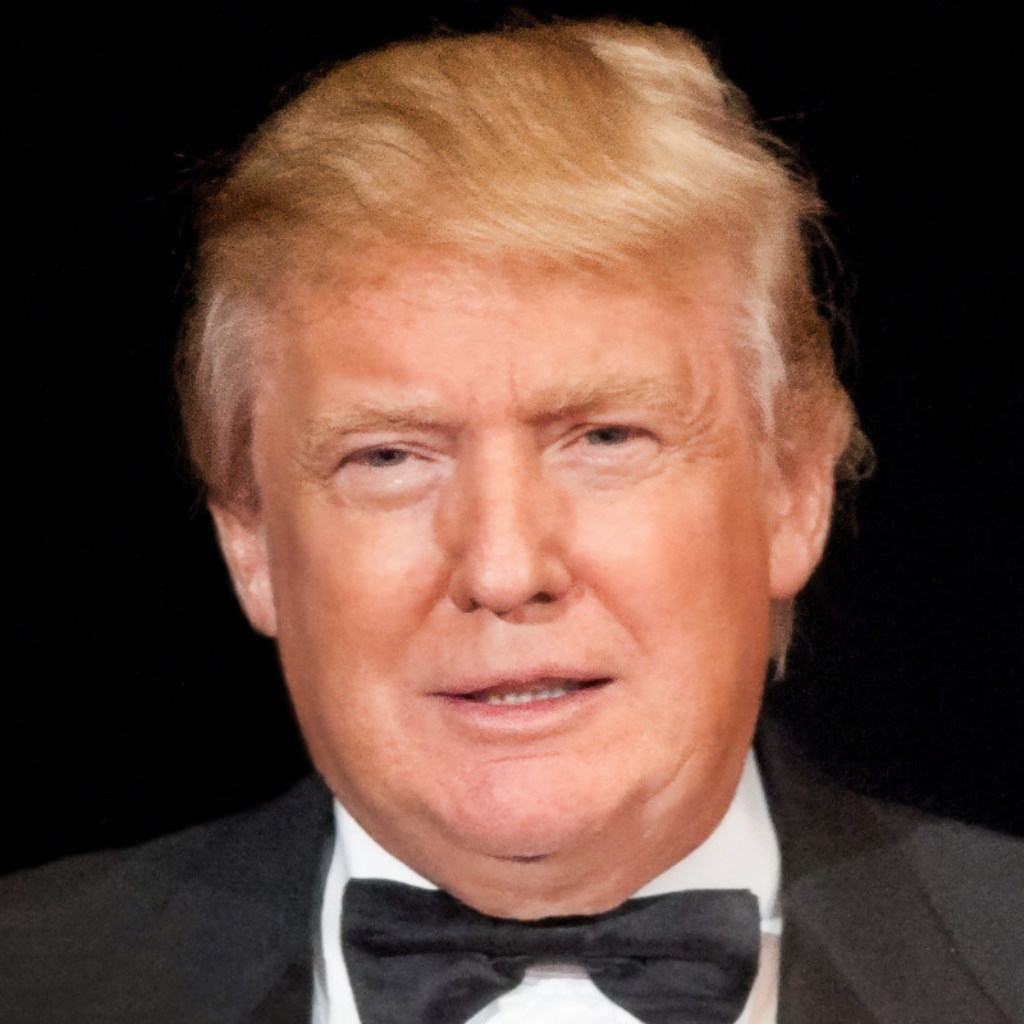

Whether Donald Trump can actually take the White House is a question for something of an alternate reality, one in which few ever thought they would actually live. With his latest victory in New Hampshire, he has shown that his supporters will come out to vote – something that his detractors suggested he may not be able to get them to do – and the possibility of a Trump term looks a little bit more of a potential reality. But what would it mean for equities markets? Which industries and companies stand to gain if the Trump administration reaches office?

We’ll start with the obvious one: defense stocks. Trump has publicly stated his administration would take a strong militaristic approach to what’s happening in the Middle East. He’s also said he will deploy U.S. forces in the South China Sea to help leverage the nation’s bargaining position with China and strengthen the U.S. armed forces as a whole. Picking trade fights with China over their currency is sure to escalate military tensions, too. The defense industry that fills government contracts will underpin this strengthening and, just as in times of war, will draw additional capital. Look for gains in stocks like Lockheed Martin Corp. (NYSE: LMT) and General Dynamics Corp. (NYSE: GD) on a Trump election.

Staying in the same general arena, gun manufacturers are also set to benefit from a Trump presidency. With his vow to protect second amendment rights, one of the driving positions of his campaign, his election could bolster the personal defense industry, an industry that has suffered over the past few years, dogged by calls for tightened gun laws. Stocks to look at in November if he wins are Smith & Wesson Holding Corp. (NASDAQ: SWHC) and Sturm, Ruger & Co. Inc. (NYSE: RGR), each of which has had a great 2016 so far, compared to the rest of the market.

Looking at the slightly less obvious, one of Trump’s lead positions is the reduction of Chinese imports to bring jobs back to the United States. He’s going to declare the Chinese government currency manipulators and demand an upside revaluation of the Chinese yuan. This could really upset trade and seriously hurt companies that import from and generally do business with and in China.

But there are companies that would benefit at their expense. One of the leading imports from China in the United States is machinery, accounting for $106.9 billion in 2015. With a portion of this figure remaining in the United States under Trump’s policies, the big machinery manufacturers in the United States look set to gain through protectionism. Farm and construction company Deere & Co. (NYSE: DE) is in line for some upside, as is commercial machinist John Bean Technologies Corp. (NYSE: JBT).

Another of Trump’s policies would see the U.S. public sector reorganized, reshuffled and trimmed considerably. Though many politicians promise this sort of thing and government still never shrinks, assuming this time it is shrunk, where will the tasks go? They’ll be outsourced to private industry. Everything from administration to payments processing to security stands to gain. International Business Machines Corp. (NYSE: IBM), which already holds a large number of government contracts, could be in line to take on some of the outsourced work, and in turn, could see some upside on a Trump presidency. Also keep an eye on private security firms: London-based G4S does a lot of business in the United States, and United Technologies Corp. (NYSE: UTX), by way of its subsidiary Chubb, could pick up privatized border guard, police and immigration-related roles.

Whether any if this will actually come to fruition remains to be seen. A Trump presidency is a long way off yet.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.