This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

Apple Inc. (NASDAQ: AAPL) is set to report its fiscal fourth-quarter earnings after the market closes on Monday. Thomson Reuters has consensus estimates of $1.31 in earnings per share and $39.85 billion in revenue. In the fourth quarter of the previous year, Apple recorded its earnings as $1.18 per share on $37.47 billion in revenue. Looking ahead to the first quarter, there are consensus estimates of $2.40 in earnings per share and revenue of $63.52 billion.

Updated at 12:50 p.m. — We have received additional date from WhisperNumber.com showing that Apple’s earnings whisper number is $1.42 per share. That is 11-cents above consensus according to the service, and they said that the so-called earnings whispers range from a low of $1.34 to a high of $1.52 per share. They further said that Apple has a 71% positive surprise history, having topped the whisper in 46 of the 65 earnings reports for which it has tracked the reports.

What everyone will be watching for in this report is the iPhone 6 sales. In the first weekend of sales, 10 million iPhones reportedly moved. According to the Wall Street Journal, iPhone sales grew more than 10% in the second and third quarters. As noted this past weekend, our key hurdle for Apple to hitting its revenue expectation is that it likely needed to sell 38 million iPhones. Apple Pay may be launching Monday, but this is not expected to be reflected at all in past earnings and may be a slow uptake before it starts to meaningfully add to earnings.

Apple issued the following quarterly guidance with its last earnings report released in July:

- Revenue range of $37 billion to $40 billion

- Gross margin 37% to 38%

- Operating expense range of $4.75 billion to $4.85 billion

- Other income/(expense) of $250 million

- Tax rate of 26.1%

ALSO READ: Is Apple’s Brand Really Worth $119 Billion?

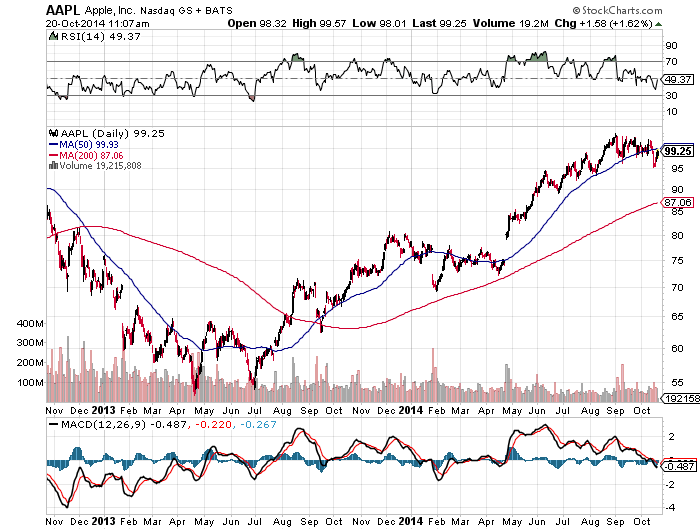

While Apple screamed higher during the period after it announced its split and buyback, the reality is that since the start of September the stock chart is resembling a pattern of lower highs in general. Last week’s market carnage also broke handily through what had been a very strong support line at $98. Now the question is if the current $99 plus will hold. Apple’s 50-day moving average is up at $99.93, while the 200-day moving average is all the way down at $87.06.

Options traders do not appear to be braced for a major move from Apple, based on the closest speculative put and call options. That being said, it really only looks as though options traders are braced for a move of much more than 3% or so in either direction.

In a recent call, Oppenheimer went from somewhat cautious to very favorable and listed its rationale for a $115 stock price. Also, Carl Icahn laid out his activist strategy for Apple shares to rise to $203 if Tim Cook gets aggressive enough. On the other side, Deutsche Bank was one of the first formal analyst downgrades after Pacific Crest threatened a downgrade.

Recent formal Apple analyst calls, including those above, were as follows:

- Credit Suisse reiterated a Neutral rating for Apple but moved the price target up to $110 from $96.

- Oppenheimer upgraded Apple to an Outperform rating from Market Perform, with a price target of $115.

- Bank of America has a Buy rating for Apple with a price target of $120.

- J.P. Morgan downgraded Apple to Hold from Buy and raised the price target to $105 from $102.

- Deutsche Bank downgraded Apple to a Hold rating from Buy and lowered the price target to $102 from $105.

ALSO READ: Market Sell-Off Sparks Big Insider Buys

Apple shares were trading at $99.18 in late Monday morning trading, up about 1.5% from the previous close of $97.67. The stock has a consensus analyst price target of $112.64 and a 52-week range of $70.71 to $103.74. The company has a market cap of roughly $595 billion. A chart review from Stockcharts.com has been provided below.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.