2014 is turning out to be another great year for equities, and that has translated into new assets piling into exchange traded funds (ETFs). Before getting universally excited across all asset classes, investors need to consider what is going on and what is expected to occur in 2015 — and then the winners will become more obvious. Equity ETFs are the winners so far, but bonds and gold not so much.

ETF.com tracks inflows and outflows into ETFs, and November of 2014 was the third best month on record for ETF inflows. The new report for November suggests that investors put in a whopping $42 billion into ETFs last month. Again, the equity sector ETFs took the lion’s share of those inflows.

Another win was that November’s gain in inflows took 2014 above 2013’s $188 billion record, with inflows so far being over $192 billion. The total U.S.-listed ETF assets are just below $2 trillion ($1.987 trillion). As a point of reference, the report represents that hedge funds have about $3 trillion and open-end mutual funds have about $15 trillion.

The Monthly ETF Flows report said:

The early-autumn pullback in financial markets caused by concern that growth was flagging in the eurozone, in Japan and in China has given way to a focus on the relatively healthy U.S. economy. The S&P 500 Index rose in November by more than 2 percent, helping, with the powerful inflows, to lift total U.S.-listed ETF assets to $1.987 trillion, just shy of a record, according to data compiled by ETF.com.

ALSO READ: How MLP Funds and ETFs Will Treat Kinder Morgan After the Merger

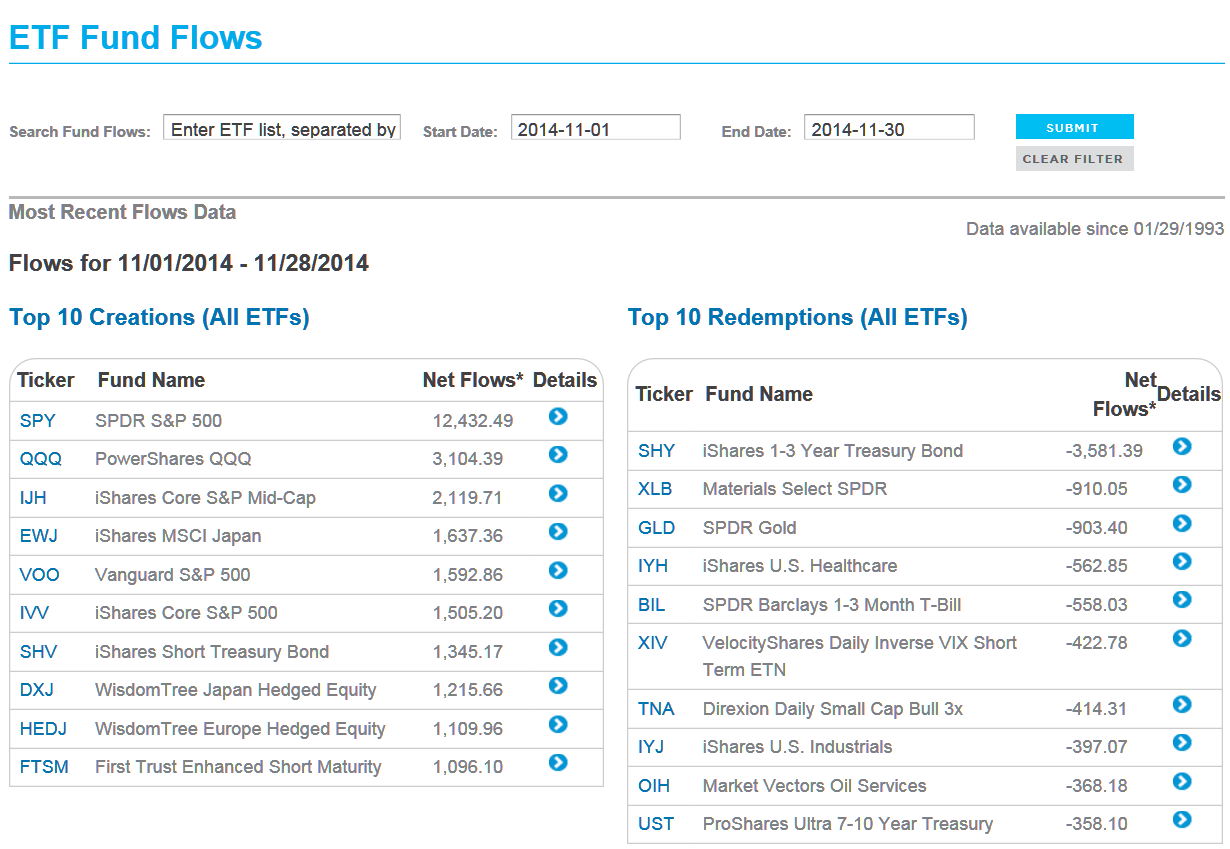

The SPDR S&P 500 ETF (NYSEMKT: SPY) is the largest equity ETF already, and it saw November inflows of over $10 billion. In total, U.S. equities pulled in almost $33 billion.

International equity ETFs saw inflows of almost $8 billion, with almost a third of those flows coming from two WisdomTree currency-hedged strategies focused on Japan and on Europe. The WisdomTree Japan Hedged Equity Fund (NYSEMKT: DXJ) saw inflows of $1.25 billion on the back of new stimulus from the Bank of Japan — making it now $12.6 billion ETF. The WisdomTree Europe Hedged Equity Fund (NYSEMKT: HEDJ) saw inflows of $1.17 billion on growing hopes for more real quantitative easing efforts than were seen late in the month, making it a $4.64 billion ETF.

Outflows were seen in bonds and the iShares 1-3 Year Treasury Bond ETF (NYSEMKT: SHY) saw a drop of $3.5 billion in assets, making it the least popular bond ETF and losing over one-fourth of its assets. The report said, “Bond flows have been volatile in the past several months given the uncertainty surrounding the interest-rate outlook.” With a rising interest rate environment expected in 2015, should this be a surprise to anyone?

Gold has lost its luster as well. The SPDR Gold Shares (NYSEMKT: GLD) saw outflows of $870 million. With gold having dropped from what was approaching $2,000 to under $1,200 of late, should this be a shock? The November Monthly ETF Flows report said of gold ETFs:

GLD was, for a short spell in August 2011, the biggest ETF in the world amid anxiety following S&P’s unprecedented downgrade of U.S. debt and signs the eurozone’s economic challenges were deepening. But since then, strength in equity markets and a dearth of inflationary pressure have hurt gold prices and the popularity of ETFs like GLD.

ALSO READ: 5 BIG DJIA Dividend Hikes Coming Before Year-End

As a reminder, most ETFs, unlike actively managed mutual funds, track indexes and have fixed policies in place that instantly put almost all new funds to work. These index ETFs simply do not tend to hold back cash for opportunities down the road. That being said, the inflows from November have already been put to work in the stock market — and have already been taken out of the bond and commodities markets.

We have included a table below from ETF.com showing the top 10 ETFs with net inflows during November, as well as those with the 10 highest outflows for November.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.