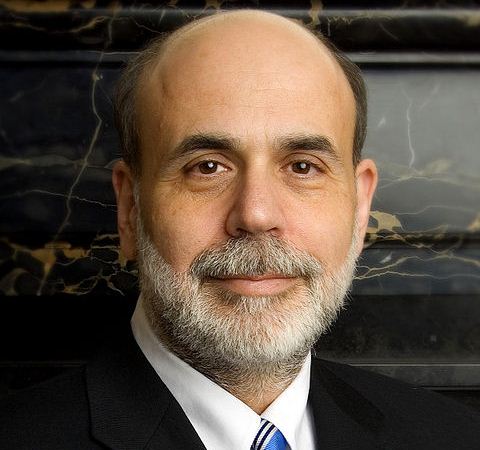

In a response to an early question related to the short-term problems facing the U.S. economy, Bernanke noted three: the sequester, the fiscal deficit, and the debt ceiling. He used the analogy of a family credit card to explain the debate over raising the debt ceiling — the funds are already spent, but now there are some in Congress who do not want to pay the monthly bill.

A few positive notes on the U.S. economy: housing is picking up, state and local government tax receipts are rising, energy prices are lower, and consumer sentiment is rising. But, Bernanke said, there’s still a long way to go.

Bernanke reiterated his often-stated point that Congress needs to do its job and he doesn’t think that raising interest rates in the short term will have the result some project, but rather would act as an additional drag on the economy.

Asked where global growth might come from, Bernanke admitted that slow growth in Europe and some emerging market economies have weighed on overall global economic growth. Sovereign debt and banking issues are being dealt with in Europe and that should stabilize the European situation over time. In emerging markets, fundamentals are “pretty good” and he called the growth in China and India the world’s most successful anti-poverty program.

In general, Bernanke said he is “cautiously optimistic” about the next couple of years, which, as it turns out, coincides with the rest of his term as chairman. After that, we’re own our own.

In general, anyone who has been paying attention to the Fed for the past four or five years probably didn’t hear anything new at today’s conversation.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.