Investing

Meet the Full 2016 Dogs of the Dow for Massive Dividends

Published:

Last Updated:

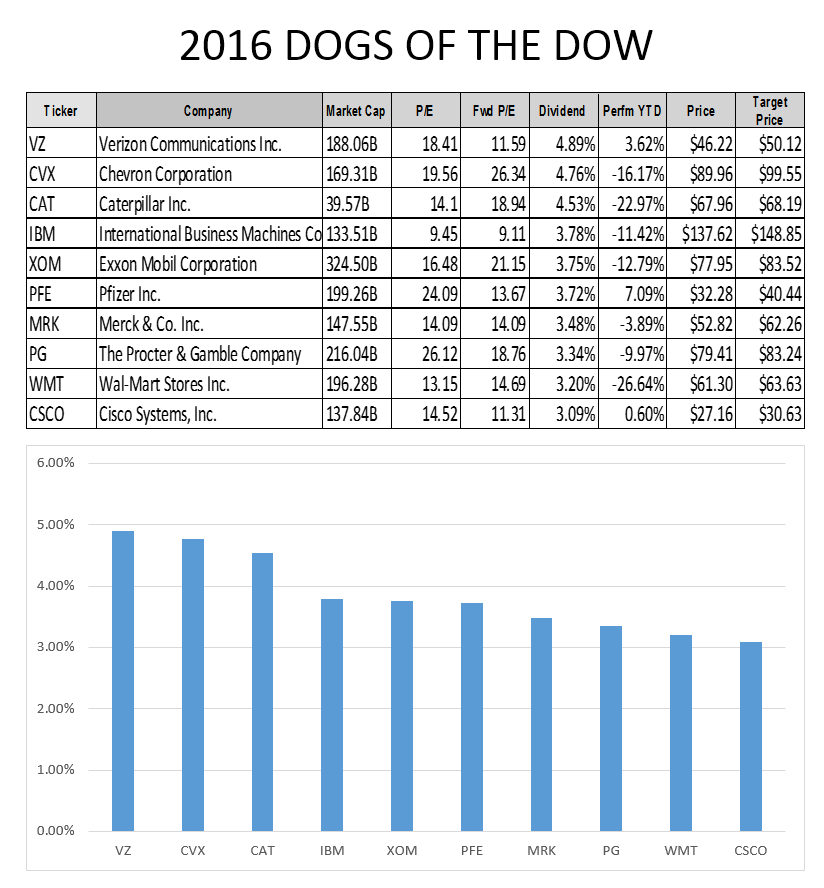

At the end of every year, investors look for opportunities and safe harbors in the year ahead. Now that 2015 has turned into 2016, investors who love dividends may want to consider the so-called Dogs of the Dow. Quite simply, this is the 10 highest yielding stocks in the Dow Jones Industrial Average (DJIA). It also turns out that the “Dogs” actually are dogs when you consider that only three of these 10 actually made money for investors on a total return basis in 2015.

24/7 Wall St. has featured each Dog on its own here, with a montage at the end of the report. With seven of these 10 stocks being so negative in 2015, some investors may take even more interest than in prior years.

Keep in mind that 14 strategists see a positive but choppy 2016 for stocks. Now consider than half to two-thirds of total returns for investors actually comes from dividends.

The 2015 Dogs of the Dow yielded closer to 3.6% on average a year ago, but the new list of 2016 Dogs has an average yield of closer to 3.85% — and that 3.85% is closer to the yields of the 2014 Dogs of the Dow.

Some of these stocks are high-yield due to major pullbacks in the underlying stocks. Other dividend yields are high due to companies and sectors simply having high dividends as a part of a return of capital strategy for their shareholders.

Meet the formal 2016 Dogs of the Dow.

Verizon

> Dividend yield: 4.89%

> 2015 closing: $46.22

> 52-week range: $38.06 to $50.86

> Analyst target: $50.12

> Market cap: $188.0 billion

Verizon Communications Inc. (NYSE: VZ) is the top Dog of the Dow for 2016. A year earlier it had been AT&T, but now AT&T is out. Verizon barely outperformed the market in 2015, with a 3.6% total return, but that current 4.89% dividend yield was the single driving force. Verizon is still in a price war, but no one expects its business to come apart. It is also cheaply valued at about 12 times forward earnings, and the $46.22 close implies more than 10% upside for total return in 2016, if analysts are right.

> Dividend yield: 4.76%

> 2015 closing: $89.96

> 52-week range: $69.58 to $113.31

> Analyst target: $99.55

> Market cap: $169.3 billion

Chevron Corp. (NYSE: CVX) is another repeat member on the Dogs of the Dow, with a 4.76% yield at the end of 2015. That compares to a dividend yield of about 3.80% this time a year ago. Chevron’s yield is so much higher because of the drop in oil leading its shares lower (down over 16% in 2015) rather than due to aggressive dividend hikes. There is one thing to watch here: Chevron’s actual dividend is higher than 2015 and 2016 earnings per share estimates. That means it is having to dip into cash reserves to pay its shareholders (short of asset sales and cost cuts).

Caterpillar

> Dividend yield: 4.53%

> 2015 closing: $67.96

> 52-week range: $62.99 to $93.57

> Analyst target: $68.19

> Market cap: $39.6 billion

Caterpillar Inc. (NYSE: CAT) has not always been very high on the Dow totem pole for dividends. The stock’s return was almost -23% in 2015, and it would have been worse without the dividend. Caterpillar’s problem is that every commodity market remains under pressure. Also, every growth market is running at slower pace or contraction, and that strong dollar is hurting its ability to export at a time when fewer nations and companies want heavy gear like this. Maybe the infrastructure pact in the United States will smooth things out for Caterpillar.

IBM

> Dividend yield: 3.78%

> 2015 closing: $137.62

> 52-week range: $131.65 to $176.30

> Analyst target: $148.85

> Market cap: $133.5 billion

International Business Machines Corp. (NYSE: IBM) is a Dogs of the Dow member due to poor performance. While IBM has raised its dividend and keeps buying back stock, its shares were down by 11.4% in 2015. The 3.78% dividend yield may not be enough to stave off declining core business concerns and lower backlogs. IBM just cannot grow its new efforts fast enough to make a huge dent. IBM is even considered a classic value trap because no one is willing to pay over 10 times earnings here.

Exxon Mobil

> Dividend yield: 3.75%

> 2015 closing: $77.95

> 52-week range: $66.55 to $93.45

> Analyst target: $83.52

> Market cap: $324.5 billion

Exxon Mobil Corp. (NYSE: XOM) also has suffered from lower oil and gas prices, just like Chevron, and its 3.75% yield made that -12.8% performance less negative than it would have been. Exxon Mobil is a large buyer of its stock and is protecting its dividend, with an emphasis on the dividend protection. Its dividend seems safer than Chevron’s, which may be why Chevron outyields Exxon.

Pfizer

> Dividend yield: 3.72%

> 2015 closing: $32.28

> 52-week range: $28.47 to $36.46

> Analyst target: $40.44

> Market cap: $199.3 billion

Pfizer Inc. (NYSE: PFE) ended 2015 with a 3.72% yield. The drug giant is now involved in a merger with Allergan, which may or may not end up being approved and which may or may not be allowed to be a tax inversion. Pfizer closed up 7% in total return, but over half of that gain was due to the dividend. Pfizer also just raised its dividend at year’s end.

Merck

> Dividend yield: 3.48%

> 2015 closing: $52.82

> 52-week range: $45.69 to $63.62

> Analyst target: $62.26

> Market cap: $147.6 billion

Merck & Co. Inc. (NYSE: MRK) has been restructuring like Pfizer, but its merger risks might be less present today than its DJIA rival. That may explain why its dividend yield is 3.48%, and Merck lost almost 3.9% in 2015. Could Merck have less event risk than Pfizer? Both companies may have pricing and patent risks as ongoing issues.

Procter & Gamble

> Dividend yield: 3.34%

> 2015 closing: $79.41

> 52-week range: $65.02 to $92.55

> Analyst target: $83.24

> Market cap: $216.0 billion

Procter & Gamble Co. (NYSE: PG) lost almost 10% in 2015, and the restructuring hasn’t seemed to help. The company still wants to get rid of more product groups to focus on core and growth markets. Now it yields 3.34%, but its valuation at over 18 times earnings just doesn’t feel cheap yet. Maybe Procter & Gamble can have a better 2016, as analysts are looking for a 5% price gain, before taking the yield into consideration.

Wal-Mart

> Dividend yield: 3.20%

> 2015 closing: $61.30

> 52-week range: $56.30 to $90.97

> Analyst target: $63.63

> Market cap: $196.3 billion

Wal-Mart Stores Inc. (NYSE: WMT) was the worst performing stock on the Dow in 2015 (-26.6%). Its dividend yield of 3.2% is so high solely because of the drop in the stock. Wal-Mart has higher wages to blame, but store sales just aren’t exactly taking off here and growth prospects may be limited. Being the world’s largest retailer by far means that maybe that Wal-Mart just needs to work on its earnings and dividends — while it buys back billions in stock too.

Cisco Systems

> Dividend yield: 3.09%

> 2015 closing: $27.16

> 52-week range: $23.03 to $30.31

> Analyst target: $30.63

> Market cap: $137.8 billion

Cisco Systems Inc. (NASDAQ: CSCO) has raised its dividend, making it the highest technology dividend. It also edged out the likes of General Electric for the tenth spot on the list. That came down to the wire for 2016. Cisco’s growth is being driven by growth markets, but the dollar and slower growth outside of the United States have both kept results mixed here. At least investors know Cisco will keep buying back stock, and it has room to raise that dividend ahead, with a valuation at less than 12 times forward earnings.

A view below has been gather from FINVIZ:

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.