenue of $197.1 million, below $203.6 million analysts polled by Bloomberg were expecting. The 52-week low is $23.99.

Samuel Weigley

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.