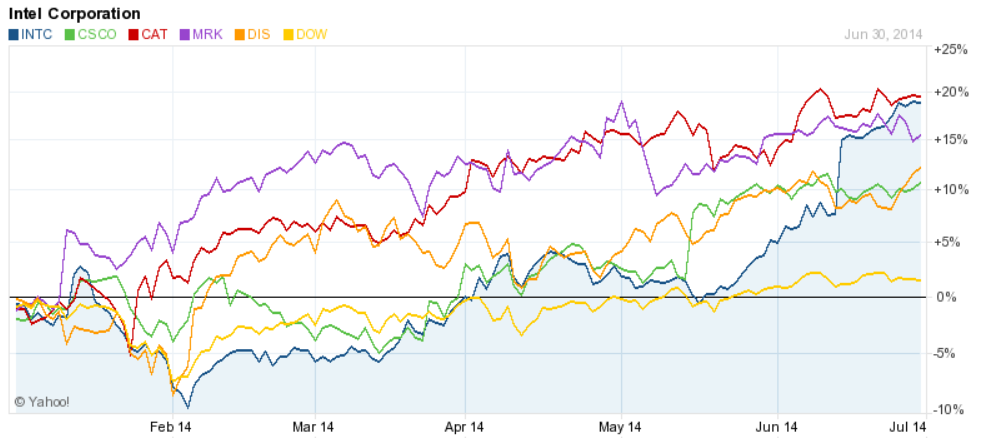

The second quarter of 2014 has come and gone, which means that we are now already half way through 2014. The five-year bull market has managed to continue making its gains. The Dow Jones Industrial Average (DJIA) rose by 2.2% in the second quarter, but it is up by only 1.5% year-to-date. The S&P 500 Index has gained 4.7% in the second quarter and is up 6.05% year-to-date.

24/7 Wall St. wanted to take a look at the best and worst stocks of the DJIA and the S&P 500 Index in 2014. While we have looked at the performance of these DJIA stocks, we also wanted to see what the prospects are going forward on each. Color has been added on each as well.

This group is the best performing DJIA stocks, and the best performing S&P 500 stocks were already run in their own piece.

Intel Corp. (NASDAQ: INTC) took first place for the quarterly winner and the year-to-date winner of all 30 DJIA stocks. The processor giant and gained 20.75% in the second quarter, and its stock is up 22.9% so far in 2014. It trades at $30.90, and the increased guidance was the driving force here. It also caught many investors by surprise and has almost certainly been one of the key drivers for the tech sector. The 52-week range is $21.89 to $31.00. Still, we would caution that the analysts have lagged here as the consensus price target on the stock from Thomson Reuters is $29.95. Intel is still a key dividend stock for tech investors with its 3% dividend yield.

Cisco Systems Inc. (NASDAQ: CSCO) was the second place winner on the DJIA during the second quarter, with a gain of 11.8%. Still, year-to-date its gain of 14.7% actually ranked at only the sixth best DJIA stock so far in 2014. The driving force here was the broad improvement in its business outlook and earnings. At $24.85, its 52-week range is $20.22 to $26.49, and the consensus price target is $25.61. Investors also get that solid 3.1% dividend yield, and Cisco remains a continual buyer of its own stock.

ALSO READ: The Ten Stocks That Will Take the DJIA to 20,000

Caterpillar Inc. (NYSE: CAT) took the second place for the year-to-date gainer with a gain of 21.1%, although its gain of 10% in the second quarter ranked only sixth among the DJIA stocks. What is so interesting here is that Caterpillar has managed to do this gain without its key growth markets being very strong. Also, no one saw this one coming, if you look at the 2014 bull and bear case for Caterpillar we ran at the start of the year. At $108.67, its 52-week range is $81.35 to $109.85, and the consensus price target of analysts is almost $112. Investors still get a 2.6% dividend yield in Caterpillar even after the strong performance.

Merck & Co. Inc. (NYSE: MRK) was the third best performing DJIA stock in the first half of 2014. The pharmaceutical giant rose almost 18% in the first half, but be advised this was front-end loaded performance — Merck’s gain in the second quarter was only 2.66%, which ranked down at 16th place of the 30 DJIA stocks in the period. At $57.85, it has a 52-week range of $44.62 to $59.84, and the consensus price target is $59.44. Investors still get a 3.0% dividend yield here.

Walt Disney Co. (NYSE: DIS) was the fourth best stock of the DJIA in the second half, with a gain of 15.3%. Still, its gain of almost 7.1% in the second quarter made it only rank as the eighth best stock of the DJIA for the period. It trades at $85.74, and we just showed how the top analyst call is now calling for Disney to rise to $100. Disney’s 52-week range is $60.41 to $86.07, and its consensus price target is $89.73. What is amazing is that Disney’s gains have kept its dividend at a very low 1% yield.

ALSO READ: The Highest-Yielding Dividends That Are Safe to Hold

The chart below is from Yahoo! Finance and illustrates the top performance of the first half of 2014 of each of these stocks, and they are compared to the DJIA. Performance metrics of the DJIA were taken from FINVIZ and individual stock data was from Yahoo! Finance.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.