That 10% market correction that investors have been calling for and predicting (and sometimes hoping for) may finally be close to fruition. This week has been the first time that we are truly seeing the baby thrown out with the bath water. Even though buyers will buy some weakness, the go-to defensive stocks also have been bashed and thrown out with the stock market correction taking place.

An easy way to think about defensive stocks being sold off was that they were being used as a source of funds. That happens when there are redemptions and liquidations, or when there are margin calls. Hedge funds have been selling, and valuations are trying to find something less aggressive than what we saw for the past three years or more. This week even brought the 10-year Treasury yield back under 2% briefly, and Fed Fund futures signaled that the Fed would not raise interest rates for even longer than previously expected.

So, what is happening with defensive stocks? Some have started to see some buying, others have not. One issue is that so many defensive stocks were having a restructuring or special situation that the valuations had been moved higher than they might otherwise have seen. The CBOE Volatility Index went above 30 on Wednesday, and it was above 29 on Thursday morning — a measure of near panic and major selling across the board. The good news is that there may be at least a bit of a silver lining ahead.

ALSO READ: 3 Franchise Stock Picks From Jefferies Put On Sale During Market Rout

American Water Works Co. Inc. (NYSE: AWK) is the top water utility in America. It has effective monopolies in micro-geographies in 40 states, covering some 14 million people. In the past, each 5% pullback in the stock has been a gift to investors. The difference this time is that the stock was down close to 3% at one point on Wednesday and was down another 0.7% Thursday morning at $48.75. After a 52-week high of $50.71, this water utility was down almost 4% from its high. The dividend yield here is about 2.5%.

McDonald’s Corp. (NYSE: MCD) is supposed to be a key defensive stock. The problem is that, even if you have to eat (and cheaply), the public has been moving away from McDonald’s. Labor wage issues haven’t helped, but neither has its move to healthier food. If you want proof that McDonald’s is still unfavorably viewed, its stock just hit a 52-week low of $89.34 on Wednesday. Shares were down 0.5% at $89.90 Thursday morning.

Altria Group Inc. (NYSE: MO) is proving that defense is sometimes not a good offense. Smoking is supposed to be defensive, but this stock only recently hit new highs. Part of the driving force behind why investors aren’t chasing Altria is that fresh hopes of continued beer consolidation was a boost for its value in SAB Miller — and now that appears to be shelved. Investors don’t want to chase up a value if it is no longer to be potentially unlocked. Despite a 4.5% yield, Altria has been slow to ramp up on e-cigarettes. A 1% drop on Thursday morning to $45.07 puts it still down only about $2 from its adjusted all-time high we recently saw. Is $2 enough of a discount, for a tobacco company nonetheless?

ALSO READ: The 10 Safest High-Yield Dividends

Duke Energy Corp. (NYSE: DUK) has been featured twice recently by 24/7 Wall St. Most recently is as becoming the perfect stock, hitting new highs just on Tuesday at a time when the broad market was selling off. Another feature was among the safest of the high-yield dividends. Maybe investors should hope or wait for a selling wave again, but this is the largest utility in America now, and the company has been exiting its deregulated markets and exiting certain operations when possible. The dividend yield is about 4.1%, which is not the highest nor the lowest among key utilities. With a 1% drop on Thursday morning to 478.10, this stock is still down less than $2 from highs, and it is still way up from $70 or so before its most recent earnings.

Kimberly-Clark Corp. (NYSE: KMB) and Procter & Gamble Co. (NYSE: PG) would normally be considered safe defensive stocks to own for a bear market. There is one small problem with each company: P&G has many brands up for sale, and Kimberly-Clark has a health care unit spin-off underway. This means that change is in the air, and investors are likely going to wait until the dust settles before giving these companies favorable views again. Kimberly-Clark shares were down 0.75% at $104.62 Thursday morning, almost $10 lower than its recent highs, and with a 3.2% yield. P&G shares were down 0.6% at $82.37 Thursday morning, which is down only about $2.50 from its 52-week high, with a 3.1% dividend yield.

Defensive stocks will work once things settle again. The problem is that there are so many issues in the defensive stocks that had inflated their valuations. Investors do not want to pay a premium on top of a safety premium during the most serious correction the market has seen in a few years.

ALSO READ: 5 Reasons Oil Is Not Rising

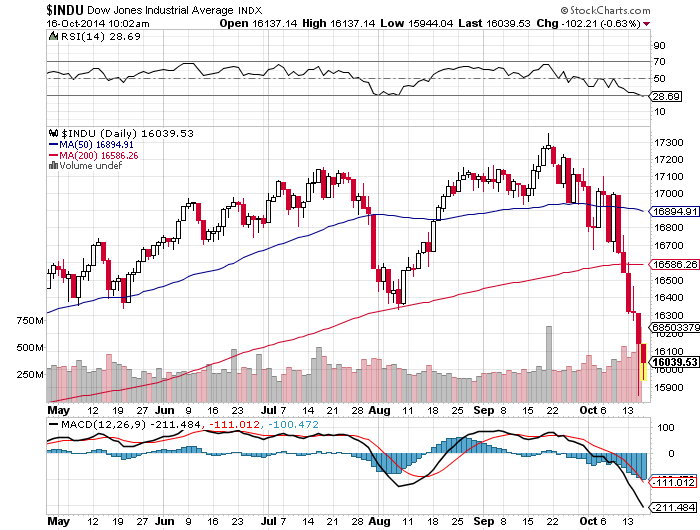

As far as what a 10% stock market correction, that means that the Dow Jones Industrial Average would have to sink to 15,615 (versus 16,040 at last check) and that the S&P 500 Index would have to sink to about 1,817 (versus about 1,847). The markets are getting close to those reading, and they have busted well under their key 200-day moving averages in the carnage of this past week.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.