Investors have been investing in emerging markets and frontier markets for years now. After all, these international markets represent the largest growth opportunities for the generations ahead. One nation’s stock market that has been extremely difficult for U.S, investors to get into is Pakistan. An exchange traded fund (ETF) has been open in London for a while, but now U.S. investors are about to have access via a new ETF.

Global X is adding a new ETF under the Frontier Market Family of Global X ETFs, called the Global X MSCI Pakistan ETF (PAK). This is set to track the price and yield performance of the MSCI All Pakistan Select 25/50 Index.

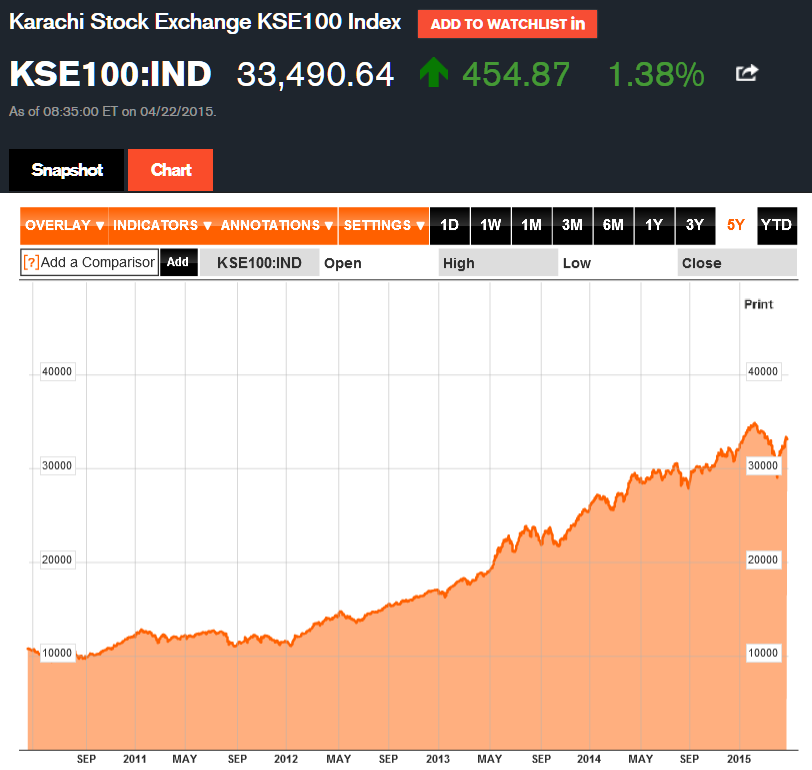

The new ETF will offer U.S. investors access to the largest, most liquid publicly traded companies in Pakistan. If you have looked at emerging market tables in the Economist or elsewhere, Pakistan is often cited as being among the top-performing nations. If you want proof of this, the Karachi Stock Exchange’s KSE 100 Index has risen roughly 200% over the past five years alone (see chart below).

ALSO READ: Lessons of Force Majeure for 2014, 2015 and Beyond

The fund’s total expense ratio of 0.88% is based on a 0.68% management fee and 0.20% in custody fees. Global X included a description of the index as follows:

The MSCI All Pakistan Select 25/50 Index is designed to represent the performance of the broad Pakistan equity universe, while including a minimum number of constituents. The broad Pakistan equity universe includes securities that are classified in Pakistan according to the MSCI Global Investable Market Index Methodology, together with companies that are headquartered or listed in Pakistan and carry out the majority of their operations in Pakistan.

Some basic facts that Global X provided along with its distribution material are as follows:

- Goldman Sachs has included Pakistan in its “Next 11” list of economies.

- Pakistan demonstrated zero correlation with the S&P 500 in 2014.

- Pakistan is one of the larger, more liquid frontier markets. With a large, youthful labor force, it has become an enticing destination for investors looking beyond traditional emerging markets, which have been demonstrating slowing growth.

The ETF fact sheet shows that the index has 31 holdings in it. Also, the industry weightings are concentrated in financials (32.7%), energy (24.2%), materials (23%) and utilities (10.8%) — roughly 90% in four sectors alone. The top equity holdings with weightings in the ETF are as follows:

- MCB Bank, 11.5%

- Oil & Gas Development, 9.8%

- United Bank, 6.1%

- Fauji Fertilizer, 5.9%

- Lucky Cement, 5.7%

- Hub-Power, 4.9%

- Pakistan State Oil, 4.8%

- Engro, 4.7%

- Bank Al-Habib, 4.1%

- National Bank Pakistan, 3.7%

ALSO READ: Will India Be the Next Driver for Alternative Energy?

More support for the growth of Pakistan came from IMF data. Pakistan’s gross domestic product (GDP) expanded from $80 billion in 2000 to over $230 billion in 2013, a 4.3% annualized growth rate. The nation’s per capita GDP on a purchasing power parity basis has risen from $2,683 in 2000 to $4,746 in 2014 — and analysts expect that Pakistan’s GDP will grow at an annualized rate of 4.6% through 2019.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.