Investing

Gigantic Airline Purchase Highlights Insider Buying: United Continental, Mattress Firm, Summit Midstream and More

Published:

Last Updated:

On a crazy earnings week when the market roller-coaster returned, and a warning from Carl Icahn raised some eyebrows, insider buying firmed some. Much of April has been plagued by very slow insider transactions, as the silent period has closed windows for executives and institutional holders to buy and sell shares. That window is starting to open and we saw some massive buys this week.

We cover insider buying every week at 24/7 Wall St., and we like to remind readers that while insider buying is usually a very positive sign, it is not in of itself a reason to run out and buy a stock. Sometimes insiders and 10% owners have stock purchase plans set up at intervals to add to their holdings. That aside, it still remains a positive indicator.

Here are some of the companies that reported notable insider buying this past week.

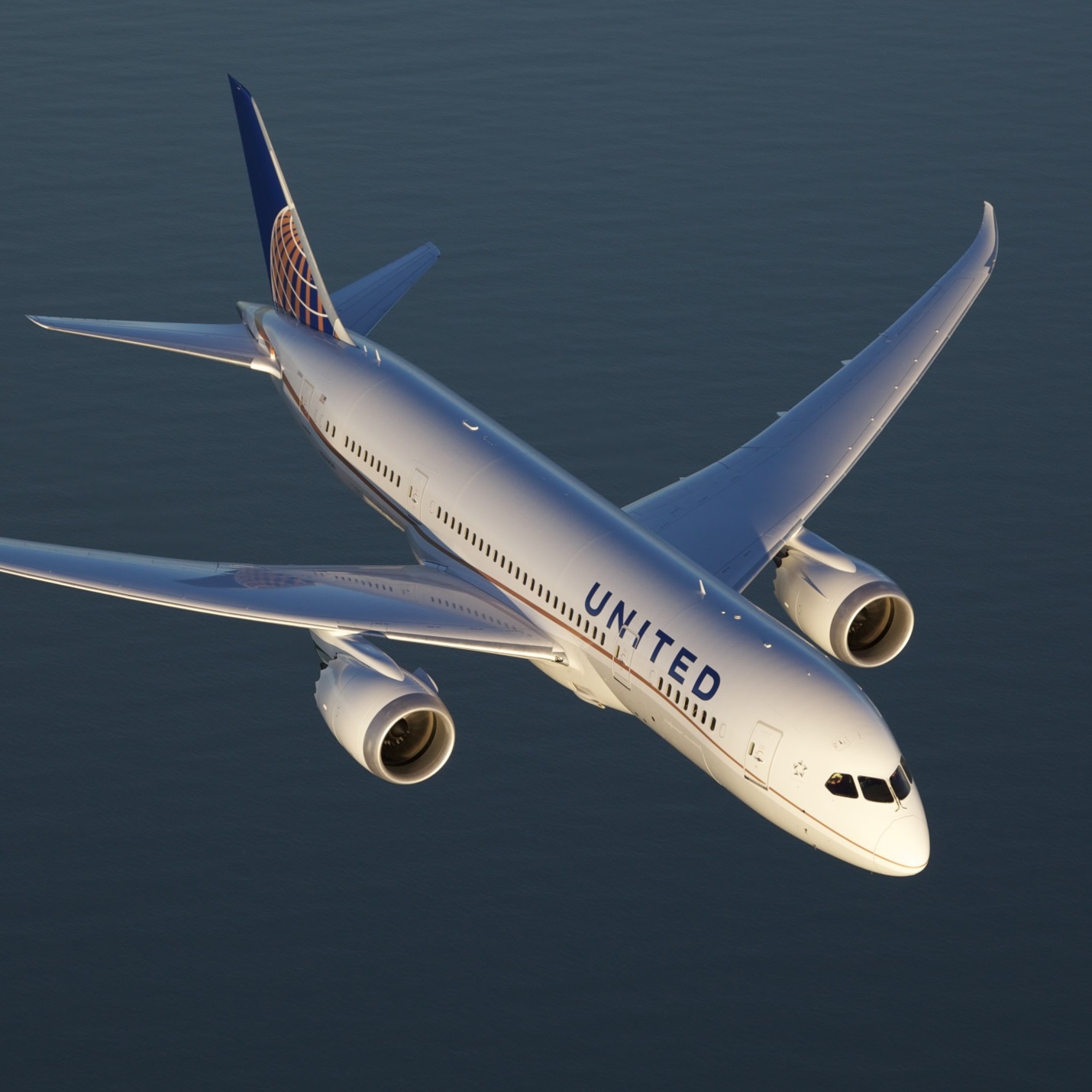

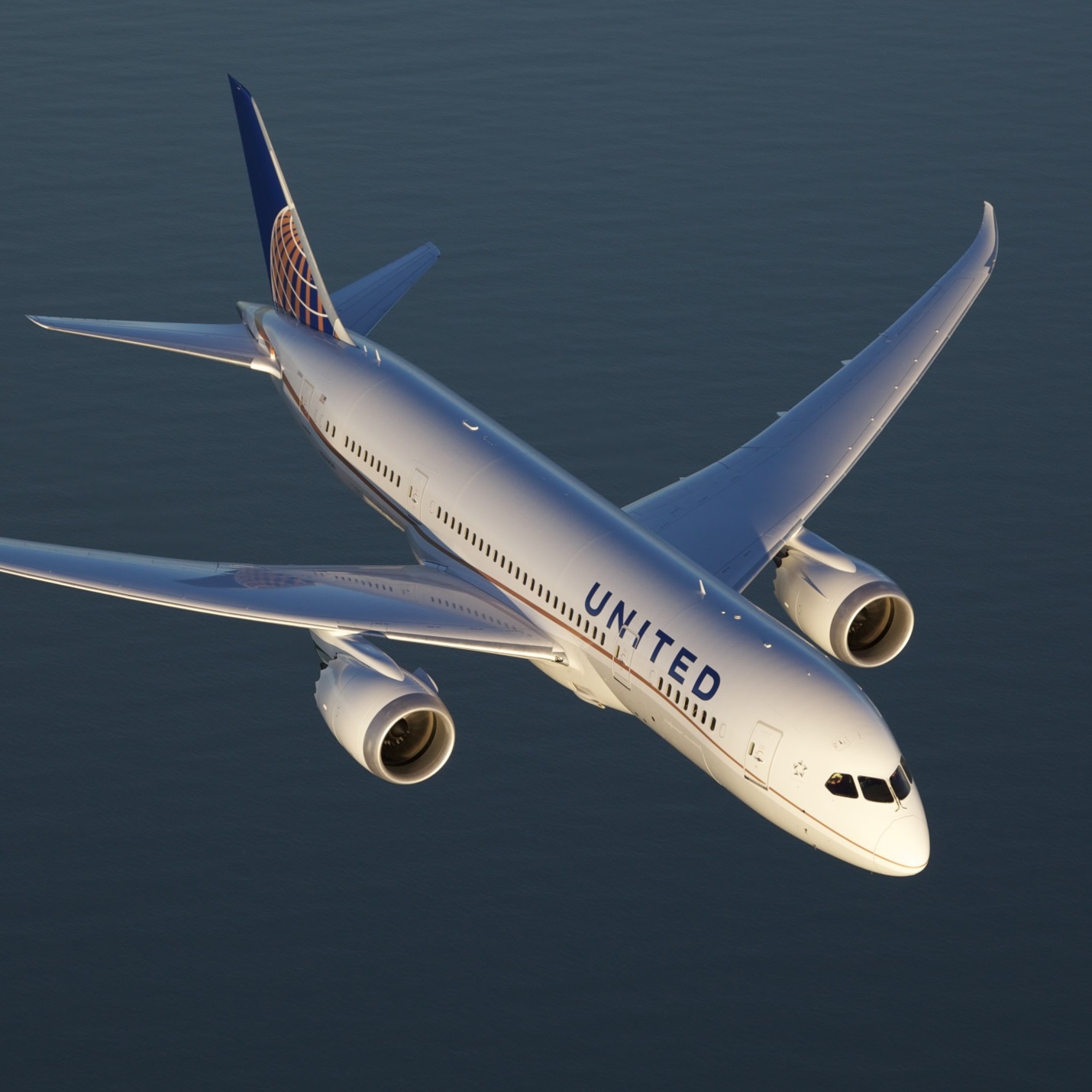

United Continental Holdings Inc. (NYSE: UAL) has finally resolved some issues with activist investors and the buying was heavy this week. A director at the firm Par Investments bought a massive 1,905,000 shares of the stock at prices between $50.76 and $54.04 a share. The total for the huge purchase came to a stunning $100 million. In addition, the chief executive officer purchased 19,800 shares at $50.53, at a cost of just over $1 million. Also buying shares were the chief operating officer, chief financial officer, three directors and an executive vice president, who bought 22,000 shares at prices that ranged from $48.38 to $49.90. The total for that buy came in at $1 million. And it appears to be better timed as shares closed on Friday at $45.83.

Mattress Firm Holding Corp. (NASDAQ: MFRM) hits our screens again, and the same company continues to add shares to its position. Berkshire Partners, which is a 10% owner of the company, bought an additional 165,000 shares at prices between $41.08 and $41.50. The total for this purchase came in right at $7 million. The stock closed Friday at $39.02, so the timing again looks early, but the firm has been scale buying stock for weeks now.

Acacia Research Corp. (NASDAQ: ACTG) had the CEO of the company, Marvin Key, and a director scooping up shares this week. The pair bought a total of 90,000 shares of the stock at prices between $4.13 and $4.15. The total for the trade came in at $400,000. The company invests in, develops, licenses and enforces patented technologies in the United States. The stock closed Friday at $4.82, so the timing looks solid.

Angie’s List Inc. (NASDAQ: ANGI) had a director at the company purchasing stock this week. That director bought a block of 12,000 shares at $8.27 apiece. The total for the trade came in at $100,000. Angie’s List operates a local services marketplace and consumer review site that allows consumers to research, shop for and purchase local services for home, health and automotive service needs, as well as to rate and review service providers in 253 markets in the United States. The stock closed Friday at $8.75, so another well-timed purchase, it appears.

While volume was still low due to earnings, the trades were big and newsworthy to some degree. As May begins, activity should start to pick up again soon.

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.