Investing

Big Earnings Week Keeps Insider Buying Slow but Steady

Published:

Last Updated:

While the earnings from the top S&P 500 companies came fast and furious this week, the insider buying was not as dramatic. As we have mentioned before, many insiders’ windows are slammed shut during earnings season, as they are restricted from buying or selling shares during the time when earnings and forecasts for future earnings are delivered.

We cover insider buying each week at 24/7 Wall St., and one interesting trend we have noticed is an increase in insider activity in the energy sector, although none hit this week. This should come as little surprise as the benchmark price of oil seems to have stabilized, at least for the time being.

Here are the companies that reported significant insider buying this past week:

Lions Gate Entertainment Corp. (NYSE: LGF) had a director at the company buying stock this week. That director bought a 35,000 share block of the filmmaker’s stock at prices that ranged from $30.97 to $31.39. The total cost for the purchase was $1.09 million. The buy looks like a solid one, as shares closed trading Friday at $32.43.

ALSO READ: Why Apple Dividend Hike and Buybacks Matter More Than Earnings

Ebix Inc. (NASDAQ: EBIX) returns to our screens this week. A 10% owner known as the Rennes Foundation was buying stock again — 30,000 shares at prices between $28.65 and $28.74. The total for the buy came to $861,000. Ebix provides software and e-commerce solutions to the insurance industry. This also looks well timed, as shares were trading at $29.77 on Friday’s close.

ServisFirst Bancshares Inc. (NASDAQ: SFBS) had a diretor at the bank step up and buy shares this week. That director bought 24,000 shares at a price of $34.81. The total for the buy came to an even $825,000. The company operates as the bank holding company for ServisFirst Bank, which provides banking services to individual and corporate customers in the south and southeast the United States. The stock ended trading Friday at $35.16.

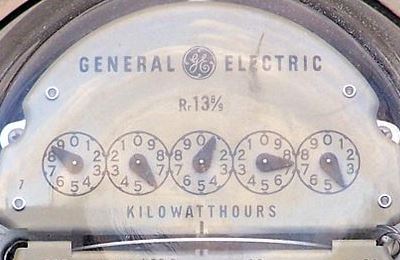

General Electric Co. (NYSE: GE) is a big name blue chip industrial that saw some insider buying this week. A director at the company bought a block of 20,000 shares of the stock at $26.93. The total for the buy came to $539,000. GE closed trading Friday at $26.80.

Neogen Corp. (NASDAQ: NEOG) had a C suite executive buy stock this week. The chief operating officer purchased a 5,000 share block at $45.84 per share. The total for the buy came to $249,000. The company develops, manufactures and markets various products and services for food and animal safety worldwide. It operates through two segments, Food Safety and Animal Safety. Shares ended the week at $46.88, so another well-placed buy order.

ALSO READ: Massive Energy Trade Highlights High-Profile Insider Selling This Week

These companies also reported insider buying this week: Accelerate Diagnostics Inc. (NASDAQ: AXDX), Coty Inc. (NYSE: COTY) and Ryman Hospitality Properties Inc. (NYSE: RHP).

While a slow week, things should start to pick up next month as the earnings reporting period for the first quarter starts to wind down.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.