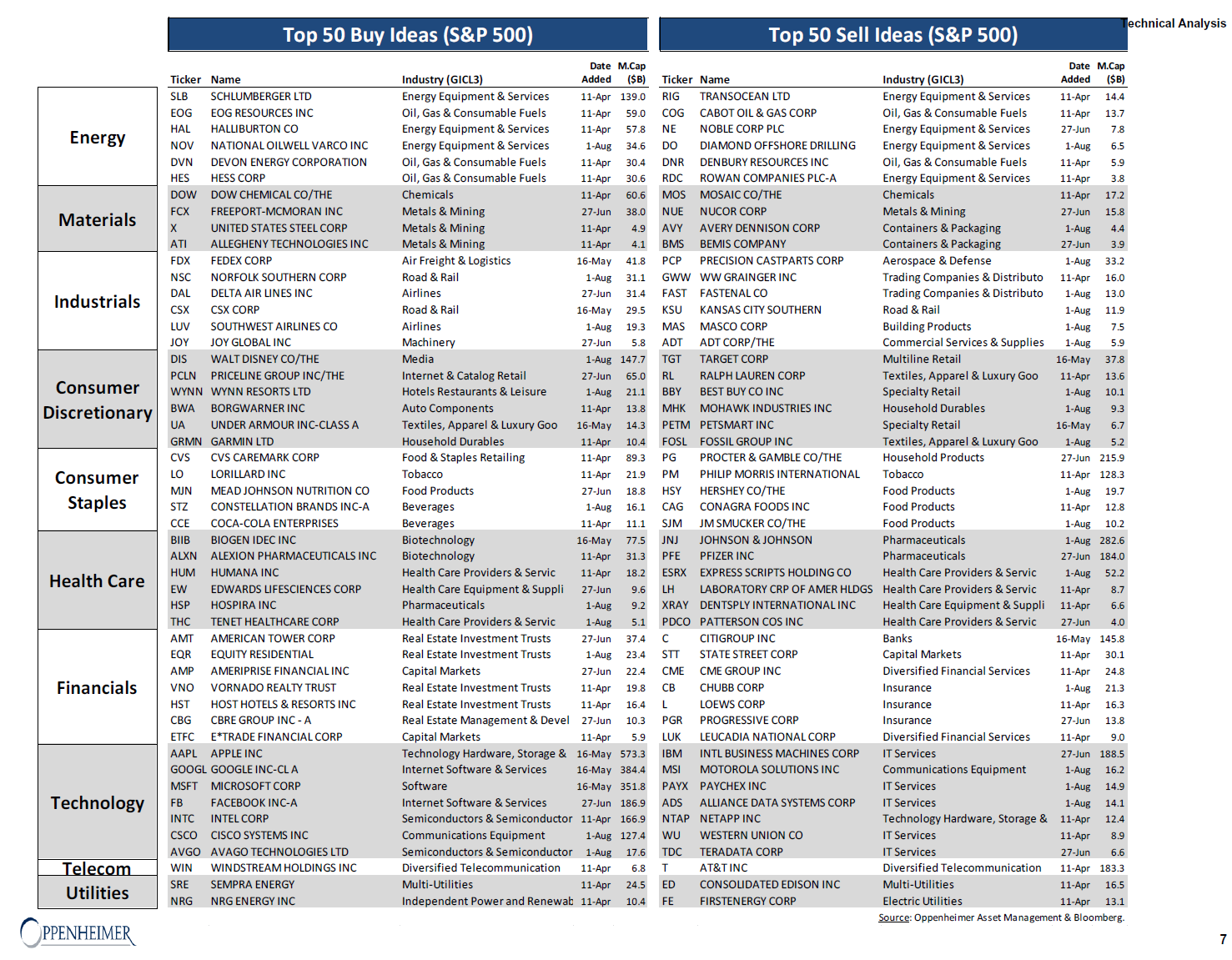

Oppenheimer makes different sorts of analyst research reports available, some of which are fundamental and some of which are quantitative or technical. A new report indicates many new technical breakout candidates among S&P 500 stocks. This sort of debunks any notion that the recent sell-off is the start of the next market crash, if you read into it, but the report does also delete many former technical buys from the list as well. A full image has been included below, but individual chart diagrams have not been included.

24/7 Wall St. has picked four of the standout technical breakout stocks. It does point out that the recent market losses have provided an opportunity to profit from its prior call to short the Russell 2000 by using the proceeds to accumulate the S&P 500.

Oppenheimer’s note did say that only 34% of S&P 500 stocks are above their 50-day moving averages. The firm believes that this is nearing a reading that would trigger a tactical buy signal indicative of internal exhaustion.

Cisco Systems Inc. (NASDAQ: CSCO) was added to Oppenheimer’s S&P 500 Buy List this week. The addition of Cisco is based on the expectation that it could be the next big-cap tech stock to breakout to the upside. Oppenheimer said:

We like that CSCO is basing at the same levels that marked a turnaround in 2002. A breakout above $26.50 resistance is still needed, and in the near term we’re watching the stock’s ability to hold $25 support.

Schlumberger Ltd. (NYSE: SLB) was listed as a continued Buy, saying “buy pullbacks; this is a pullback” in the call. Oppenheimer noted that the stock has been on its S&P 500 Buy List since April. The call said:

We have advised buying pullbacks that allow overbought conditions to reset, and we believe this is such an opportunity. We’re watching for signs of stabilization in the $103-$105 support range. Daily RSI is also below 35 for the first time in over a year.

Equity Residential (NYSE: EQR) was just added to the firm’s S&P 500 Buy List. Oppenheimer pointed out that the real estate investment trust (REIT) has been range-bound between $50 and $65 for the past three years. Its chart has just nudged above that topside trend line. Oppenheimer said a “breakout above this range would be a meaningful signal and portend additional gains toward $80 (height of range projected from breakout point).” The firm also suggested that Equity Residential’s breakout relative to REIT exchange traded funds (ETFs) indicates that the stock has been an industry leader.

ALSO READ: GE’s Chart Showing Major Concern for the Market

Tenet Healthcare Corp. (NYSE: THC) was added to Oppenheimer’s S&P 500 Buy List this week due to a multiyear breakout above $49 resistance. The firm now believes that this represents the support line. Oppenheimer is targeting a continuation of Tenet’s rally to $60 as long as the $49 support holds. This $60 target is based on the height of the prior range projected from the breakout point.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.