Investing

Large Cap Blue Chips Dominate Jefferies Top Value Stocks to Buy

Published:

Last Updated:

Despite the nice move back up in the markets, many stocks are trading substantially lower than they were this time last year. While investors have started to buy some of the beaten down companies, it’s pretty easy to spot a reluctance to go all-in as volumes remain low. And many experts think much of the current buying is no more than short covering, especially in the energy sector. One thing the selling has done is taken many top large cap growth stocks and moved them into value territory on a price basis.

In a recent research report, Jefferies focused on some large cap stocks that are still trading way below their 52-week highs. At current levels they offer investors not only a solid entry point, but some serious upside potential. All are rated Buy at Jefferies.

AbbVie

This is the top global pharmaceutical stock at Jefferies and is also on the Franchise Stock Picks list. AbbVie Inc. (NYSE: ABBV) is a global, research-based biopharmaceutical company formed in 2013 following separation from Abbott Laboratories. The company’s mission is to use its expertise, dedicated people and unique approach to innovation to develop and market advanced therapies that address some of the world’s most complex and serious diseases. AbbVie markets medicines in more than 170 countries.

One of the biggest concerns is what might happen with AbbVie’s anti-inflammatory therapy Humira, which generated $14 billion in sales in fiscal 2015. That is the most any drug has recorded during a single year and represents a gigantic part of the company’s overall earnings. The problem with Humira is that biosimilars and generics are itching to enter the market, with Amgen leading the charge. Some Wall Street analysts project that AbbVie may have a difficult time stopping that trend.

Jefferies has become much more positive on the stock and feels that the company’s response to Coherus’ Inter Partes Review (IPR) on key Humira patents looks solid and an IPR denial is a very real possibility.

The company reported mixed fourth-quarter numbers but affirmed guidance, and some on Wall Street were concerned over a new hepatitis C drug from a rival company. AbbVie reported earnings per share that were up 27% from the year-earlier quarter and a penny over analysts’ consensus, according to Thomson Reuters. Revenue rose 18% but fess short of estimates. Jefferies cites the company’s very cheap valuation and strong catalysts this year as reasons for moving it to the top global pick.

AbbVie investors receive an outstanding 4.12% dividend. The Jefferies price target is $80, among the highest on Wall Street. The Thomson/First Call consensus target is $72.25. Shares closed Tuesday at $55.32.

This company just scored a major defense contract. Booz Allen Hamilton Holding Corp. (NYSE: BAH) is a leading provider of management consulting, technology and engineering services to the U.S. government in defense, intelligence and civil markets, as well as to major corporations and not-for-profit organizations. Wall Street sees the company using the firm’s cash stockpile for acquisitions and the possibility for increased dividend payouts.

Jefferies also sees the potential for additional growth at the company through potential acquisitions. With cybersecurity also becoming a major priority for U.S. commercial companies, Booz Allen could benefit there as well. The analysts also cite the huge carve-out in the federal budget for cybersecurity as a big positive going forward.

Booz Allen shareholders currently receive a 2.12% dividend. Jefferies has a $34 price target, while the consensus target is $32.70. The stock closed on Tuesday at $28.36.

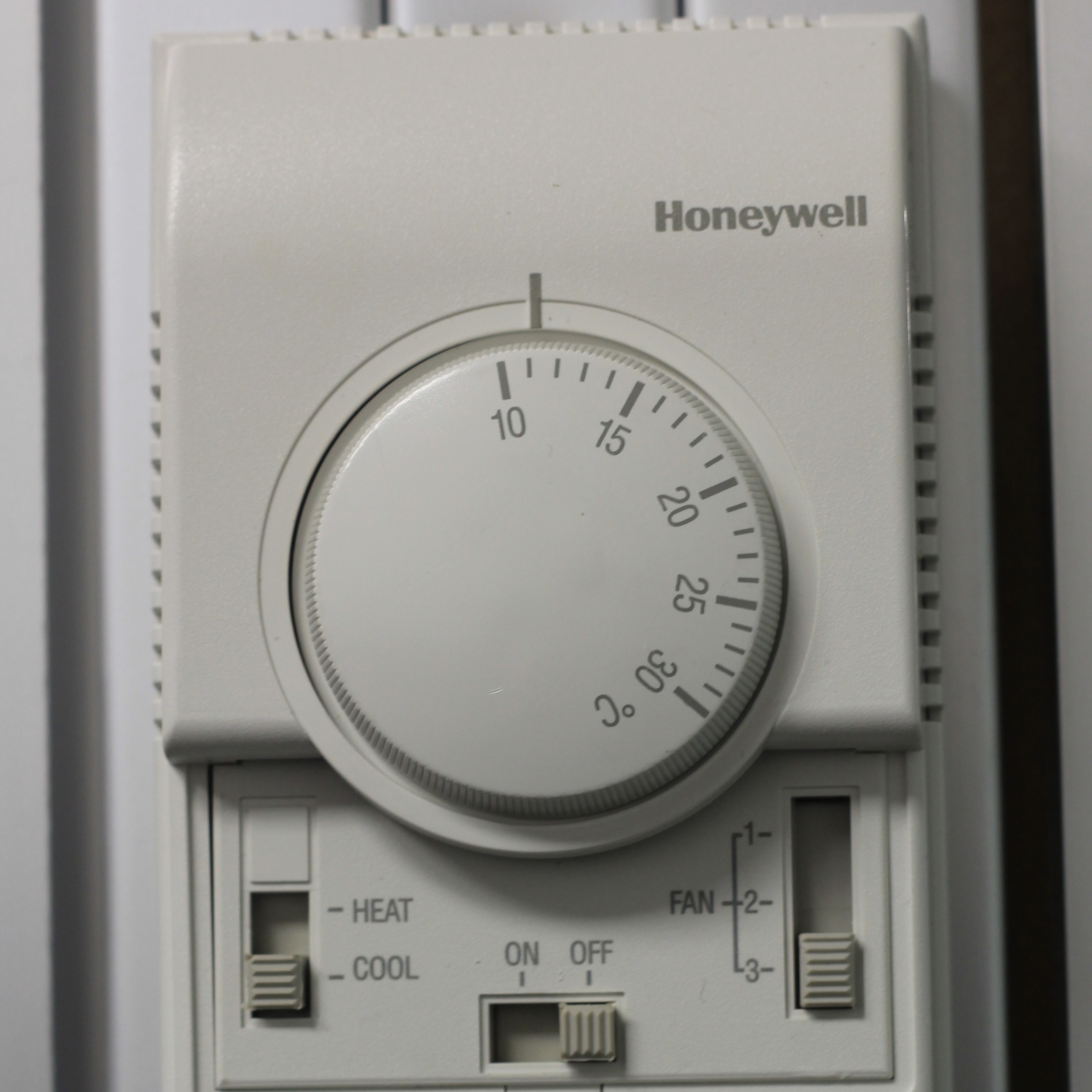

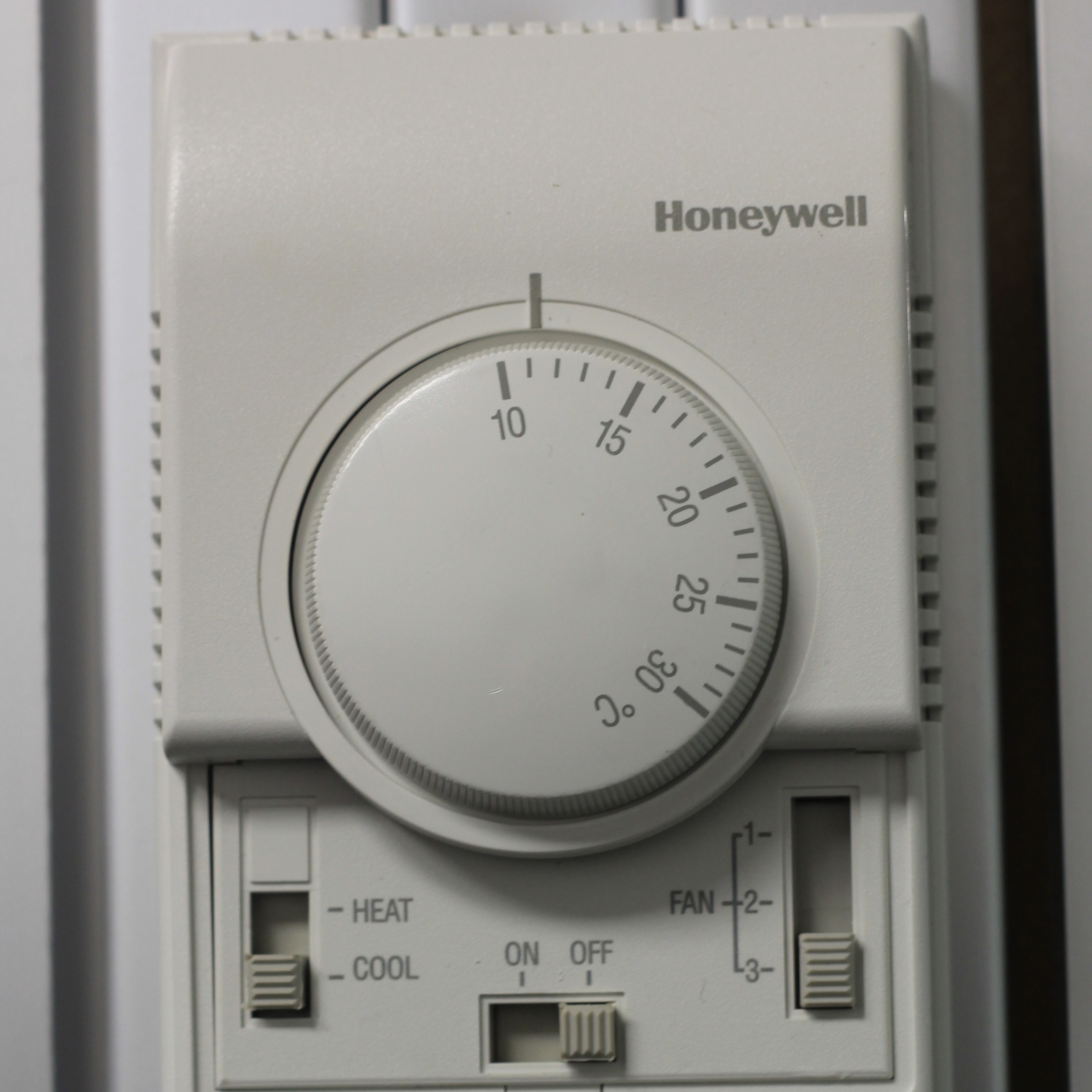

Honeywell

This big cap multinational makes sense for investors looking for defense and aerospace exposure, and diversification as well. Honeywell International Inc. (NYSE: HON) is a diversified technology and manufacturing leader, serving customers worldwide with aerospace products and services; control technologies for buildings, homes and industry; turbochargers; and performance materials. A proposed merger with United Technologies looks off the table for now due to antitrust concerns.

The company recently announced that its Industrial Cyber Security business now is offering the Palo Alto Networks Next-Generation Security Platform to industrial customers. The collaboration enables customers to better prevent cyberattacks against their process control networks and operational technology environments in order to protect their assets and maximize production uptime and safety. This is a part of the Honeywell business that many on Wall Street are very excited about.

Honeywell investors receive a 2.21% dividend. The $120 Jefferies price target compares to the consensus target of $116.60. Shares closed Tuesday at $107.58.

JPMorgan

With this stock trading at a very low 9.65 times estimated 2016 forward earnings, Wall Street analysts agree that JPMorgan Chase & Co. (NYSE: JPM) seems attractively valued on estimated price-to-earnings and a very solid price-to-book value. The company is expected to benefit from commercial loan growth and an upturn in capital spending. Yet, some on Wall Street have cautioned that last year’s divestiture of the physical commodities business could provide an earnings headwind throughout this year.

Improvement in loan growth, terrific equity capital markets and a steady increase in deposits will be a solid plus. Trading at a discount to many of the large cap banks on 2015 earnings estimates helps upside potential as well. With $2.6 trillion in assets on a worldwide basis, and one of Wall Street’s savviest leaders in Jamie Dimon, the stock is a solid buy for investors.

Dimon also recently put his money where his mouth was, reportedly buying a stunning 500,000 shares of the stock for a massive $26 million. That brings his total holdings in the bank to 6.7 million shares, worth over $360 million.

Investors receive a 2.99% dividend. The $67 Jefferies price target is less than the $70.07 consensus target. Shares closed on Tuesday at $58.78.

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.