Here are Tuesday’s market winners and loser.

Biggest Winners

Shares of Medicis Pharmaceutical Corp. (NYSE: MRX) are up 37.90% to $43.52 on trading volume of 19.4 million shares. Valeant Pharmaceuticals International Inc. (NYSE: VRX) has agreed to buy Medicis for $2.6 billion. Before Tuesday, the 52-week high was $40.10.

Shares of Heckmann Corp. (NYSE: HEK) are up 20.45% to $3.24 on trading volume of 5.7 million shares. The company announced its intentions to buy Power Fuels for $380.5 million in cash, debt and stock. The 52-week high is $7.05.

Biggest Loser

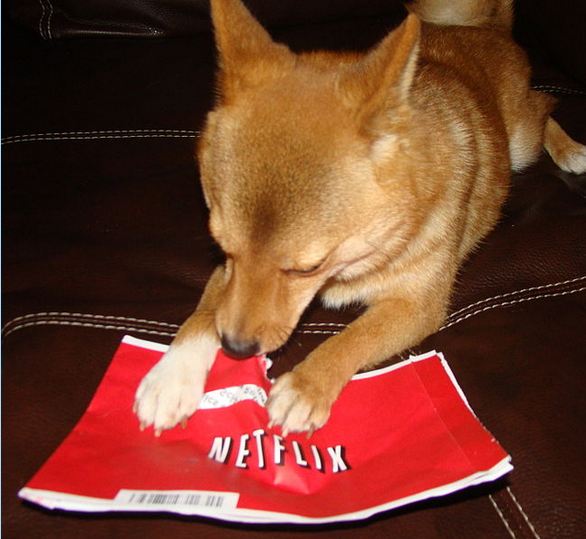

Shares of Netflix Inc. (NASDAQ: NFLX) are down 10.92% to $53.20 on trading volume of 4.1 million shares. Rival Amazon.com Inc. (NASDAQ: AMZN) has signed a content deal to add EPIX movies to Prime streaming. The 52-week low is $52.81.

Samuel Weigley

Follow him on Twitter: SWeigley

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.