As the slow tax season over summer is approaching, we are reviewing tax data from states around the U.S. to see how things are coming along. In California, it looks as though the gains made in the first months of this year are petering out.

As the slow tax season over summer is approaching, we are reviewing tax data from states around the U.S. to see how things are coming along. In California, it looks as though the gains made in the first months of this year are petering out.

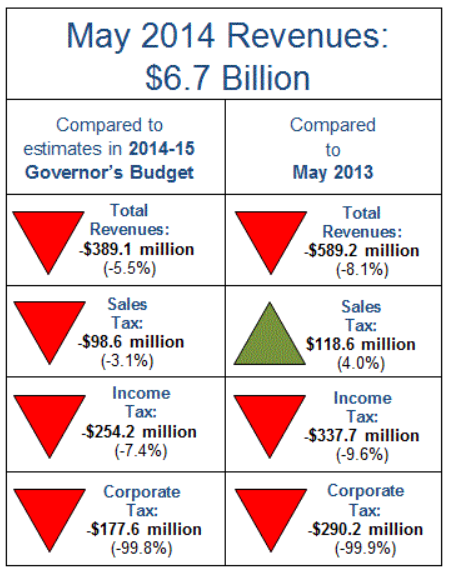

California State Controller John Chiang has released his monthly report covering California’s cash balance, receipts and disbursements during the month of May 2014. Revenues came up 5.5% short at $6.7 billion, or by $389.1 million, under Jerry Brown’s proposed budgets in January. Chiang’s report does show that the revenues have still exceeded expectations year-to-date by about 2.1%, or a total of $1.8 billion.

One word of warning may be in here, or an asterisk. As California’s cash position exceeded expectations by $5 billion as of the release of the Governor’s May revision, the state’s Department of Finance did not produce formal cash flow projections for the May revision.

Income tax collections in May came in $254.2 million below Governor Brown’s estimates, a shortfall of 7.4%. Corporate taxes were under estimates by $177.6 million, a sharp 99.8% percent. Sales tax receipts also came in 3.1% light by some $98.6 million.

California’s cash reserves exceed the governor’s original projection by $4.9 billion so far at the end of May. The positive reserve is made up of $3.5 billion higher internal borrowable resources, as well as a cash deficit that is lower than projections by $1.4 billion.

California’s cash deficit is now $8.5 billion, and it is being covered by both internal and external borrowing.

ALSO READ: Seven States Running Out of Water

The Chiang statement said:

While this is the first time in six months that revenues have fallen short, the overall budgetary health remains stable and there is no threat to the State’s ability to pay its bills on time and in full. As lawmakers finalize their spending decisions in the coming days, my office urges fiscal restraint with an eye toward slashing the billions of dollars in debt accrued during the Great Recession.

The trend at hand here is not good, and it is ahead of the summer season when tax receipts from corporations and individuals are often slower. This should not affect California credit ratings by any means as of yet, but it still needs to be watched closely, particularly if spending turns out to have limited flexibility when receipts run light.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.