Investing

Huge Warren Buffett and Starboard Value Trades Highlight Insider Buying: Phillips 66, Pandora, Sears, Advance Auto Parts and More

Published:

Last Updated:

What a week, and it could be a preview of the kind of summer investors could be in for. With multiple headline and economic events right around the corner, many investors are bracing for a spike in volatility. One thing is for sure, despite any perceived or real issues out there, insiders at some of the top companies made some of the biggest purchases this past week that we have seen in a while. And buying volume swamped selling volume.

We cover insider buying each and every week at 24/7 Wall St., and we like to remind our readers that while insider buying is usually a very positive sign, it is not in of itself a reason to run out and buy a stock. Sometimes insiders and 10% owners have stock purchase plans set up at intervals to add to their holdings. That aside, it still remains an overall positive indicator.

Here are some of the companies that reported notable insider buying last week.

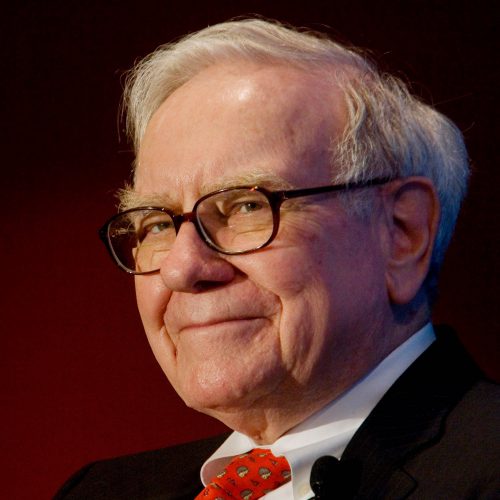

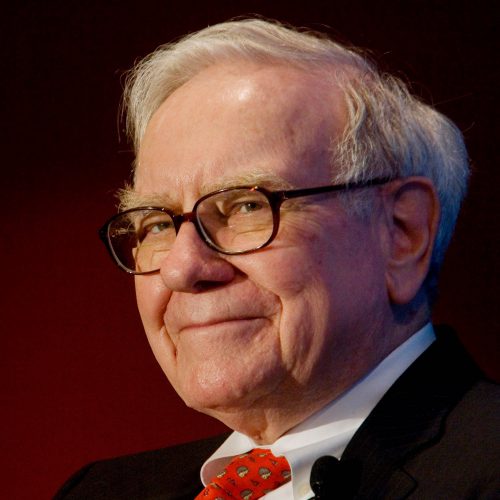

Phillips 66 (NYSE: PSX) had a big-time buyer at the desk once again this past week, and just like all this year so far, the share count is huge. Warren Buffett’s Berkshire Hathaway was busy scooping up 537,968 shares of this energy manufacturing and logistics company at prices between $79.74 and $80.16. The total for this trade came to a stunning $64 million. Phillips 66 operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). The stock closed the day on Friday at $80.13.

Advance Auto Parts Inc. (NYSE: AAP) had a huge buyer this past week. Starboard Value purchased a huge 400,000 share block of the stock last week at prices that ranged from $155.20 to $156.76. The total for this giant purchase came in at a staggering $62 million. The company through its subsidiaries, engages in the automotive replacement parts, accessories, batteries and maintenance items for domestic and imported cars, vans, sport utility vehicles and light and heavy duty trucks. Shares closed on Friday at $150.71.

Sears Holding Corp. (NASDAQ: SHLD) had a director and 10% owner also buying shares last week. Fairholme Capital Management bought some 778,000 shares of the struggling retailer’s stock at prices between $12.61 and $13.30. The total for the trade came to $10 million. The stock was trading on Friday’s close at $13.02 and has been absolutely battered over the past year.

Pandora Media Inc. (NYSE: P) is a beaten down technology stock that saw a big institutional account accumulating shares. Crosslink Capital bought 250,000 shares of the company at $11.33 per share. The total for the purchase was posted at $3 million. Pandora Media provides Internet music streaming services in North America. The stock closed Friday at $12.52, so it appears to be a well-timed purchase.

Summit Midstream Partners L.P. (NYSE: SMLP) is another energy company that saw an insider adding shares, and it has hit our screens all year. A director and 10% owner, Energy Capital Partners, bought 164,896 shares of the stock at prices that ranged from $20.85 to $20.92. The total for the trade came to a sizable $3 million. The company focuses on owning, developing and operating midstream energy infrastructure assets, primarily shale formations, in North America. The company provides natural gas gathering, treating and processing services. The shares ended the week at $21.10.

These companies also reported insider buying last week: American Electric Power Inc. (NYSE: AEP), Nanosphere Inc. (NASDAQ: NSPH), Sprouts Farmer Market Inc. (NASDAQ: SFM), Western Digital Corp. (NASDAQ: WDC) and Western Refining Inc. (NYSE: WNR).

Last week was a total about face as the insider buying volume swamped the sellers. It will be interesting to note the trends as we get into the summer.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.