As the major indexes swing wildly up and down, a few stocks are not only safe havens, but also have high sustainable dividends and chances to rise in better markets. Among them are companies that are leaders in their sectors, and ones that need management to correct recent blunders.

These include the shares of America’s two huge telecommunications firms, AT&T Inc. (NYSE: T) and Verizon Communications Inc. (NYSE: VZ). Each has an iron-clad balance sheet and yields above 4%, and they participate in one of the hottest sectors in America, wireless communications. Another advantage these companies hold is that their smaller competitors, Sprint Corp. (NYSE: S) and T-Mobile US Inc. (NASDAQ: TMUS) have made no progress in taking AT&T and Verizon wireless market shares.

Apple Inc. (NASDAQ: AAPL) finally pays a dividend, which produces a yield of 1.8%. Its balance sheet cash position swells by billions of dollars each quarter. Its board has decided to put billions more into share buybacks. Apple’s stock has continued it rapid rise. If products like the iPhone 6 continue to dominate the smartphone markets, Apple’s product advantages and sales will only grow.

ALSO READ: America’s Worst Run Companies

It is usually not prudent to invest in the stocks of companies that have struggled with their businesses recently. An exception is McDonald’s Corp. (NYSE: MCD), which is retooling its menu to be more attractive to consumers. Given its number of locations and the share of total fast-food outlets the company represents, its tremendous marketing budget and its ability to test menus and change them quickly, McDonald’s opportunity to turnaround is at least even. The company continues to generate cash. Its shares yield 3.7%.

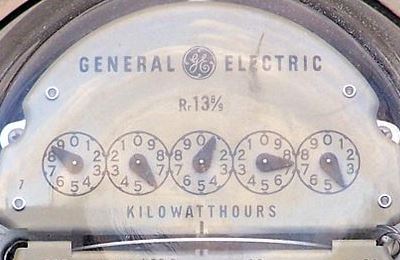

General Electric Co. (NYSE: GE) has been a whipping boy among large companies. Its conglomerate model continues to be unpopular. The argument against its management is that it has tried to run too many disparate businesses. However, the tide has turned modestly in its direction as it sells underperforming assets and presses into promising ones. Although these efforts have not lifted results much, some portion of the analysts who follow the company think they will. GE has a yield of 3.9%.

Finally, International Business Machines Corp. (NYSE: IBM) has been left for dead by many investors. It has been slow to offset hardware sales and equally slow to move into more modern tech sectors, particularly cloud computing. It still has a solid balance sheet. And, the board’s patience for CEO Ginni Rometty has likely begun to fray. A turnaround effort may be successful, probably without her. IBM’s yield is 2.8%

Among the largest companies with the safest investments, there are several that have shares that could rise because of strong positions within their industries. There also are several huge, troubled companies in which management might make improvements. The common thread among them is dividends that will not be cut.

ALSO READ: The World’s Most Innovative Companies

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.