Investing

Credit Suisse Focus List Has Catalysts for 30% to 50% Upside Picks

Published:

Last Updated:

The bull market is now seven and a half years old since the V-bottom in March of 2009. Equity valuations are rather high at 18 times expected S&P 500 earnings. The Federal Reserve keeps signaling that it is itching to raise interest rates, and we keep hearing about dividend and safety-stock levels being inflated from asset rotation and a lack of other income opportunities. So what are investors supposed to do as we near an election and move closer to 2017?

24/7 Wall St. has noticed that investors have ignored all the warnings and that they keep finding different and new reasons to buy stocks. Investors will buy any quality stock if there is a discounting, or if the market goes on sale with a pullback. Now we have Credit Suisse out with an update to its Focus List.

In an effort to see what upside calls in Credit Suisse’s Outperform rated shares might be, we took a look at the firm’s top ideas that had implied upside of 30% to 50%. Investors and readers should keep in mind that traditional upside in Buy or Outperform ratings on Dow or S&P 500 stocks are closer to a range of 8% to 15% as things are right now.

The Credit Suisse U.S. Focus List is a compilation of 15 to 20 of the firm’s analyst picks that each has the highest conviction in what it called catalyst-driven ideas. The list reflects its analysts’ most favored and differentiated ideas. These are also deemed to be non-consensus based versus peers and competitors, and the selected names generally have upcoming catalysts in the next three to six months.

Some of these companies have seen problems of late. Still, most of these are household names. As a last reminder, analysts are not always right, and sometimes unseen outside forces wreck any good upside thesis. Here are five picks from the Credit Suisse Focus List with upside projections of 30% to 50%.

Apple

Apple Inc. (NASDAQ: AAPL) remains the top technology stock among large caps covered by Kulbinder Garcha. His target is $150, which would be up 39% from the $107.66 share price listed in the Focus List review. Due to a ho-hum reception on the new iPhone and Apple Watch refreshes, Apple shares were last seen trading at $105.62.

Here is how analysts see the new iPhone and smartwatch announcements.

Credit Suisse showed that there are few upcoming catalysts that the rest of us did not think of in the months ahead. After the product refresh announcements, Credit Suisse thinks that next quarter’s guidance in October will provide a catalyst as it will provide a better indication of iPhone 7 expectations. Positives given for Apple’s $150 price target were Apple’s high retention rate, its complete ecosystem and Apple’s growing installed base.

Apple has a 52-week trading range of $89.47 to $123.82 and a consensus analyst price target of $123.66. Keep in mind that Apple’s market cap is $568 billion, so a 2% drop or gain is representative or more than $10 billion in overall market value.

Affiliated Managers

Affiliated Managers Group Inc. (NYSE: AMG) was a top financial stock in the Credit Suisse Focus List. The firm’s Craig Siegenthaler has an Outperform rating on Affiliated Managers and a $212 price target. That was shown to be up 50% from the stated Focus List share price of $141.00, but investors should note that the shares actually were trading last at $147.71.

The upcoming catalysts pointed out by Siegenthaler were seen as follows:

Affiliated Managers has a 52-week range of $115.97 to $190.74 and a consensus price target of $192.75.

Hanesbrands

Hanesbrands Inc. (NYSE: HBI) is rated as Outperform by Credit Suisse’s Christian Buss, along with a $37 price target. That was versus a Focus List share price of $26.16, implying some 41% in potential upside.

Credit Suisse sees an integration of the Pacific Brands acquisition and investments that should further increase e-commerce penetration as upcoming catalysts. An additional positive was seen in the Hanes roll-out of second half product innovation “Fresh IQ technology” to retail as part of their “Innovate-to-Elevate” strategy.

Shares of Hanesbrands have a 52-week range of $23.25 to $33.24. The consensus price target is $34.50.

Twenty-First Century Fox

Twenty-First Century Fox Inc. (NASDAQ: FOXA) was the top media play for upside on Credit Suisse’s Focus List, although it is classified under the Consumer Discretionary category. The firm’s Omar Sheikh has a Outperform rating and a $33 price target. This implied 33% upside to the target price from the stated $24.28 Focus List price. The shares were actually last seen at $25.75.

Catalysts were listed as follows: the launch of Hulu live-streaming service (2017), performance of new content investments at National Geographic and Fx, film box-office performance, and monthly TV network ratings. The firm’s $33 target price is based on a sum of the parts methodology, and the stakes in Sky, Hulu, Shine/Endemol and STAR India separately at a combined $20 billion.

The stock has a 52-week range of $22.66 to $31.40 and a consensus price target of $32.45.

Whole Foods

Whole Foods Market Inc. (NASDAQ: WFM) is rated as Outperform on the Credit Suisse Focus List, with a $40 price target. That is 30% in implied upside from the stated share price of $30.80. Still, Whole Foods was last seen trading at $29.24, so there is more implied upside now.

Credit Suisse’s Edward Kelly’s only catalyst listed in the Focus List review was upcoming earnings, which might bring at least some pause from investors. After all, earnings trends for Whole Foods, organic and natural foods players and grocery stores in general have not been so positive as investors were used to seeing for years.

Shares of Whole Foods have a 52-week range of $28.07 to $35.58 and a consensus price target of $31.10. Whole Foods may be the king of organic and natural grocers, but its market cap has come back down under $10 billion again.

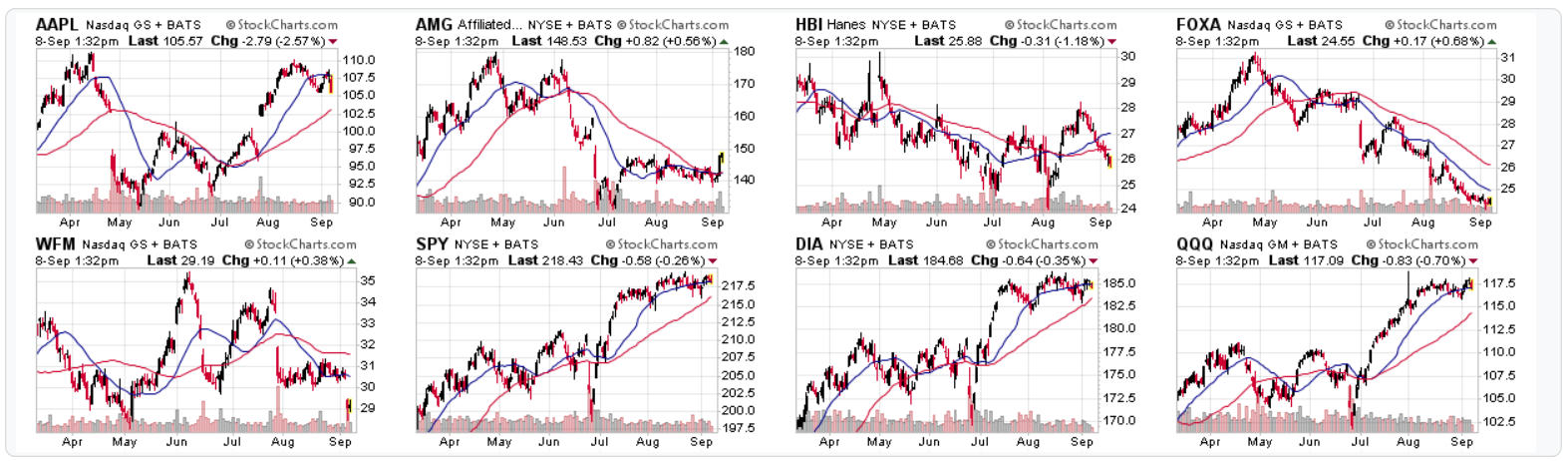

Again, these views are those Credit Suisse. Whether or not these catalysts come about remains to be seen. Again, there are no free lunches on Wall Street. The following chart montage (expandable) is from StockCharts.com.

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.