Combine the biggest IPO ever with stock indexes hitting record highs, and you had all the ingredients for one of the most exciting weeks on Wall Street this century. With almost late 1990s excitement, attention was drawn back to stocks and high-profile deals. This didn’t stop insiders from continuing to add to positions.

Each and every week at 24/7 Wall St., we track insider activity so our readers have an idea of what top executives and 10% holders are doing. This week was no exception, as regular buyers returned and some executives took advantage of a price dive to load up on company stock.

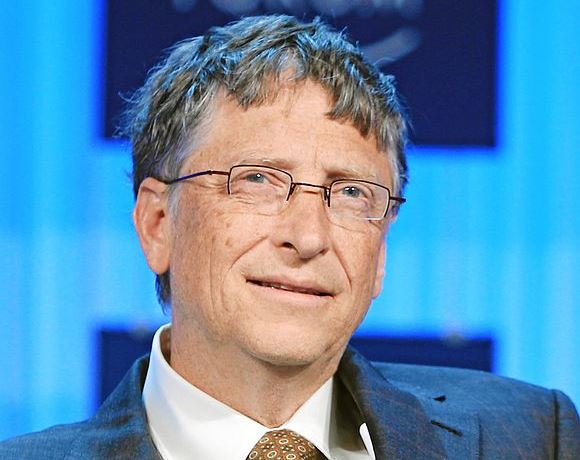

Republic Services Inc. (NYSE: RSG) takes up its usual pole position in this week’s edition of insider buying. The private investment office for billionaire Microsoft founder Bill Gates, Cascade Investments, bought an additional 375,531 shares of the waste management company at $39.04 to $39.11, for a total purchase of $14.7 million. The stock was trading at $39.23 on Friday’s close.

American Assets Trust Inc. (NYSE: AAT) saw the executive chairman, who is also a 10% owner of the company, come in for a very large purchase. He bought a tidy 400,000 shares of the stock at $33.80, for a total purchase price of $13.5 million. The company owns, operates, acquires and develops retail, office, multifamily and mixed-use properties primarily in California and Hawaii. Shares closed Friday at $33.55.

READ ALSO: Insider Selling Mounts as Markets Hit All-Time Highs

China Recycling Energy (NASDAQ: CREG) saw a massive buy at the top. The CEO bought 13,829,074 shares of the stock at a price of $1.37. The total purchase came to a whopping $18.9 million, a very bullish sign. The stock was trading at $1.18 at Friday’s close.

Heartware International Inc. (NASDAQ: HTWR) saw a 10% owner of the company make a significant purchase of the shares. Adage Capital Partners bought 100,000 shares at prices ranging from $76.74 to $77.07. The total purchase came to $7.7 million. Heartware is a medical device company engaged in developing and manufacturing miniaturized implantable heart pumps or ventricular assist devices for the treatment of advanced heart failure in the United States and internationally. Shares hit an intraday high of $84.31 on Friday, so the purchase looks very well timed.

ULTA Salon, Cosmetics & Fragrance Inc. (NASDAQ: ULTA) has been absolutely on fire, but that did not stop the CEO and a director of the firm from buying company stock. They bought a combined 20,000 shares of the hot retail company at $118.90 to $119.70, for a total purchase price of $2.4 million. This was after the stock had already gapped up huge, and it is incredibly bullish for shareholders. The stock ended the week at $120.38.

Prospect Capital Corp. (NASDAQ: PSEC) is a high-yield business development company that has seen shares trade all over the place this year. A downdraft in the stock was all the CEO needed to make a large personal purchase. He bought 105,000 shares at prices between $10.10 and $10.17, for a total purchase of $1.1 million. This is the second time this year the CEO has bought stock on a big dip, and it is bullish for shareholders. Shares were trading late Friday at $10.10.

READ ALSO: 10 Stocks Trading Under $10 With Huge Upside Potential

Other top companies that saw insider buying this week included: Leidos Holdings Inc. (NASDAQ: LDOS), Miller Energy Resources Inc. (NYSE: MILL), Energy Transfer Equity L.P. (NYSE: ETE), PolyOne Corp. (NYSE: POL) and Cousins Properties Inc. (NYSE: CUZ).

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.