Investing

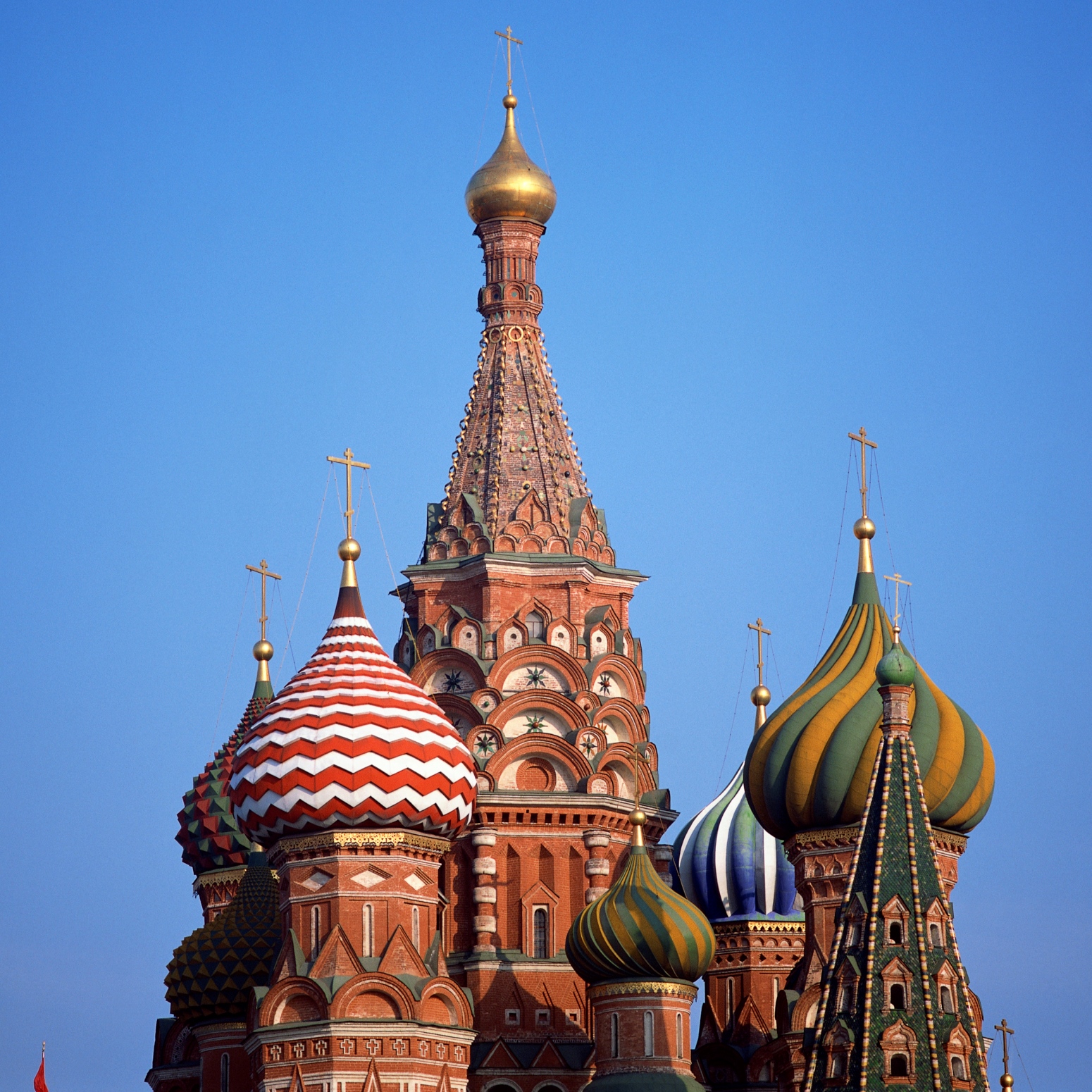

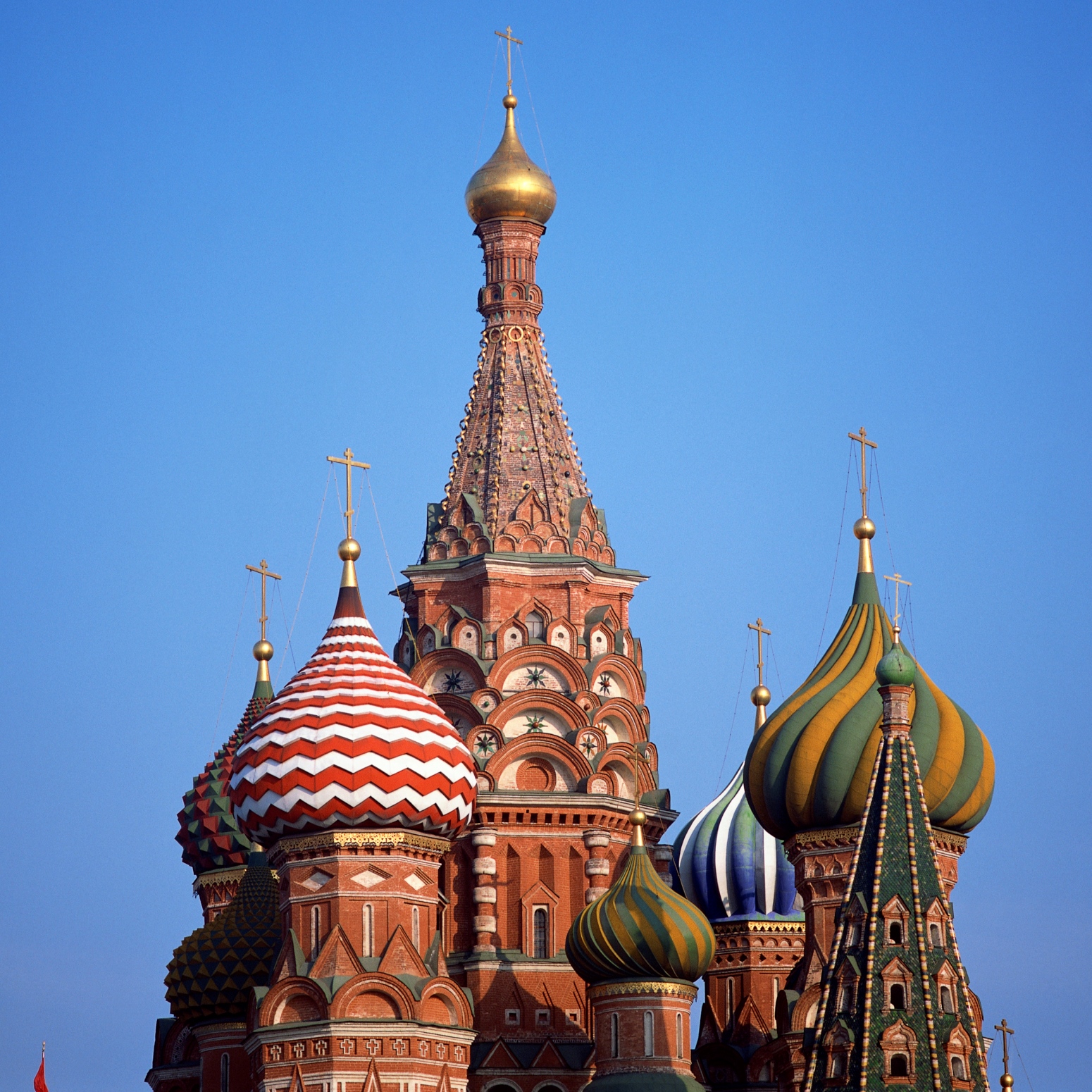

Why Credit Suisse Keeps Warming Up to Investing in Russia

Published:

Last Updated:

Investing in Russia often has been more problematic than investing in other emerging market economies. Still, this was a literal gold mine or oil field for the so-called BRIC investors for years. Then came the softening oil and commodities markets and the post-Ukraine sanctions. That was followed by Russia’s military involvement in Syria. Those issues and more created a recessionary climate that proved to be quite painful for investors who sought to make gains from investing in Russia.

Now that oil has stabilized, gold is up and Russia’s role looks more defined in Syria, investors have started nibbling back into Russia. On top of news that money outflows out of Russia have slowed in 2016, Credit Suisse’s emerging markets investing team has lifted its weighting for Russia.

The Credit Suisse call showed that the firm was taking profits on Mexican equities and was using the proceeds to raise exposure to Russia.

Credit Suisse’s new stance is that emerging market investors can now be 25% underweight rather than the firm’s prior target of being 50% below the emerging market benchmark.

What matters here is that Credit Suisse had maintained a negative bias toward exposure in Russia since late in 2013. This actually marks its third successive move since December 2015, a move that Credit Suisse said is a reallocation of its country portfolio toward value and away from growth.

Credit Suisse moved toward neutralizing its deep underweight stance on Russia for the following six reasons and beliefs:

24/7 Wall St. wanted to look at exchange traded funds (ETFs) and closed-end funds to see how they have done so far in 2016.

Market Vectors Russia ETF (NYSEMKT: RSX) was last seen up 2.4% at $16.85 on Monday, versus a 52-week trading range of $11.81 to $20.84. Its performance in 2016 has so far been up 12.4%, prior to Monday’s gains.

iShares MSCI Russia Capped (NYSEMKT: ERUS) ETF was also up 2.4% on Monday, trading at $13.28. Its 52-week range is $9.05 to $16.14, and its performance in 2016 has so far been up 16.5%, before Monday’s gains.

Then there is The Central Europe, Russia and Turkey Fund Inc. (NYSE: CEE), which has more geographic diversity than just Russia. Its shares were up 1.5% at $18.78 on Monday, versus a 52-week range of $14.21 to $24.12. Its shares were last seen up 11.3% so far in 2016.

Direxion Daily Russia Bull 3X ETF (NYSEMKT: RUSL) is one of the triple-leverage ETFs, so you can imagine that its move is exaggerated — up 7.2% to $57.42 on Monday, in a 52-week range of $22.44 to $150.40. If you include its big gain on Monday, its performance was up over 28% so far in 2016, on a split-adjusted basis.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.