What is Q-GARP? Quality growth at a reasonable price. The UBS Q-GARP list is constructed using an initial quantitative screen of stocks based on: 1) quality metrics — high and stable profitability, 2) growth — high expected earnings growth, and 3) valuation — low valuation relative to peers. The final list of stocks to buy is a compilation of quality growth stocks that the analysts at UBS believe are trading at attractive valuations.

This year has been an outstanding year for the Q-GARP stocks. The combined list is up 26.4% year to date, versus the S&P 500’s 21.4%. In addition, since its inception in 2007, the list is up a cumulative 66.2%, versus the S&P 500 at 27.8%. The key to these stocks versus the benchmark is both do well when times are good, like now. However, when times are bad, like 2008, the Q-GARP stocks outperformed by almost 10%, a significant difference.

In a new report, the UBS team adds three new names to the list, and we update some of the other top dividend names to buy.

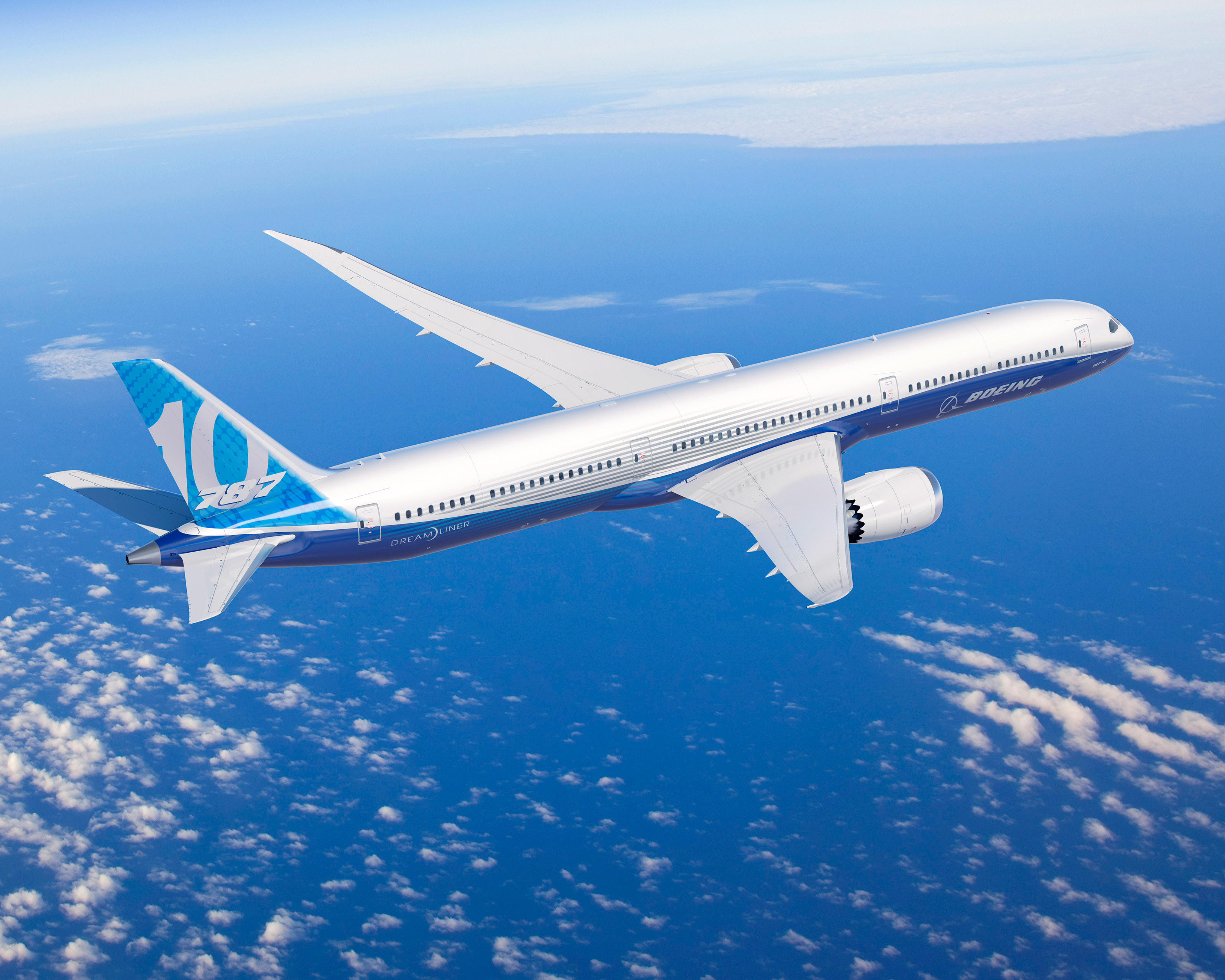

Boeing Co. (NYSE: BA) is added to the list. The company has shaken off the fits and starts from the Dreamliner, and the even larger 787-9 recently completed its maiden test flight. We recently profiled how Boeing may become the most important stock in the DJIA. Boeing should experience robust free cash flow generation over the next several years, as the company benefits from a commercial aerospace upcycle (driven by expanding global demand and the replacement of less fuel-efficient planes) and decelerating research and development costs. The UBS price target for this top name is $107. The Thomson/First Call estimate is at $123.50. Investors are paid a 1.7% dividend.

Dicks Sporting Goods Inc. (NYSE: DKS) continues to be one of the largest and fastest growing retail chains in the United States. UBS thinks that Dick’s appears to be the best-positioned company within sporting goods retailers, as ample growth avenues include new store count expansion, e-commerce initiatives and its “store within a store” concepts with branded partners Nike (NYSE: NKE) and Under Armour (NYSE: UA). The UBS target for the stock is $59, while the consensus is placed at $56. Shareholders receive a 1.0% dividend.

Southwestern Energy Co. (NYSE: SWN) is the third name to be added to the UBS Q-GARP list. The company is a top energy name to buy and should benefit from its fast-growing production in attractive shale plays, notably in the Fayetteville and Marcellus areas. The UBS target for the stock is posted at $45, and the consensus figure is at $43.

We scanned the list to find the top names that were paying the highest dividend yields at this time. With the Federal Reserve not tapering its quantitative easing (QE) at this week’s meeting, dividend-paying stocks again step to the forefront for investors seeking income. Here are the top Q-GARP dividend stocks and their dividend payouts.

- Ameriprise Financial Inc. (NYSE: AMP) 2.3%

- Apple Inc. (NASDAQ: AAPL) 2.6%

- Colgate-Palmolive Co. (NYSE: CL) 2.3%

- E.I. du Pont de Nemours & Co. (NYSE: DD) 3.1%

- Emerson Electric Co. (NYSE: EMR) 2.6%

- Medtronic Inc. (NYSE: MDT)

- Qualcomm Inc. (NASDAQ: QCOM) 2%

- United Technologies Corp. (NYSE: UTX) 2%

The key thing to remember is the outperformance of the Q-GARP stocks when the good times are not rolling. The rising tide usually lifts all boats. When the tide goes out and the market heads down, investors want to own names that can ride out the storm in a better fashion.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.