Investing

US Index Levels All Challenging 10% Corrections: DJIA, Nasdaq, S&P 500

Published:

Last Updated:

Analyzing the stock market in 2016 and 2015 is becoming harder and harder. The end game, regardless of how you view the market in general, is that this just isn’t your granddaddy’s stock market.

One thing that may matter is that the major U.S. stock market indexes finally have started challenging the 10% formal correction from the 2015 highs. A correction may hardly be a reason to buy, but the formal 10% unilateral correction was elusive for roughly four years. Investors literally bought up every single dip.

As the first week of 2016 has been the worst start to a year in stock market history, 24/7 Wall St. wanted to offer up some basic stats here outlining what the 10% market correction levels really are.

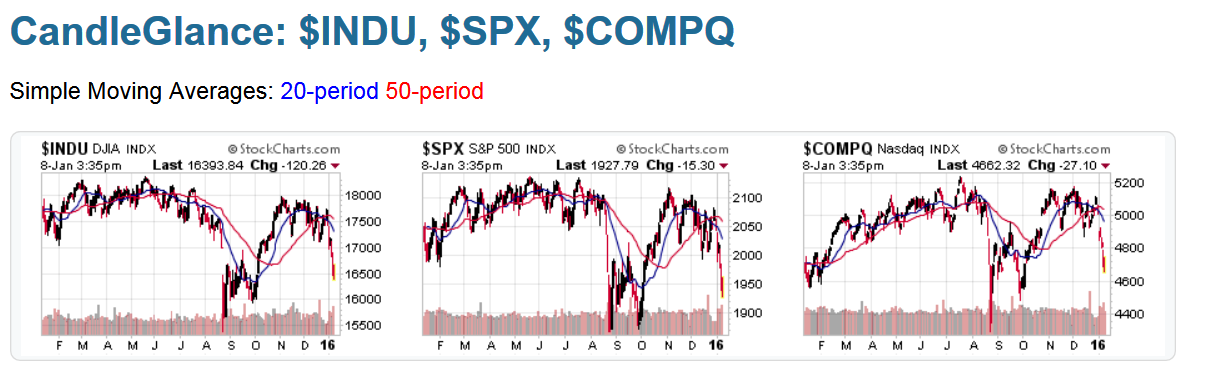

The Dow Jones Industrial Average (DJIA) high has been 18,351.40, so a formal 10% correction would be at 16,515 and. the DJIA was at 16,450 late on Friday. The SPDR Dow Jones Industrial Average ETF (NYSEMKT: DIA) has a high of $183.35, and a 10% correction would be $165.01. Its late-Friday price was $163.87. Note that the ETF has management fees and pays dividends.

The S&P 500 Index peaked at 2,134.72, so its formal 10% correction would be right at 1,921.25, and the S&P 500 was at 1,934.50 late on Friday, versus a daily low of 1960.40. The SPDR S&P 500 ETF (NYSEMKT: SPY) has a high from 2015 of $213.78, so a 10% correction would be $192.40. It was at $192.80 late on Friday.

Nasdaq’s 10% correction from its 5,231.94 high of 2015 would come into play at 4,708.70 or so, and the Nasdaq was at 4,687 late on Friday.

Back to predicting the stock market and how different things were. Oil and other commodity prices being lower used to be good for your granddad. There was no Shanghai Stock Exchange, China was a nation of farmers rather than manufacturers and China wasn’t the world’s manufacturer. Isis was an Egyptian god then, and other Middle Eastern terrorist groups were threats over there, and most people couldn’t identify (maybe still) where Syria was on the map. Refugees were called refugees rather than migrants. The term quantitative easing did not really exist. There was no real euro then, so the PIIGS (Portugal, Italy, Ireland, Greece, Spain) didn’t even matter. The Federal Reserve and other major national central banks tended to move interest rates in the same direction. Gold was bought for jewelry or inflation rather than for a different reason every single day. High-frequency trading and flash crashes didn’t exist, nor did circuit-breakers. ETF inflows and outflows did not exist as they were mutual fund flows. Social media was the water cooler, and FANG (Facebook, Amazon, Netflix, Google) was still just a big mean tooth. Oh, and the world believed that buy and hold forever was the way to go for just about any and every strategy. Anyhow, you get the point. There are dozens of more issues to throw in now that did not exist in previous decades. This isn’t your granddad’s stock market.

24/7 Wall St. has included StockCharts.com market charts for the Dow, S&P 500 and Nasdaq over the past year.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.