Larry Summers has lost his chance to be chairman of the Federal Reserve, brought down by arrogance, missteps as president of Harvard and close relationships to Wall Street. Widely regarded former Treasury Secretary, Timothy Geithner, worn down by years on office, says he will not be a candidate. Deputy Fed Chair Janet Yellen has been seen as the candidate of the left, a group sometimes characterized as “progressive.”

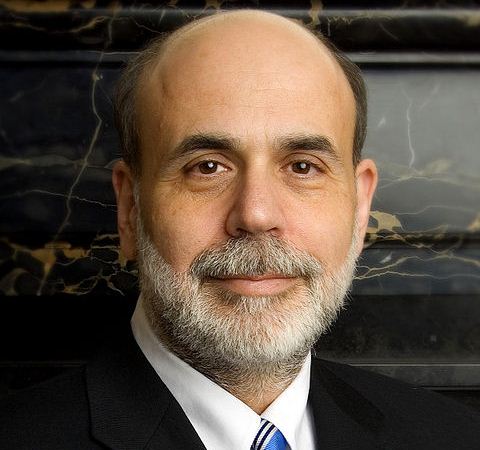

Current chief Ben Bernanke has hinted that he does not want to return. President Obama has done more than hint he does not want Bernanke to stay. However, at a time when Obama’s reputation is weak, even within his own party, and with a budget and debt ceiling war with Republicans about to begin, the president could calm the financial markets, and aid the national economic recovery, by putting aside his bias and convincing Bernanke to remain for one more term.

Bernanke has proven that he will not buckle to pressure to cooperate more with the administration, or even to brief them on his plans. That independence has been seen as an evenhandedness that many other policy makers and the financial world applaud. Bernanke answers to no one.

Bernanke also has done a remarkable job of forming consensus among the various “doves” and “hawks” who sit around the Board of Governor’s table at the Federal Reserve. Disagreements over monetary policy and the series of “quantitative easing” decisions may have broken out into the open. But Bernanke has kept those debates from undermining a course he believes is best to heal the economy. Even for those who disagree, those who believe he should be either more or less aggressive, there is a consensus he has “done no harm.”

No group likes certainty more than Wall Street. Some experts believe that when Bernanke leaves and uncertainly reigns, markets will crumble, at least for a time. The current market rally has helped fuel the overall economy, even for people who are not investors. Nearly every day there is a news story about how often the markets will reach new highs before the end of the year.

Finally, Bernanke has done a number of things that the general public may not care about, but those things are essential to the health of the financial system. One was the Fed’s decision to implement Basel III in the United States. Another was to keep pressure on large banks through a series of “stress tests.”

Whether President Obama likes Bernanke may not sway his decision about the next Fed chief. The president may find that Bernanke is the only choice widely acceptable, and the only one that can help keep the markets and — as much as monetary policy can — the economy stable.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.