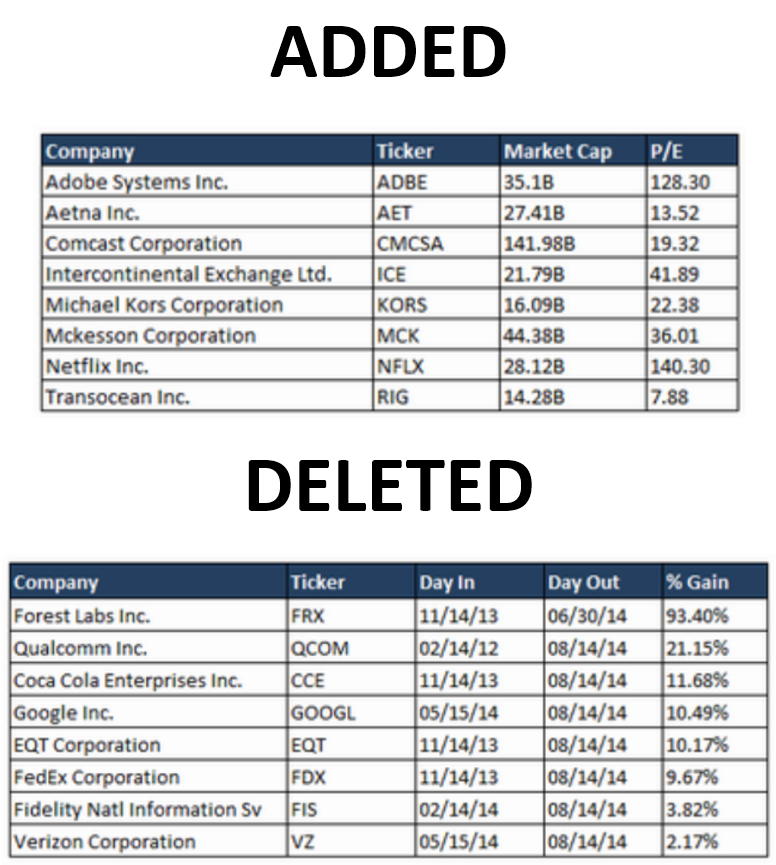

The Direxion iBillionaire Index ETF (NYSEMKT: IBLN) recently made some serious changes to its portfolio, based upon iBillionaire Index changes. The exchange-traded fund has made several changes after the broad 13F filings from billionaires and large hedge funds were seen in the last week. It turns out that eight stocks were added to the iBillionaire Index, and oddly enough two of those had been removed as recently as the first quarter.

One company making a return appearance was Transocean Ltd. (NYSE: RIG). This was after seeing that Carl Icahn, Leon Cooperman and Bruce Berkowitz were among the energy company’s billionaire shareholders. The ETF statement said, “With a market cap of $14.16 billion, Transocean is currently trading near its 52-week low and has a 7.73% dividend yield — the result of last year’s proxy battle with Carl Icahn for a $3 dividend last year.”

Netflix Inc. (NASDAQ: NFLX) also returned to the index after having been deleted in the first quarter. Chase Coleman’s Tiger Global bought back a stake in the second quarter, and Julian Robertson’s Tiger Management took a position in the company last quarter. This addition was despite the gradual selling from Carl Icahn.

24/7 Wall St. included an image in a table format showing the actual additions and deletions in this index and ETF. The six added were all well-known companies.

Comcast Corporation (NASDAQ: CMCSA) was shown to be in there after its plans to acquire Time Warner Cable. The iBillionaire Index showed that Steve Mandel purchased 12.15 million of its shares. Others with positions were Chase Coleman, David Tepper and George Soros; and George Soros initiated a position in Time Warner Cable in the second quarter as well.

READ ALSO: Warren Buffett’s 10 Most Dominant Stocks

Others that have become part of the iBillionaire Index were listed as follows:

- IntercontinentalExchange Inc. (NYSE: ICE)

- Adobe Systems Inc. (NASDAQ: ADBE)

- Aetna Inc. (NYSE: AET)

- McKesson Corporation (NYSE :MCK)

- Michael Kors Holdings (NYSE: KORS)

We have included a table below that was compiled from information inside of the iBillionaire Index to us.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.