Most Wall Street firms run model portfolios for their institutional and retail clients. Like all portfolios, they make weighting changes based on a variety of specifics, which can include everything from valuation to loss or gains in technical and relative strength. Usually when a portfolio manager eliminates a position, either the thesis on the stock has totally broken down or the stock has hit the established price target. Piper Jaffray took a large chunk out of its model portfolio, and in the process eliminated some high-profile names.

When a full position is eliminated from a portfolio, of course all of the stock is sold. When the Piper Jaffray managers thinned out their portfolio recently, they took out more than 10% of the holdings, from a portfolio that was set at 92% equity invested. Clearly some of the names had probably hit their price targets’ others may have just sputtered and not fulfilled expectations.

Here are the stocks that recently got the axe from the Piper Jaffray Model Portfolio.

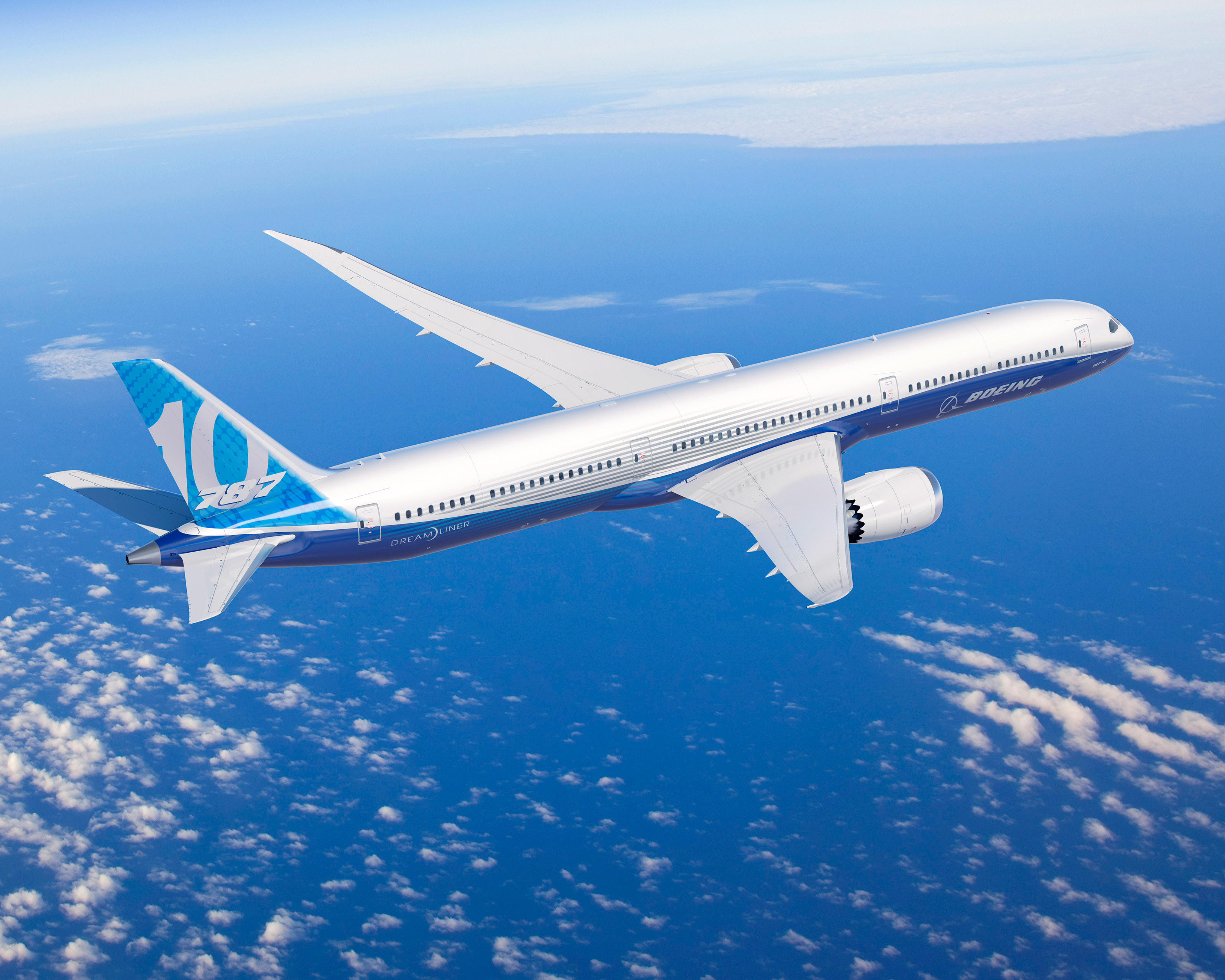

Boeing Co. (NYSE: BA) was a top name last year on Wall Street, and valuation may be the main call at Piper Jaffray. While the company is forging ahead with the new 737 Max and 767 models, continued problems with the 787 Dreamliner still plague the aerospace giant. Investors are paid a 2.4% dividend. The Thomson/First Call consensus price target is at $152.64. The stock closed Monday at $129.59.

BRF S.A. (NYSE: BRFS) engages in raising, producing and slaughtering poultry, pork and beef in Brazil. The company is also involved in processing and selling fresh meat, processed products, milk and dairy products, pasta, frozen vegetables and soybean derivatives. The emerging market stock rout could be the main reason this stock was shown the door. Investors are paid a miniscule 0.2% dividend. The consensus price target is a gigantic $53.86. The stock closed Monday $17.10.

Colfax Corp. (NYSE: CFX) is bumping into 52-weeks highs, and that could be a cause for dismissal. The company, which is a leading global manufacturer of gas- and fluid-handling and fabrication technology products, recently had a large secondary offering, which could have also sparked the exit. The consensus price target is $58.67. Colfax closed way above that number at $70.62.

Danaher Corp. (NYSE: DHR) is another company trading at 52-week highs. It reported earnings of $0.96 a share in fourth-quarter 2013, which beat the consensus estimates by a penny. The results increased 10.3%, compared to the earnings of $0.87 a share reported in the prior-year period. The healthy increase in earnings was mainly attributable to core revenue growth and better margin expansion. Specific initiatives for new product development and increased investment were the other positives for the company. Investors are paid a 0.5% dividend. The consensus estimate is set at $84.64. Danaher closed Monday at $76.56.

Renasant Corp. (NASDAQ: RNST) had poor fourth-quarter results and was also recently downgraded to Market Perform at Raymond James. The company operates 83 banking and financial services offices in Mississippi, Tennessee, Alabama and Georgia. Investors are paid a 2.5% dividend. The stock closed Monday at $28.27.

Tidewater Inc. (NYSE: TDW) provides offshore service vessels and marine support services through the operation of a fleet of marine service vessels. The stock has been in a free-fall since January, and it looks as though the Piper Jaffray managers have thrown in the towel. Investors are paid a 2.1% dividend. The stock closed at $48.36 on Monday.

Ternium S.A. (NYSE: TX) looks like another valuation call as the stock is close to a 52-week high. Many steel makers got hit recently when the U.S. Department of Commerce declined to impose tariffs on South Korean steel pipes. After investigating allegations that Korean companies were selling steel pipes used by energy companies at unfairly low prices, the Commerce Department said Monday that it had found no evidence of such behavior. Investors are paid a 2.1% dividend. The consensus target is posted at $33.83. Ternium closed Monday at $30.38.

It is pretty clear that in most cases the Piper Jaffray managers were clearing the deck of stocks in their books they saw as fully valued. Being at a 52-week high is hardly unusual with the S&P 500 at record levels and the Nasdaq at 13-year highs. As soon as we find the portfolio adds, we will post them.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.