Investing

Merrill Lynch Technical Titans List Scans for Best Stocks to Buy

Published:

Last Updated:

The Merrill Lynch Technical Titans List was formerly known as the Most Attractive Buy List and was introduced in February 2006. It is designed to identify common stocks that are attractive based on the firm’s own technical analysis. The primary objective of the list is to generate superior risk-adjusted returns versus the benchmark (S&P 500) over the long term through both tactical and strategic stock selection. In other words, the Bank of America Merrill Lynch team is looking for the top stocks that will supply investors alpha. While the list seeks to generate these returns by capturing short to intermediate term (three to six months) price appreciation for the selected stocks, positions can be held longer term.

The advantage of technical analysis is its basis of metrics and data. Typically all stocks are covered by analysts looking at fundamental and balance sheet data. The Technical Titans list begins with Merrill Lynch Buy- or Neutral-rated stocks. From there they identify industry groups, and then individual stocks within those groups, that have positive or constructive technical price trends and chart patterns. Here are some of the top Technical Titan stocks to buy at Merrill Lynch broken out by sector.

PetSmart Inc. (NASDAQ: PETM) is a top name to buy in the consumer discretionary sector. Americans’ love affair with their pets has continued to grow unabated, and the top retailers have benefited. One aspect analysts often point to is how pet stocks do well even in bad times, as pet owners always continue to care for and feed their animals. The Merrill Lynch price target for the stock is $90. The Thomson/First Call estimate is lower at $78. PetSmart closed Tuesday at $72. Investors are paid a 1.1% dividend.

Schlumberger Ltd. (NYSE: SLB) is a top Technical Titan energy stock to buy. With U.S. oil production rising at an incredible rate, the top oil field services companies are seeing increasing business. Schlumberger also benefits from a massive international exposure that continues to grow. Investors receive 1.4% dividend. Merrill Lynch has a $106 price target on the stock, and the consensus is posted at $99.50. Schlumberger closed Tuesday at $90.54.

Regions Financial Corp. (NYSE: RF) makes the grade in the financial sector. Having sold off its Morgan Keegan brokerage arm in 2012, the company is now focused on its core banking business. The improving economy is helping the company increase earnings. Its presence in the fast-growing southeastern United States also is helping growth. Investors are paid a 1.3% dividend. Merrill Lynch has a $12 price target for the stock, while the consensus stands at $11. Regions closed Tuesday at $9.57.

Merck & Co. Inc. (NYSE: MRK) is a top health care name to buy. With one of the top pharmaceutical portfolios, a growing pipeline of new products and the deep pockets required to make acquisitions, Merck remains a top name among professional portfolio managers. Shareholders receive a very attractive 3.6% dividend. The Merrill Lynch price target for this industry leader is $54. The consensus target is lower at $50.50, and Merck closed Tuesday at $46.57.

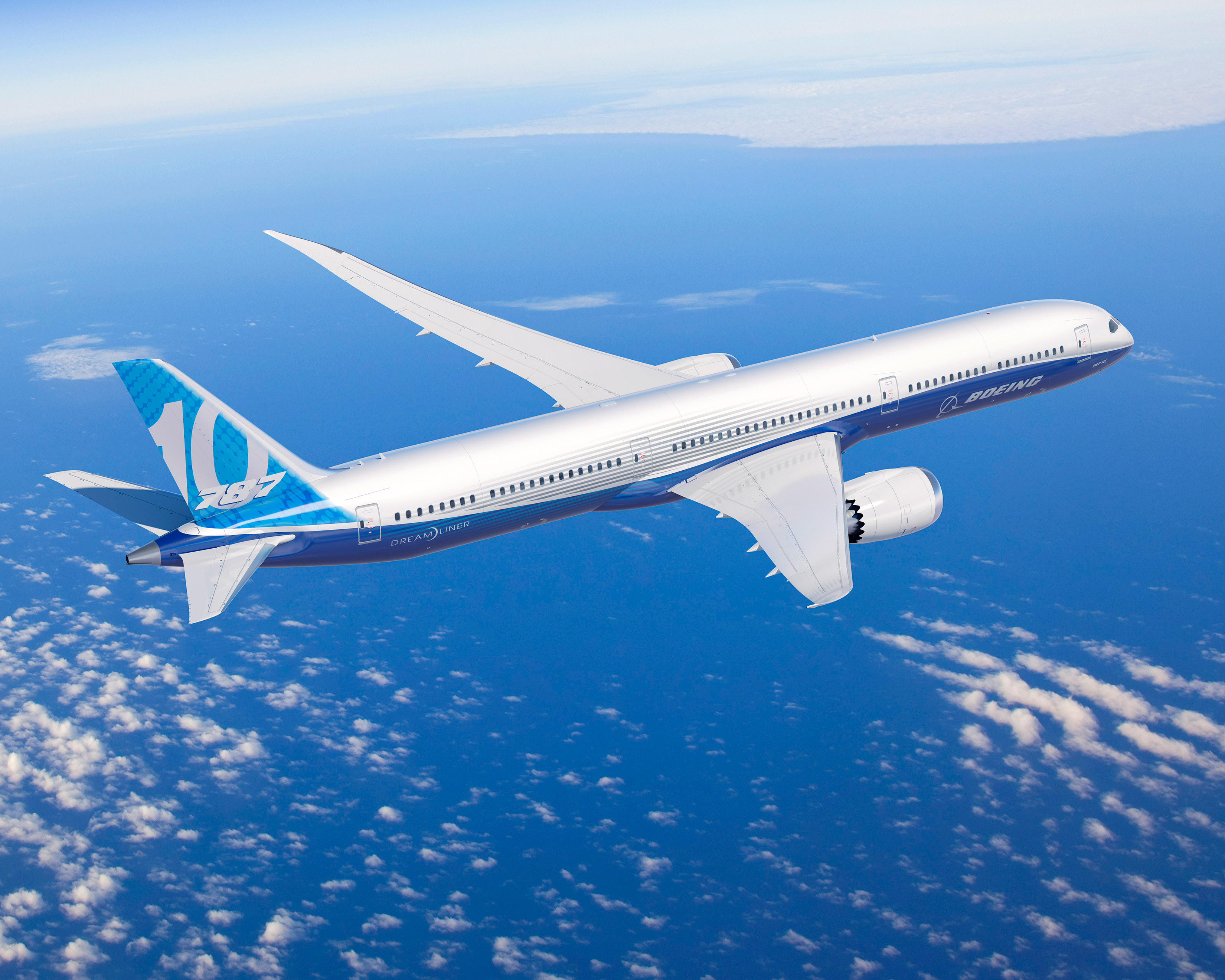

Boeing Co. (NYSE: BA) is a Technical Titan stock to buy in the industrials sector. Despite continued problems with the Dreamliner aircraft, the company has continued to receive huge orders from around the world for all models. We recently wrote about how Boeing may become the most important stock in the DJIA. Investors are paid a 1.6% dividend. Merrill Lynch’s price target for the stock is set at $130, the same as the consensus price objective. Boeing closed Tuesday at $118.18.

Cognizant Technology Solutions Corp. (NASDAQ: CTSH) was just added to the Technical Titans list, and it is a top technology name to buy. The company provides information technology (IT), consulting and business process outsourcing services worldwide. The company operates through four segments: Financial Services; Healthcare; Manufacturing, Retail and Logistics; and Other. Merrill Lynch’s price target for the stock is $90. The consensus price objective is $87.50. Cognizant closed Tuesday at $85.91.

Dow Chemical Co. (NYSE: DOW) makes the list in the materials sector. The company recently sold its polypropylene business for $500 million as part of an ongoing plan to divest almost $1.5 billion in assets. Investors are paid a very solid 3.3% dividend. Merrill Lynch has a $38 price target for the largest U.S. chemical company. The consensus is at $38 also. Dow closed Tuesday at $40.43.

Technical analysis combined with strong fundamental analysis is a win-win for investors. The technical chart pattern is based on volume and price movement. When combined with solid business and balance sheet analysis, investors have two very good reasons to own a stock. In a pricey market that has had the biggest appreciation in years, that makes good sense.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.