Investing

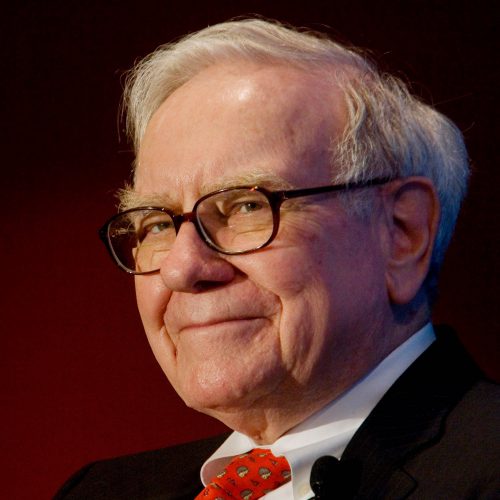

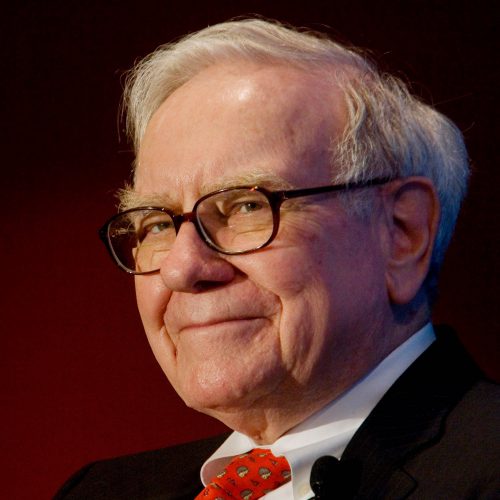

Major Changes Seen in Warren Buffett and Berkshire Hathaway Stocks: Apple, Wal-Mart, Phillips 66, Deere and More

Published:

Last Updated:

Berkshire Hathaway Inc. (NYSE: BRK-A) has released its public equity holdings as of June 30, 2016. What makes this so interesting for Warren Buffett fans, outside of Buffett being one of the richest men alive, is that there have been many key changes in the Buffett stocks over the past few quarters. The Berkshire Hathaway earnings report in recent weeks showed that the total equity securities listed on the balance sheet was $102.563 billion, while the 13F filing with the SEC showed the balance as of June 30 as being $129.7 billion.

24/7 Wall St. and its founders have followed the portfolio changes from Buffett’s top stock holdings for about two decades now. We track the changes made each quarter, and ultimately these end up being quite different through time. Buffett’s addition of two more portfolio managers in recent years only makes the changes look even more extreme over time.

Investors need to keep in mind that approximately 61% of the aggregate fair value of the common equity securities is concentrated in four companies: Wells Fargo & Co. (NYSE: WFC) at $23.7 billion, International Business Machines Corp. (NYSE: IBM) at $12.3 billion, Coca-Cola Co. at $18.1 billion and American Express Co. (NYSE: AXP) at $9.2 billion.

Again, big changes have been made. Buffett also has large stakes in food-giant Kraft Heinz Co. (NYSE: KHC) and refining giant Phillips 66 (NYSE: PSX), and the March quarter showed a new $1 billion stake in Apple Inc. (NASDAQ: AAPL). Berkshire Hathaway also ended the June 2016 quarter with almost $72.7 billion in cash and cash equivalents. That figure is from a total of insurance and other, railroad utilities and energy, and finance and financial products.

Here is how the new list of Warren Buffett and Berkshire Hathaway’s public share holding looks as of June 30, 2016.

American Express Co. (NYSE: AXP) was the same 151.6 million or so shares, a position that remains perpetually static whether shares rise or fall. Buffett has owned Amex for so long it may be cheaper for him to just hold rather than pay gains.

Coca-Cola Co. (NYSE: KO) was the exact same stake of 400 million shares, a position that has also remained static for years. Buffett has defended his stake here for years.

International Business Machines Corp. (NYSE: IBM) was listed as the same 81.232 million shares in June as it was in March. Still, this Big Blue stake has been raised and raised. It was 81.03 million shares as of last December 31, about 79.5 million shares as of the end of last June, and the end of 2014 position was 76.971 million IBM shares.

Wells Fargo & Co. (NYSE: WFC) is a position that Buffett might add to for infinity. The June 30 stake was listed as the same 479.704 million shares listed in March. This was 470.29 million shares last September, and again it just keeps being raised. As a reminder, it was documented that Buffett has filed to be allowed to increase his stake north of the 10% threshold with the SEC. With Wells Fargo being a serial acquirer of its own stock, Buffett might end up owning more than 10% of the stock even without trying.

Kraft Heinz Co. (NYSE: KHC) was listed as 325,634,818 shares, the same stake it was on March 31 and at the end of 2015. This stake is from the 3G Capital deal and is actually more important than it seems. Buffett had suggested that his exposure would be coming down due to his preferred shares being redeemed. The earnings report in recent weeks confirmed that. The value here as of June 30 was $28.8 billion.

Phillips 66 (NYSE: PSX) was an INCREASED STAKE to 78.782 million shares as of June 30. As of March 31, it was a 75.55 million share stake and this has risen steadily. This stake previously had been classified as an elimination in 2015 and then was shown after Buffett got the stake classified with the SEC as confidential.

Apple Inc. (NASDAQ: AAPL) was an INCREASED STAKE to 15.227 million shares as of June 30, worth some $1.455 billion. The stake in Apple was a new position back in the March quarter, listed as 9,811,747 shares worth some $1.069 billion at that time.

Axalta Coating Systems Ltd. (NYSE: AXTA) was the same stake of 23.324 million shares, after having been listed as a new position of 20 million shares.

Bank of New York Mellon Corp. (NYSE: BK) was a larger stake at 20.827 million shares, up from a prior 20.112 million. That was versus 24.6 million shares in the past.

Charter Communications Inc. (NASDAQ: CHTR) was a slightly lower stake at 9.337 million shares. This was 10.326 million shares in March but was up then from 10.281 million at the end of 2015.

Costco Wholesale Corp. (NASDAQ: COST) was the same stake at 4,333,363 shares.

DaVita Inc. (NYSE: DVA) was the same 38.565 million shares, but this had been raised in prior quarters before Buffett entered into a standstill agreement not to buy more than 25% of the company.

Deere & Co. (NYSE: DE) was a smaller stake at 21.959 million shares. That is down from 23.28 million shares, but that had been 22.884 million shares at the end of 2015 after some 5.83 million shares had been added at the end of last year.

General Electric Corp. (NYSE: GE) was the same stake of 10.585 million shares. This stake was raised in 2014 and had been telegraphed before because of the warrants.

General Motors Co. (NYSE: GM) was the same stake of exactly 50 million shares, but this had been raised from 41 million shares last year.

Goldman Sachs Group Inc. (NYSE: GS) was the same stake of 10.959 million shares, but this had been as high as 12.631 million shares prior to the end of 2015.

Graham Holdings Co. (NYSE: GHC) remains the same tiny stake of 107,575 shares in what is just the remains of Washington Post breakup.

Johnson & Johnson (NYSE: JNJ) was the same tiny stake of only 327,100 shares, but Buffett watchers know this is a leftover bit from a much larger stake in years past.

Kinder Morgan Inc. (NYSE: KMI) was listed as 26.533 million shares as of June 30. This was the same stake as in March and was selected by one of Buffett’s portfolio managers rather than on his own.

Lee Enterprises Inc. (NYSE: LEE) was the same tiny stake of only 88,863 shares.

Liberty Media Corp. (NASDAQ: LMCA) and Liberty Global PLC (NASDAQ: LBTYA) are both again listed as Buffett and Berkshire Holdings. These are counted as Class A and Class C shares, so we will leave these stakes simplified just like that.

M&T Bank Corp. (NYSE: MTB) was the same position at 5.382 million shares — same as always.

MasterCard Inc. (NYSE: MA) was the same 4.934 million shares as in March, but this was 5,229,756 shares at the end of 2015.

Media General Inc. (NYSE: MEG) was the same-sized stake at 3.471 million shares.

Mondelez International Inc. (NASDAQ: MDLZ) is the same position again at 578,000 shares, remaining handily lower than in the past and dating back to the Kraft breakup.

Moody’s Corp. (NYSE: MCO) was the same position of 24.669 million shares yet again, but this stake is still lower than in years past.

NOW Inc. (NYSE: DNOW) was the same stake of 1.825 million shares.

Procter & Gamble Co. (NYSE: PG) is still a much lower stake of just 315,400 shares, same as in March. This had previously been listed as almost 52.8 million shares in the prior formal 13F report before the Duracell swap. P&G had once peaked at 96.3 million shares in the Buffett stocks.

Restaurant Brands International Inc. (NYSE: QSR) was the same stake at 8.438 million shares. The reality is that this is much larger if you consider the $3 billion in perpetual preferred shares pointed out previously.

Sanofi (NYSE: SNY) was the same position at 3.905 million shares.

Suncor Energy Inc. (NYSE: SU) was a lower stake at 22.275 million shares. This had been up to 30 million shares previously, but this used to be a smaller stake at 22.35 million last June.

Torchmark Corp. (NYSE: TMK) the same stake at 6.353 million shares.

Twenty-First Century Fox Inc. (NASDAQ: FOXA) was the same stake of 8.951 million shares at the end of 2015. This stake was raised from 6.228 million shares in prior reports, versus 4.747 million shares at the end of 2014.

U.S. Bancorp (NYSE: USB) was the same position of 85.06 million shares at the end of June but that stake had been raised slightly before the prior quarters (was 80.09 million shares at the end of 2014).

USG Corp. (NYSE: USG) was the same stake at just over 39.002 million shares, but this had been raised prior to the end of 2014.

United Parcel Service Inc. (NYSE: UPS) was the same position of just 59,400 shares, way down from 2012.

VeriSign Inc. (NASDAQ: VRSN) was slightly smaller at 12.952 million shares, after having had been a tad larger at 13.044 million shares in March. This one had previously grown in 2014.

Verisk Analytics Inc. (NASDAQ: VRSK) was the same position at 1,563,434 shares, but that is lower than in prior quarters.

Verizon Communications Inc. (NYSE: VZ) was the same stake at 15 million shares in June versus the end of March, but that had been raised a year earlier.

Visa Inc. (NYSE: V) was the same stake of 10.239 million shares at the end June, but this is up from 9.885 million shares in 2015. The Visa stake had been raised throughout 2014.

WABCO Holdings Inc. (NYSE: WBC) was the same 3.237 million shares, but this had been coming down through time. At one point the stake was over 4 million shares.

Wal-Mart Stores Inc. (NYSE: WMT) was a stake was taken down by more than 15 million shares to 40.226 million by the end of June. That was decreased by 949,430 in March to some 55,235,863 shares. That stake was 56.185 million shares at the end of 2015 and was down from 60.385 million shares at the end of last June and after having been raised prior to 2015.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.