Oppenheimer is out with its favorite ideas for stocks to buy from its favorite sectors. The move is from the inflection points under its technical analysis themes, and the report hinges around the low volatility readings from the VIX in the stock market.

While the report contains a total of 50 buys and 50 sells against each other in the S&P 500, the most interesting part is that there are three buy ideas from Oppenheimer’s favorite stock sectors. These include Facebook, Hess and Delta Air.

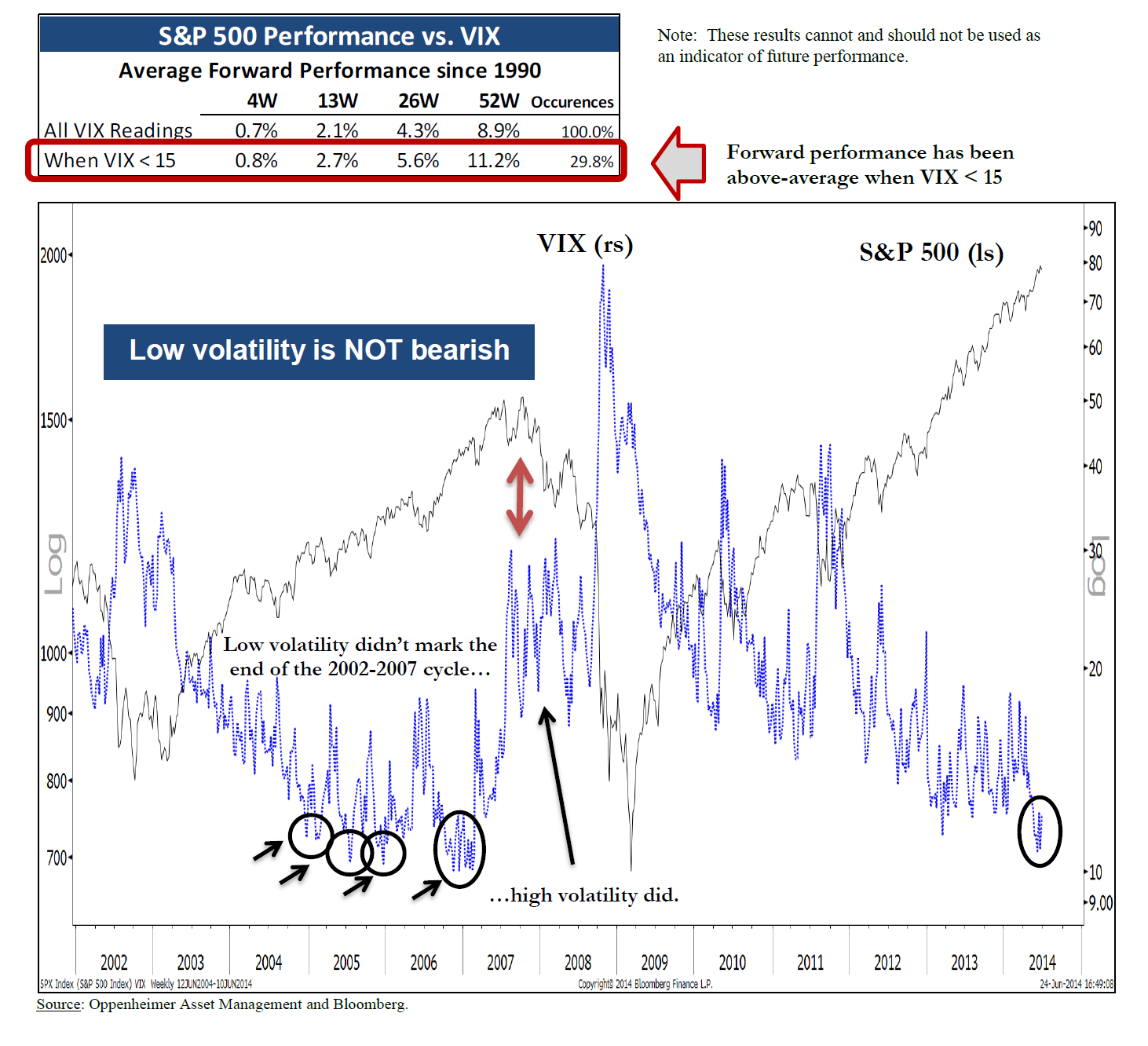

The report discusses a low level in the VIX not being bearish for stocks. Oppenheimer even goes on to show how the S&P 500 has tended to post above-average performance in the month, quarter, half-year and even a year after the VIX is below 15 (see table and chart image below). It stated:

We believe this study is another piece of evidence that argues against a bull market cycle top. While we believe that the bull market cycle is intact, we recognize that tactical conditions have become less favorable. For instance, the composite Put/Call ratio is back to its most optimistic levels of the year. We see 1900 to 1925 as support should the S&P 500 require time to consolidate. Overall, we recommend sticking with the S&P 500’s strong trend and using weakness to buy stocks in the Technology, Energy, and Industrials sectors.

Facebook Inc. (NASDAQ: FB) was represented in the technology sector as follows:

We like big-caps, we like Technology, we like FB. FB was one of the few Internet stocks that held its 200-day moving average in April, and a subsequent rally above $63 indicates a resumption of the stock’s uptrend, in our view. We expect a test and ultimate breakout above $72 resistance.

Hess Corp. (NYSE: HES) was represented in the energy sector as follows:

Hess remains on our Buy List because the stock is reversing a six-year downtrend vs. the S&P 500 and we see ample opportunity for additional outperformance. The stock’s breakout above $87 is now a level of support and we believe the stock should continue to trend toward its $130 all-time peak notched in 2008.

ALSO READ: Nine Analyst Stocks Under $10 With Massive Upside Potential

Delta Air Lines Inc. (NYSE: DAL) is one we would count in transportation, but Oppenheimer has it counted and lumped into a broader industrials sector. Delta was represented as follows:

We view the Airlines industry within the middle innings of a bearish-to-bullish secular reversal. We therefore advocate exposure to the group and believe dips should be bought. DAL has rallied in a healthy manner, and we do not see signs of a top. We continue to expect higher highs and believe the stock’s dip to $37 support should be bought.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.