The stock market finally has reminded investors that sell-offs can happen. With the bull market now over six years old, the one trend that has lasted for almost four years now is that every single pullback has been bought by investors. The reason for bottom-fishing on each pullback has been different each time, but the buying always materialized.

The question now, for value investors and technicians alike, is how to find the great companies where shares have been battered to the point that they are either oversold technically or where the value proposition is compelling. Then a secondary goal is to try to find those oversold stocks that actually may have shown some signs of life or where there may be a case for strong technical support.

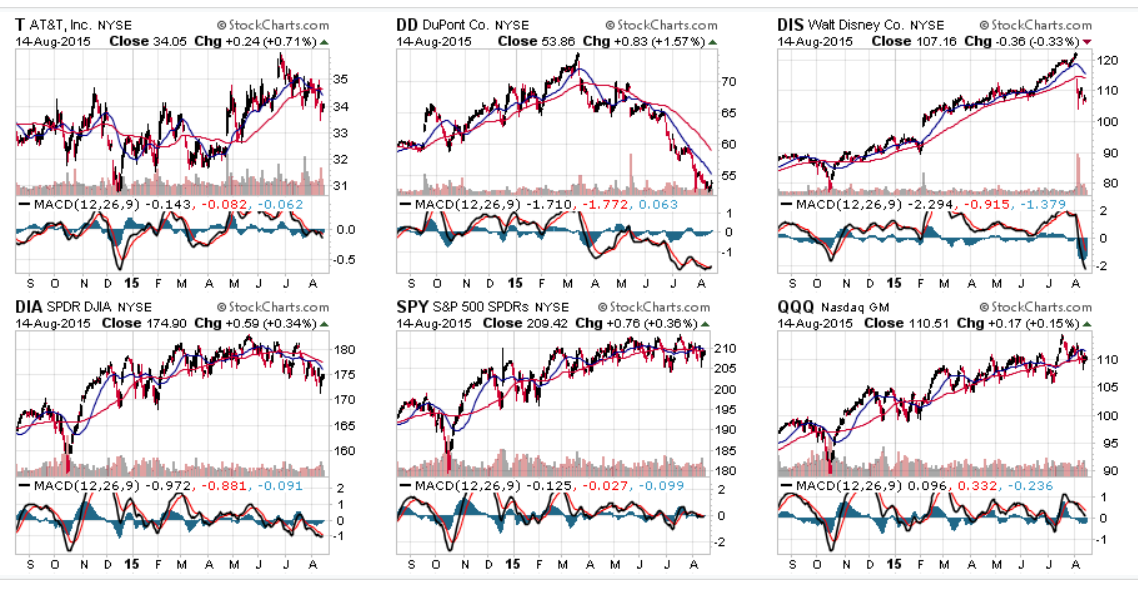

24/7 Wall St. has identified three such stocks that are oversold and that may be entering an areas where there are signs of life or where key support is believed to be very close under current share prices. These included AT&T, Disney and DuPont, and all were DJIA stocks until AT&T was replaced in the Dow this year. Detailed charts from StockCharts.com have been provided at the end in two groups.

AT&T Inc. (NYSE: T) just held its analyst meeting this last week, and the reaction to the guidance was a sharp sell-off followed by a decent support tested recovery. Shares were testing $35 on the upside, and then fell to $33.50 on the downside to end the week at $34.05. 24/7 Wall St. believes that the DirecTV merger actually will stabilize much of its business and will allow for serious cost synergies that have not been properly modeled into the stock. That merger will even support the AT&T dividend. For whatever it is worth, three well-known firms on Wall Street issued price targets at $40 or higher after that meeting’s reaction.

ALSO READ: 6 Oil and Energy Stocks Analysts Want You to Buy Now

After closing up 0.7% at $34.05 on Friday, AT&T has a consensus price target of $37.05 and a 52-week range of $32.07 to $36.45. It also has a stellar dividend yield of 5.5%. That $33.50 level is what acted as support this past week.

Walt Disney Co. (NYSE: DIS) is that last of the three oversold stocks that may have found some life. The catalyst for the selling here was the reaction to earnings, as well as a loft valuation, and some overblown fears that networks and ESPN might not have the same glory days ahead. The added value of Star Wars here is almost assured to blow away any prior expectations over time, and ditto for its superhero and Frozen franchises. Disney keeps winning elsewhere too, but this last forward posturing from Bob Iger seemed to make everyone think that the great run has been seen.

At $107.16, Disney is now down from a high of over $122. Disney’s 52-week range is $78.54 to $122.08 and its consensus analyst price target is $121.30. Unfortunately, its dividend yield is only about 1.2%, because its shares had risen so much in the past two or three years. Support was down around $106 this past week, but Disney may take a while for its chart to stabilize, based on what was nearly a 300% rally in four years. Argus remained very positive with a $123 target after the earnings drop.

E.I. du Pont de Nemours and Co. (NYSE: DD), or just DuPont, has truly been the Dow’s ugly ducking in 2015 and was the worst of the 30 Dow stocks with a loss of almost 22%, until Chevron barely edged it out on Friday. A poorly handled spin-out did not help matters, and 2015 is looking as though it could be the trough in chemicals and ag. Earnings growth is expected to resume in 2016. Even JPMorgan tried to come to its defense with a valuation upgrade on Friday, saying enough is enough.

ALSO READ: 4 Oil and Gas MLPs Still Raising Distribution Payouts

DuPont’s gain on Friday was 1.6% to $53.86 after JPMorgan defended it. It has a consensus analyst price target of $62.07, a 52-week range of $52.36 to $76.59 and a dividend yield that is now approaching 3%. The pivot here was $53, and $50 to $53 has been a key pivot point in the past five years.

Investors need to assume one thing here. Oversold stocks can keep getting oversold. It happens. While failed support is painful for investors, pure market technicians just use the line “support failed to hold, and support is now even lower.”

Another consideration is that if the market gets another downdraft, then oversold stocks also will become just that much oversold. Again, the trick is not to try to catch falling daggers, it is to identify which companies may have found at least some support and tried to show signs of life.

Oil stocks were not included this week due to the continued pressure. Some oil stocks are finding signs of life again, but others are not. Here are six oil and energy stocks that analysts want you to buy now.

ALSO READ: Why Warren Buffett Keeps Dumping His Big Oil Bets

The charts below from StockCharts.com show the longer-term picture on how the stocks performed against the 50-day and 200-day moving averages. Then a second group of charts has been included for 20-day and 50-day moving averages, then compared to ETF charts of the DJIA, S&P 500 and the Nasdaq. Also included in the longer-term and near-term chart history is a look at MACD and RSI readings. These charts can be expanded as well.

ALSO READ: JPMorgan’s Favorite Biotech Stocks to Buy for Rest of 2015

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.