Investing

8 Big Companies That Should Now Be on Every Investor and Trader Radar

Published:

Last Updated:

While earnings season has been very mixed for many aspects of the market, the reality is that some companies, and their stocks, are continuing to do extremely well. In fact, some stocks did so well on great news this past week that they almost have to be on every single trader’s and investor’s radar screen for stocks to buy. These stock moves and ramifications ahead even stand out knowing that this was the best week for the stock market in quite some time.

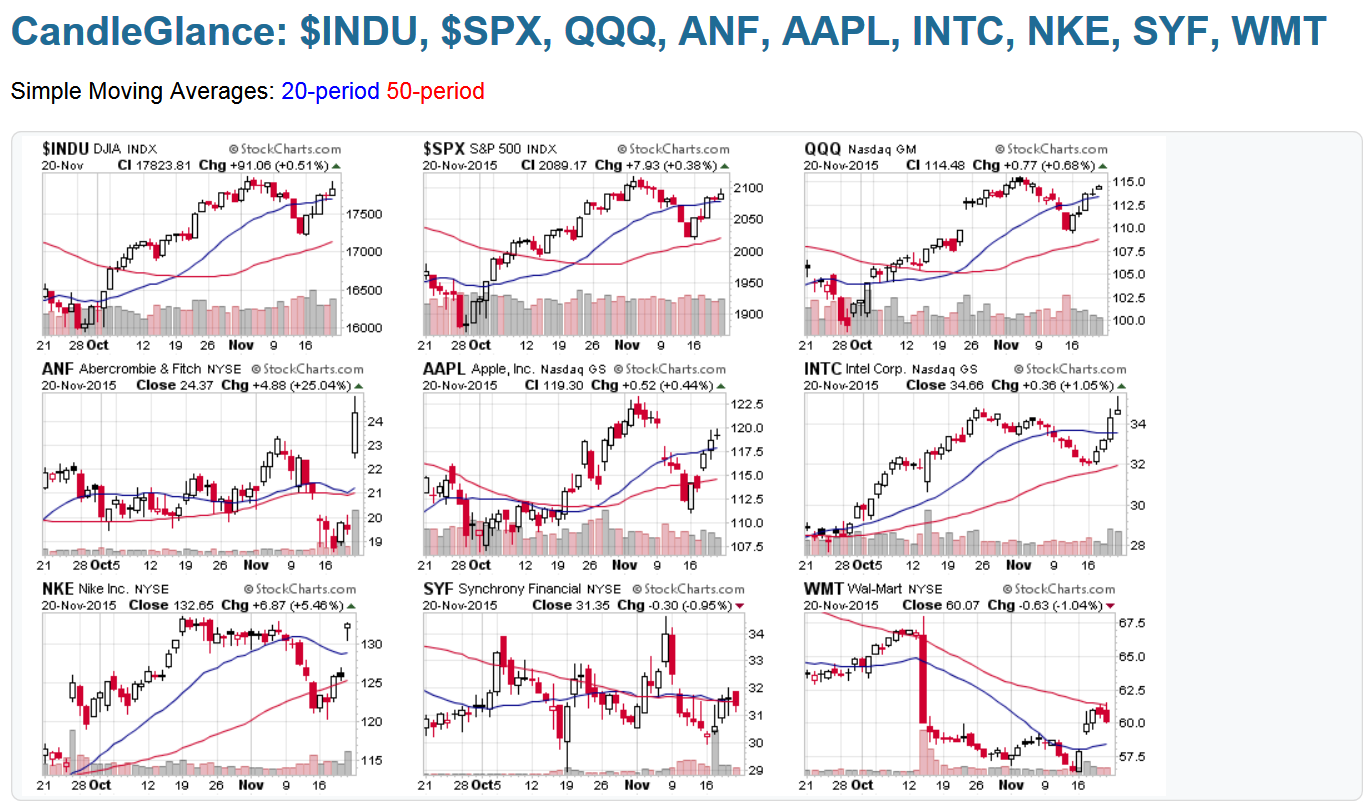

What is so interesting about last week is that the top stocks to watch of this magnitude are all rather large in size. They are all very well-known, and some are stocks that many investors would want to own. 24/7 Wall St. included a montage of stock charts at the end for a better review.

Included in each key upside mover this week is a brief bit of the news driving the shares, the trading reaction and how that pertains to the past and what may lie ahead.

Abercrombie & Fitch Co. (NYSE: ANF) could be back from the depths of investor pain. Its earnings report yielded some positive signs (like profits that doubled) that its turnaround may be continuing to build up steam. Abercrombie & Fitch’s stock price rose a whopping 25% to $24.37 on Friday. This may still be another 25% higher before it gets close to a 52-week high again, but it was the highest closing price since February 24, 2015.

ALSO READ: 6 BioHealth Movers That Now Cannot Be Ignored

Apple Inc. (NASDAQ: AAPL) was up big on Wednesday and Thursday, up to almost $119 after closing at $113.69 ahead of the news. The driving force here was not just that Goldman Sachs added Apple to the prized Conviction Buy List. The firm thinks investors may re-rate and revalue Apple as a subscription services stock rather than just as a hot tech stock. Apple closed at $119.30 on Friday, less than $2.00 short of its key 200-day moving average.

Intel Corp. (NASDAQ: INTC) rose 3.4% on Thursday to $34.30, the highest dividend-adjusted price target since October. While it delivered that great dividend hike that was better than we expected, the reality is that its growth forecast for 2016 is not just about Intel’s PC business. Intel closed higher four days in a row, and Friday’s $34.66 close was the highest adjusted closing price in a month.

Match Group Inc. (NASDAQ: MTCH) had a $12 per share initial public offering (IPO) that was priced at the low-end of the range expected, but the online dating and hookup series of sites opened at $13.50 and ended up closing at $14.74 on its debut, with more than 26.5 million shares trading hands. Match even closed up over 3% higher on Friday at $15.20.

Nike Inc. (NYSE: NKE) was back over $130 after doing everything shareholders could ask for. Nike announced a dividend hike, a higher share buyback and also split its stock. The only thing its CEO didn’t do was raise its guidance, and it didn’t tell all the kids that Santa would grant every single wish. Nike hit an all-time high close of $132.65 on Friday, and that $140.79 consensus analyst price is likely headed even higher.

ALSO READ: 8 Companies That Failed Shareholders Last Week

Square Inc. (NYSE: SQ) managed to have a good IPO after all, at least after it priced low and opened. If those late-stage “smart” venture capitalists were not happy about how that deal priced, that is their problem. The credit card reading device player priced at $9.00, less than expected, but the stock opened with a 3.7 million share print at $11.20 and closed up 45% at $13.07 on almost 50 million shares. Square closed down 1.7% at $12.85 Friday on 16 million shares, but that may not be the end of the world considering its massive IPO-pop gain.

Synchrony Financial (NYSE: SYF) has now gone independent of GE, completing its share exchange — with over 125 million shares trading hands for a closing price of $30.58 on Tuesday. Shares were above $31.50 late in the week, and now analysts and investors can finally look at Synchrony on its own without the risks of what the long-pending deal means. Synchrony was almost a $34 stock as recently as November 6.

Wal-Mart Stores Inc. (NYSE: WMT) may have just said that the worst is over. After crushing shareholders with guidance and rising costs a month earlier, the world’s largest retailer had better earnings than expected and delivered $117.4 billion in revenues. Comparable store sales are now up for five straight quarters, and e-commerce sales and gross merchandise value globally increased approximately 10% on a constant currency basis. Shares hit a low under $57.00 just last week, but the stock was back above $61.00 for part of Thursday, versus $57.87 before this week’s earnings, and it closed down 1% at $60.07 on Friday. Keep in mind that Wal-Mart shares would have to run 50% before hitting a 52-week high now.

ALSO READ: 4 Biopharma and Pharmaceutical Stocks With Game-Changing Catalysts Coming

A chart review from Stockcharts.com below includes the charts for the six stocks featured that were not IPOs. They also included a chart for the Dow, the S&P 500 and the Nasdaq 100 ETF (QQQ).

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.