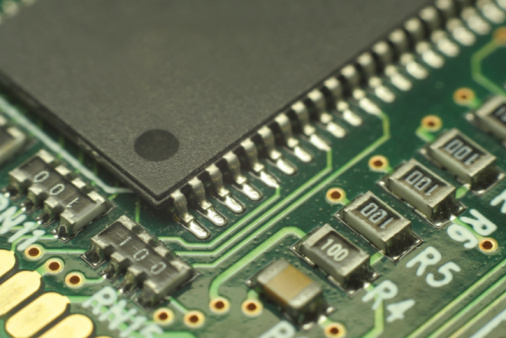

First-quarter earnings season for the semiconductor sector yielded generally in-line results and guidance, somewhat calming investor fears. While the resulting outperformance in the semiconductor index (SOX) is a relief, the Deutsche Bank A.G. (NYSE: DB) research team believes investor selectivity needs to rise further as the macro demand remains tepid.

Within this slow but improving environment, the analysts believe investors should focus away from the already expensive high-quality, broad-based names that require a strong macro recovery to generate upside and move toward companies that offer specific growth drivers or those that can generate earnings leverage with minimal revenue upside. In a report released late yesterday, they highlighted their semiconductor stocks to buy.

Intel Corp. (NASDAQ: INTC) is the mega-cap name that tops the Deutsche Bank list. Now a virtual value stock, Intel wants a bigger piece of the mobile processor market. They recently released the Silvermont, a 22 nanometer system-on-chip that boasts three times the performance and five times less power consumption than current Atom core chips. The Thomson/First Call price target is $23. Shareholders are paid a solid 3.80% dividend.

Broadcom Corp. (NASDAQ: BRCM) stays high on the Deutsche Bank list of stocks to buy. While Broadcom has more than 70% share in the combo connectivity segment, they only have about 10% of the 3G baseband market and are looking to grow that number. The consensus price objective for the stock is $40. Investors are paid a 1.20% dividend.

Avago Technologies Ltd. (NASDAQ: AVGO) engages in the design, development and supply of analog semiconductor devices. The consensus target for this stock is $42. Investors receive a 2.40% dividend.

Freescale Semiconductor Ltd. (NYSE: FSL) sells its ARM-based semiconductors to a number of companies in the automotive, industrial and consumer device markets. The consensus price objective is $16.

NXP Semiconductors N.V. (NASDAQ: NXPI) just completed a 144-A, $750 million debt placement to help finance continued growth and to pay off existing floating rate debt. The consensus target for the stock is $36.

ON Semiconductor Corp. (NASDAQ: ONNN) is the top small cap name to buy at Deutsche Bank. Monday the company reported first-quarter 2013 earnings of $0.10 per share, topping estimates by 25%. The consensus price target for this top name is $10. Hitting the target would represent an almost 25% move from current trading levels.

Fairchild Semiconductor International Inc. (NYSE: FCS) is another company with chips for the automotive industry. The consensus estimate for the stock is at $17.

Monolithic Power Systems Inc. (NASDAQ: MPWR) rounds out the list of top semiconductor stocks to buy. MPS had an outstanding first quarter of the year, hitting record revenue while continuing to deliver solutions that meet or exceed industry standards. The consensus price objective for the stock is at $28.

Deutsche Bank points out in their research that from a risk perspective the semiconductor sector is inherently cyclical and therefore volatile as demand and inventory gyrations are always looming. With that caveat, picking the right names with growth potential for the future could add up to big portfolio gains.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.